Introduction

This article explores incrementality attribution in mobile marketing, providing marketers and user acquisition managers with insights into measuring true campaign impact in an era of privacy changes. As privacy-first policies and the loss of traditional tracking signals reshape the digital landscape, understanding how to accurately assess the effectiveness of your marketing efforts is more important than ever. Whether you’re a marketer, UA manager, or mobile growth professional, this guide will help you navigate the complexities of incrementality attribution and its role in driving smarter, data-driven decisions.

What is incrementality attribution?

Incrementality attribution measures the incremental lift, which is the extra conversions or revenue generated specifically because of an ad campaign, beyond baseline organic activity. Incrementality Attribution helps determine the causal impact of marketing efforts on desired outcomes, such as conversions or sales. By comparing the performance of a test group exposed to marketing with a control group that is not, marketers can isolate the true effect of their campaigns and make more informed decisions about budget allocation and strategy.

Incrementality attribution in mobile marketing

Incrementality attribution is a method that measures the incremental lift, meaning the extra conversions or revenue generated specifically because of an ad campaign, beyond what would have happened organically. Incrementality aims to measure the true impact of your marketing campaign based on a specific outcome. This approach is especially relevant in mobile marketing, where privacy changes and the loss of device identifiers have made traditional attribution models less reliable.

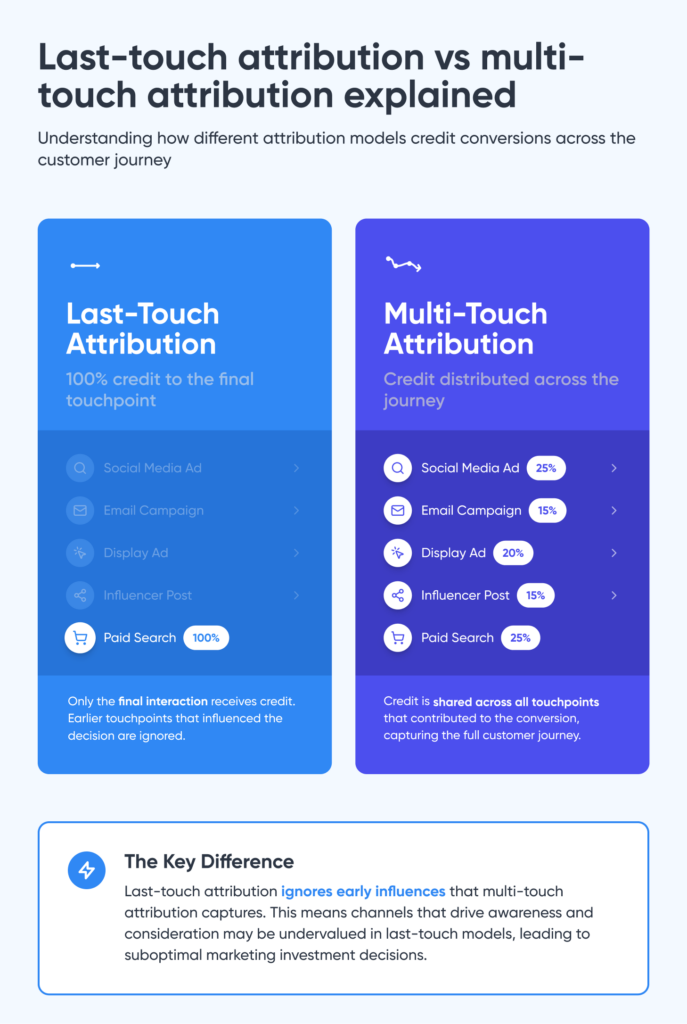

Attribution, in general, is the process of matching two data points, such as clicks to installs, or impressions to installs. Attribution models credit a conversion or sale to the marketing touchpoints a customer interacted with on their journey. Incrementality, on the other hand, is a term for measurement of the true effectiveness of advertising activities, focusing on what would not have happened without the marketing effort.

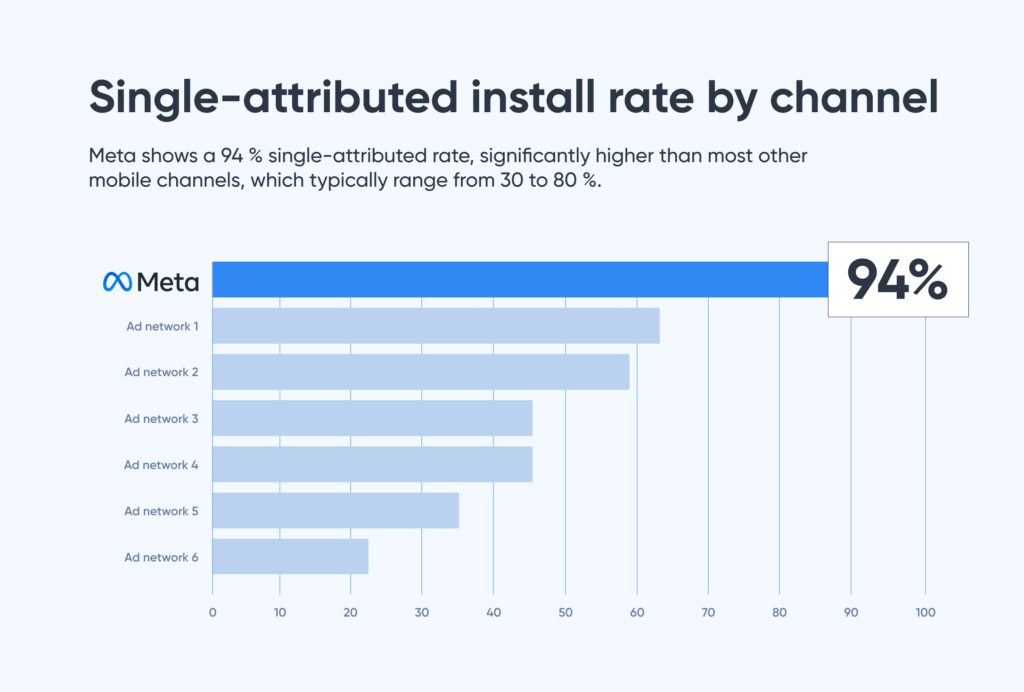

We’ve explored next-generation attribution extensively, including post-IDFA user acquisition, the end of last-click measurement, and the future of mobile measurement. Incrementality attribution is a big part of that conversation as the impetus for all these discussions is the loss of signal that privacy measures, necessary though they may be, are causing for marketers. The shift away from third-party cookies is further impacting advertising measurement and attribution models, making it harder to accurately assess the effectiveness of marketing activities.

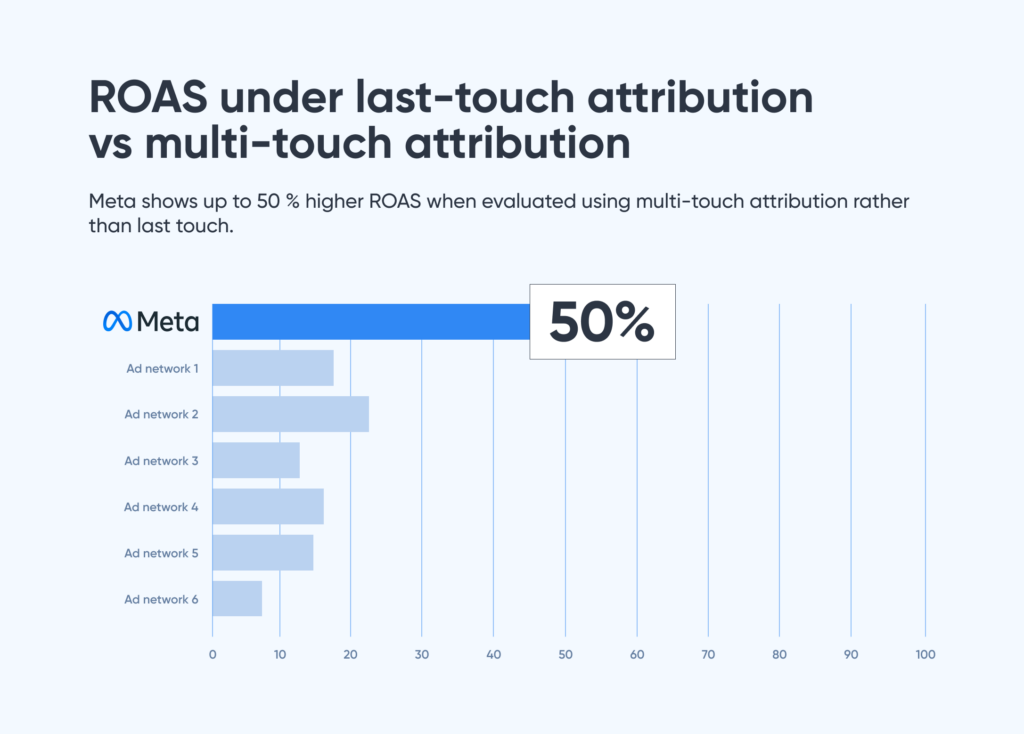

Next-generation attribution is about finding new ways to measure true marketing impact. Attribution models have traditionally been used to measure advertising effectiveness by crediting customer actions to specific marketing touchpoints, but their limitations in the face of privacy changes have led to the rise of incrementality attribution as a more reliable approach.

The mobile measurement question

The challenge of privacy-safe measurement

How will marketers measure, attribute, and optimize marketing in a privacy-safe ecosystem?

And let’s be honest, this is not just any old marketing we’re talking about. This is not selling real estate or sports drinks or Lululemon pants. Mobile user acquisition is perhaps the fastest-paced marketing niche around, where shortening the distance between stimulus and response is critical to campaign optimization.

Attribution methods in mobile marketing

There are various methods available for attribution, including:

Each of these offers a systematic way to evaluate marketing effectiveness. Understanding the customer journey, tracking the series of touchpoints and interactions a potential customer has before converting, is essential for accurate measurement and attribution.

Real-world perspectives

I’ve been intrigued by what I’ve been hearing from AppLift veteran Maor Sadra’s new startup INCRMNTAL, as well as what Brian Krebs, the CEO of MetricWorks, has had to say about incrementality as a key form of mobile marketing measurement.

Recently, I had a conversation with Moshi Blum for the Mobile Heroes podcast I do with Peggy Anne Salz for Liftoff.

He’s the VP of Beach Bum, a mobile game studio owned by Voodoo, was a general manager for Adjust, led user acquisition for Viber, and more. And he knows incrementality, with the blood, sweat, tears, and scars to show for it, along with pretty much every other form of mobile measurement from both the high-volume practitioner side as well as the measurement provider side.

He’s kinda been there, done that on a lot of different levels. And he’s pretty realistic about the challenges and opportunities in marketing measurement.

In fact, if you remember Winston Churchill’s famous quote about democracy being the worst of all forms of government except for the rest, you’ll recognize the inspiration behind Blum’s view of last-touch attribution:

“Last touch attribution is the worst way to measure your marketing campaigns … except all other metrics of measuring your marketing campaigns.”

– Moshi Blum, VP Marketing at Beach Bum

As we move forward, let’s explore the benefits of incrementality attribution and how it can provide unique insights for marketers.

Benefits of incrementality attribution

Benefits of incrementality testing

Incrementality attribution has some significant benefits for marketers and UA managers:

- Isolates true campaign impact: By comparing test and control groups, incrementality attribution reveals how many conversions are outcomes directly attributable to specific marketing actions.

- Informs budget allocation: It helps marketers understand which channels and campaigns are truly driving incremental results, enabling smarter budget decisions.

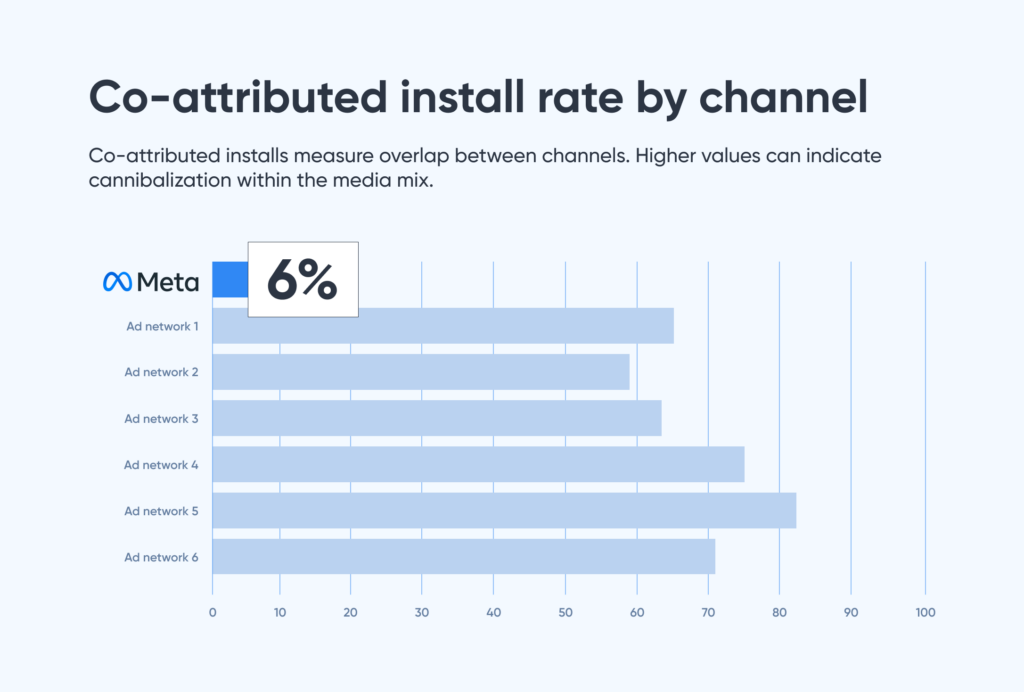

- Optimizes media mix: Incrementality attribution provides insights into the interplay between channels, helping marketers optimize their media mix for maximum impact.

- Reduces wasted spend: By identifying conversions that would have happened organically, marketers can avoid spending on users who would have converted anyway.

Real-world examples

You could, for example, be adding a brand new app to your portfolio. With limited or no pre-existing campaigns, you can fairly easily check incrementality via different platforms, channels, and partners. In other circumstances, you can pause most or all of your efforts on an app, put all your eggs in one basket, and check the results. While you know you’ve got some existing organic and some persistent lag from prior campaigns, you’ll get a useful read on a channel that you might have been wondering about.

Incrementality testing and incrementality measurement allow marketers to determine incremental lift by comparing test and control groups, revealing how many conversions are outcomes directly attributable to specific marketing actions. This approach goes beyond traditional attribution by isolating the true value of your campaigns. Incrementality tells you what would have happened without your marketing efforts, helping you understand the genuine impact and effectiveness of your spend.

Not only that, you’ll get a sense for the interplay between channels, especially as you see audience overlap between them. Here’s how Brian Krebs put it in a chat I had with him:

“The analogy I hear often is the fishing poles in the stream, right? It’s the same group of fish, each media source you’re adding is just another fishing pole.

And the critical thing here is not really to optimize your marketing based on what the last touch happens to be, the ads that happened to get the last touch. It’s really optimizing the media mix, which is optimizing the perfect number of fishing poles and the perfect mix of fishing poles in that stream.”

– Brian Krebs, CEO of Metricworks

With these benefits in mind, let’s examine the challenges and complexities involved in incrementality testing.

Why is incrementality testing hard?

Challenges in measuring incrementality

So why is incrementality, which is intended to show you the additional or incremental results of your marketing campaigns, so notoriously hard?

Because causes and effects are mixed up, and the relationships between individual causes and effects are spaghettied into difficult-to-separate masses. Also, many effects are over-determined, which means that they don’t have a single cause but multiple factors are working together to create an effect. Everything is changing all of the time as multiple departments in your organization are building product, releasing features, kicking off campaigns, posting to social, crafting offers, building creative. And shocker: the world is changing, as macro-level systems like weather and economy intersect with microcosms of individual situations and moment-by-moment states like hunger, desire, boredom, time, attention, and more.

Steps of incrementality testing

To accurately measure the causal impact of marketing activities, marketers often use controlled experiments, such as randomized controlled trials (RCTs). Here’s how incrementality testing typically works:

- Define the objective: Decide what outcome you want to measure (e.g., installs, revenue, paying users).

- Set up test and control groups:

- Randomly divide your audience into two groups.

- The test (treatment) group is exposed to the advertising campaign.

- The control group is not exposed to the campaign.

- Run the campaign: Deliver your marketing activity to the test group while withholding it from the control group.

- Measure outcomes: Track the results for both groups over a set period.

- Compare results: Analyze the difference in outcomes between the test and control groups to determine the true causal impact of your campaign.

This approach helps distinguish between correlation and causation, ensuring that the measured lift is directly attributable to the marketing effort rather than external factors.

So much so that separating out incremental impact can seem impossible.

“Over the experience we had with trying to understand how to calculate it or bring it even further from installs to revenue, from revenue to paying users, from paying users to understanding how much of what I spent on Google or Facebook or Apple or any other ad network is actually contributing to my bottom line of profit … that’s something that I found absolutely or almost impossible to get.”

– Moshi Blum, VP Marketing at Beach Bum

Despite these challenges, incrementality testing offers unique benefits for marketers, which we explore next.

Marketing mix modeling and optimization

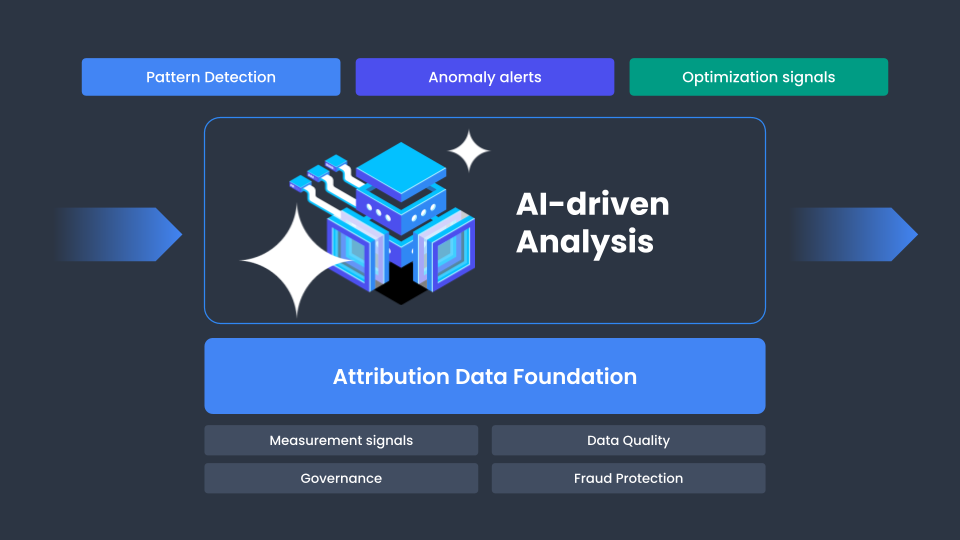

Marketing Mix Modeling (MMM) is like the ultimate reality check for your marketing efforts. Instead of relying on gut feelings or the last ad someone clicked, MMM uses statistical analysis to untangle the web of your marketing tactics and show you what’s really driving business outcomes, be it sales, conversions, or revenue. By factoring in incremental attribution, MMM goes a step further: it doesn’t just tell you what happened, but reveals the true effectiveness of each campaign, channel, or tactic in generating incremental conversions.

For marketers juggling multiple campaigns and channels, this means you can finally see which marketing activities are actually moving the needle, and which are just along for the ride. Incremental attribution within marketing mix modeling helps you assign credit where it’s truly due, giving you a clearer understanding of how your marketing budget is performing across the board.

The real power of MMM with incrementality is in optimization. With a comprehensive view of your marketing performance, you can make smarter budget allocation decisions, shifting spend toward the channels and campaigns that deliver real, incremental impact. No more over-attribution to the loudest touchpoint or underestimating the value of a steady performer. Instead, you get actionable results that help you maximize marketing ROI and drive more effective outcomes for your business.

In a world where every marketing dollar counts, combining marketing mix modeling with incremental attribution gives you the insights you need to optimize campaigns, boost conversions, and ultimately grow sales. It’s not just about measuring what happened, it’s about understanding why, so you can do more of what works and less of what doesn’t.

As you consider how to integrate incrementality into your measurement strategy, it’s important to understand how it fits within the broader attribution mix.

Incremental attribution as part of the attribution mix

The key is layering and weaving.

Layering in different measurement methodologies as needed. Weaving them together when and where appropriate. Not necessarily relying on just one but using them all to build up a multifaceted and modeled version of reality that is based as much as possible on deterministic and granular data and as much as necessary on probabilistic and aggregated information.

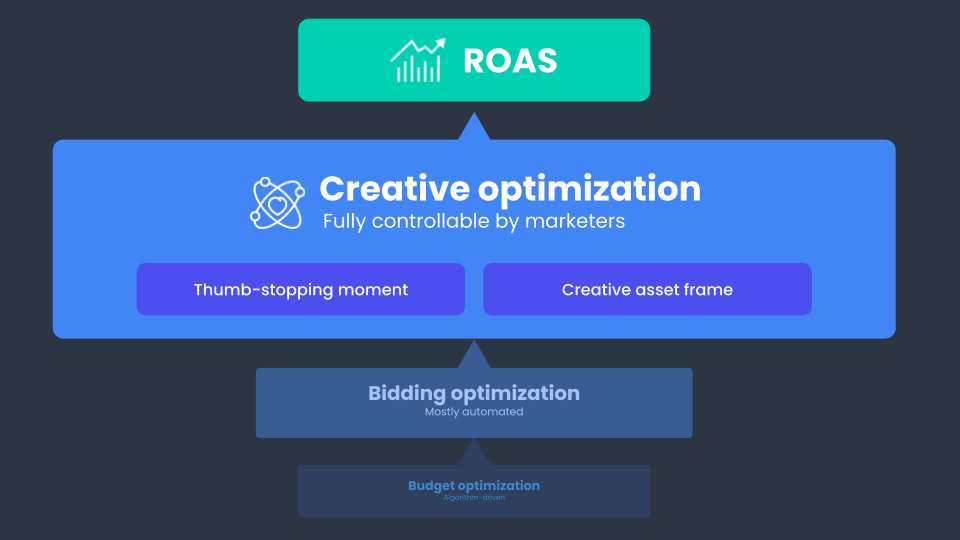

Achieving a holistic view of marketing performance means understanding every marketing touchpoint and the various touch points a customer interacts with along their journey. Attribution tells marketers where marketing activity occurs and which touch points are involved, but it may not always provide true attribution or real-time feedback on which interactions genuinely drive conversions. Traditional attribution models assign credit across multiple touch points, often proportionally, but incrementality attribution goes further by seeking to reveal the actual, additional impact of each marketing effort beyond what would have happened naturally.

Which means there’s a place for incrementality.

It’s not in micro-measurement of the details of a marketing campaign or the performance of one creative over another, or even the relative efficacy of one sub-campaign over another. That’s almost impossible, Blum says, and I think he’s right.

But there is an occasional role in getting good insight whether a campaign adds accretive value or not, or whether a channel is adding valuable fishing poles to the stream or even, could it be fishing in a stream that few other channels access.

Incrementality also has specific value for specific channels like Apple Search Ads, where you can check organic volume on keywords and competing keywords. There, Blum says, it’s easier to measure your impact; whether you’re “buying your own traffic” (AKA wasting ad spend on already-were-going-to-install organic users), or defending your keywords from competitors, or actually creating a would-you-believe-it brand new install that wouldn’t have happened any other way.

(Note, that’s “easier,” not “easy.”)

As we’ve seen, incrementality attribution is a valuable tool in the marketer’s toolkit, but it’s not a one-size-fits-all solution. Let’s look at how last-click attribution still plays a role in mobile marketing.

Love it or hate it, last-click works

That fits where it fits, but most of the time, Blum says, he’s simply focusing on expanding growth through channels that perform well according to last-click mobile attribution data, whether that’s GAID/AAID on Android or SKAdNetwork on iOS.

Where incrementality seems to fit best in mobile marketing is not as a day-to-day measurement methodology but as a monthly or more likely quarterly check-up on channel quality.

And that’s when you do the full meal deal test.

“What you’re doing is you’re really running a randomized controlled trial like you would in a pharmaceutical company … taking a population, dividing it up into two separate groups randomly, that’s key here into a control group and an experiment group, or a treatment group, or a test group, whatever you want to call it. And that treatment group is the one that sees ads. The control group does not.”

– Brian Krebs, CEO of Metricworks

Incrementality testing is considered the gold standard for measuring true marketing ROI because it isolates the causal impact of campaigns. This approach can be used to evaluate the effectiveness of specific platforms, such as Google Ads, within a multi-channel strategy. Additionally, machine learning is increasingly applied to analyze experimental data and optimize attribution accuracy.

Clearly, that’s extra work. And because you’re likely pausing other activity while doing this kind of test and potentially doing it for multiple channels, it takes time and has significant opportunity cost for apps that need to grow fast.

But it is a worthwhile investment, from time to time.

Just not the silver bullet we might wish it could be in an era of less signal and less hard data.

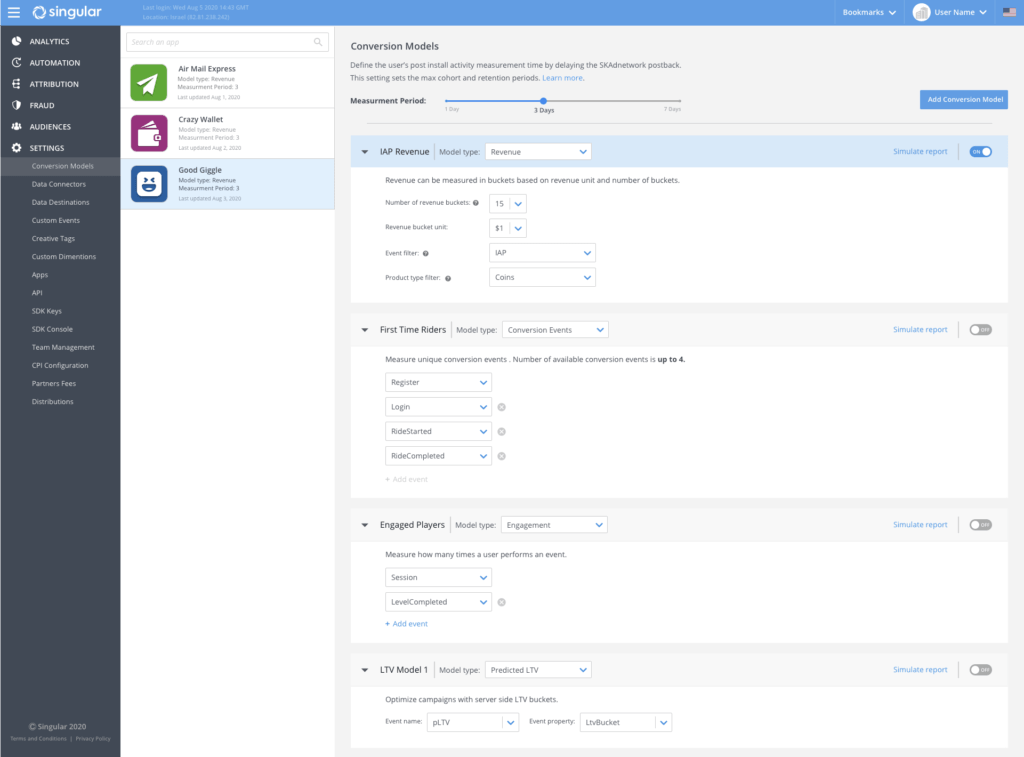

We can help

Working on incrementality? Need a full suite of data from cost to attribution to modeling to probabilistic? Singular can help.

Book some time to chat today.