Mobile app marketing isn’t the same game we played just a few years ago. Privacy got stricter, but platforms now provide more data. AI is eating half of our jobs … but also giving us 3 more. Campaigns that might have run for months or weeks now live for weeks if not days.

And somehow, in spite of all the chaos, UA marketers are still finding smarter, more flexible, and more sustainable ways to grow.

The playbook isn’t what it used to be.

Nothing is.

But here are 25 tips and strategies that actually work now, mostly straight from in-depth conversations with smart marketers like you on the Growth Masterminds podcast, and data-driven reports and guides that we’ve recently published. For more details on the tip or strategy, follow the link to the full story, study, or Growth Masterminds episode with the insights.

Enjoy!

1. Diversify mobile app marketing ad spend beyond big platforms

If you’re still running the bulk of your UA through Google and Meta, you’re limiting your upside.

Our recent app growth insights report with Moloco shows that independent and regional ad networks are delivering outsized returns for marketers who are willing to test outside traditionally safe channels.

Diversification reduces risk, of course, but it also uncovers new audiences and geos that your competitors aren’t touching. In 2025, there are more viable partners than ever … and the marketers who expand beyond the big 2 are the ones uncovering fresh growth: critical for successful mobile app marketing.

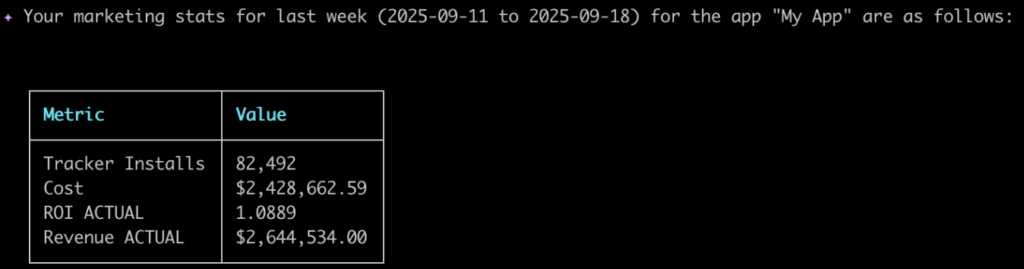

2. Use the ROI Index and ROI Quadrant to pick partners

Picking an ad partner to test isn’t guesswork anymore.

Or dependent on which ad network schmoozed you at a recent conference.

The Singular ROI Index 2025 lays out which platforms deliver value and which ones burn budget. Our ROI Quadrant makes the trade-offs crystal clear: some networks scale with high costs, some look cheap but return little, and some deliver the holy grail of growth at low cost.

Using these tools lets you prioritize where to test while avoiding ad networks that deliver only vanity metrics. Your mileage will always vary, so this is not an infallible cure-all … but it is a smart and time-saving strategy to get going.

3. Leverage generative AI tools in creative

Umm … Captain Obvious here.

You already know that creative has always been the most important lever in all performance marketing, including mobile app marketing. Now it’s also the most AI-driven. Generative AI platforms are helping marketers brainstorm, storyboard, and automatically generate new creative variations at scale. That means you can test 10X more ideas, creative, and hooks in the same timeframe.

The perhaps non-Captain-Obvious point is that you can now use AI to get deep insight into which creatives are working — all the way down to ROI — and also WHY some creatives are working. That’s thanks to Creative IQ from Singular.

The marketers winning this year aren’t just dabbling with AI … they’re using it as an always-on creative partner.

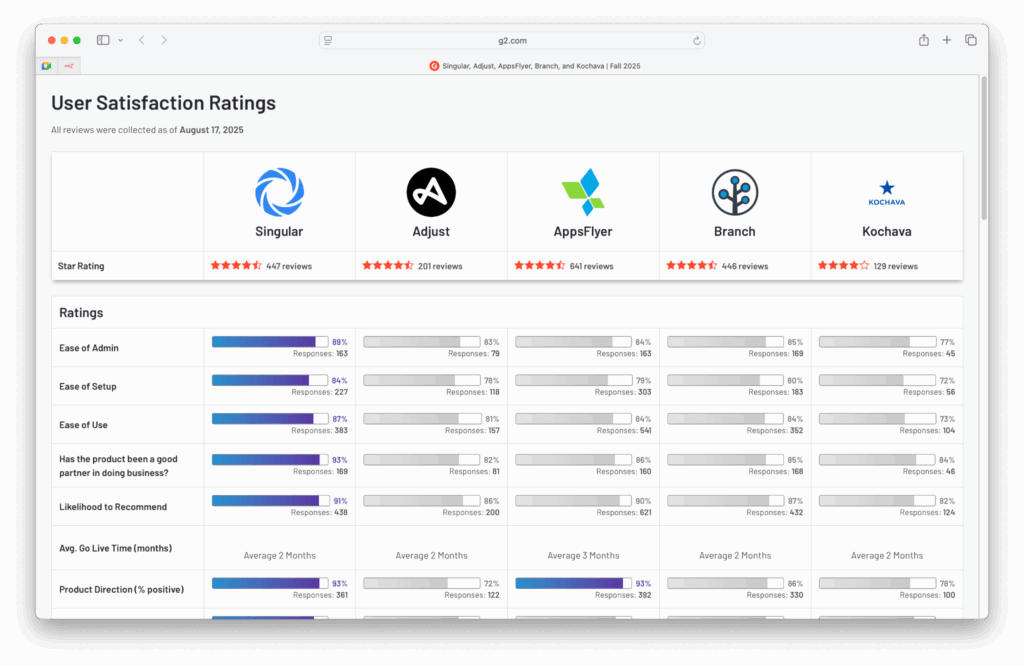

4. Pick your analytics tools carefully

Analytics is both your growth x-ray and measuring stick, but not every tool is right for every job.

The best teams in 2025 are using layered stacks: product analytics with live ops capabilities for retention, attribution platforms for UA efficiency, and creative analytics for optimizing ad spend. Too often, teams fall into the trap of expecting one tool to do it all and then miss opportunities because their visibility is limited.

Even smarter teams are now using tools like Extract to get App Store data like crashes, ratings, reviews, revenue, on-store CTR and conversion data, and more, and mixing into their marketing BI to get super-fast insights into growth changes.

Building the right analytics mix is a competitive advantage that lets you spot winners faster and cut losers before they waste your budget.

5. Watch quarterly spending and vertical shifts

Markets aren’t static.

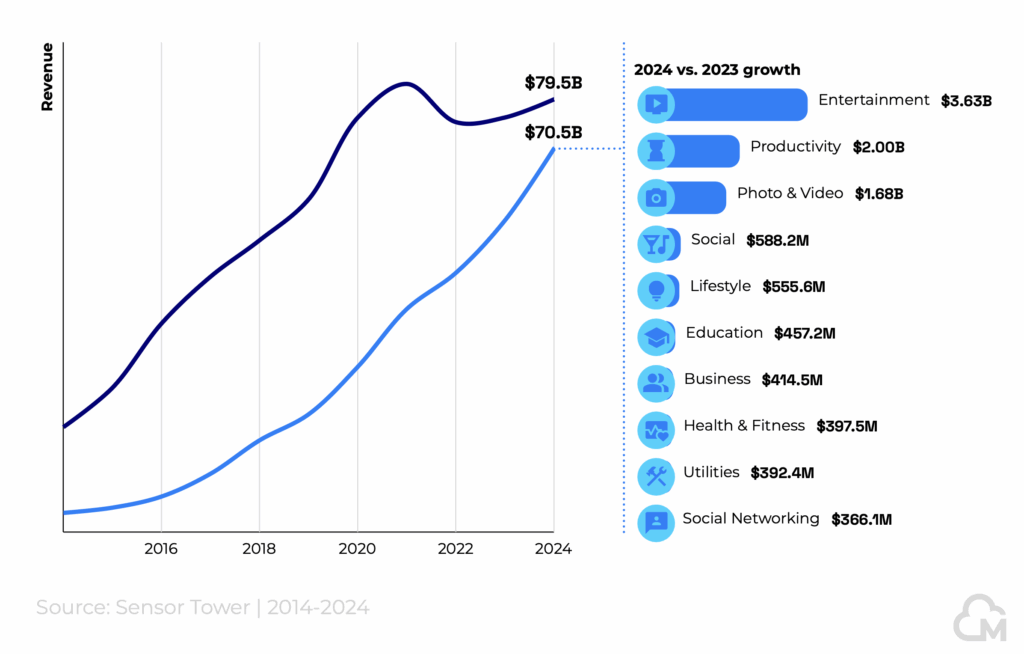

Our Quarterly Trends Report from Q2 2025 showed that verticals like entertainment and productivity were booming while shopping apps are facing macro headwinds, including tariffs. Our latest QTR shows different trends with different risks and upsides.

If you’re not paying attention to market shifts in mobile app marketing, you’ll keep spending where ROI is declining, or consumer attention is waning.

Smart marketers reallocate spend quickly, shifting dollars from weakening verticals into the ones gaining momentum. And while you can’t just instantly change your signature apps’ verticals, you can use recent credible information to adjust your marketing and product strategies.

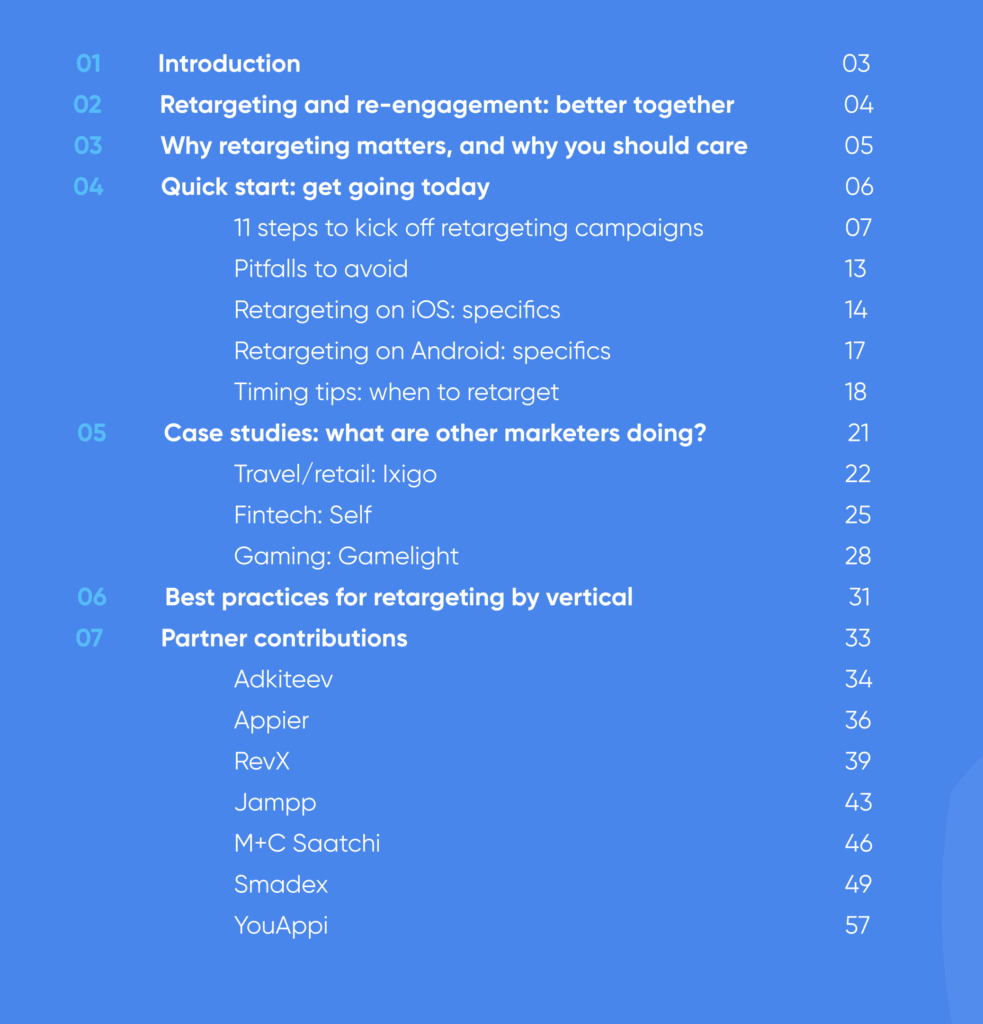

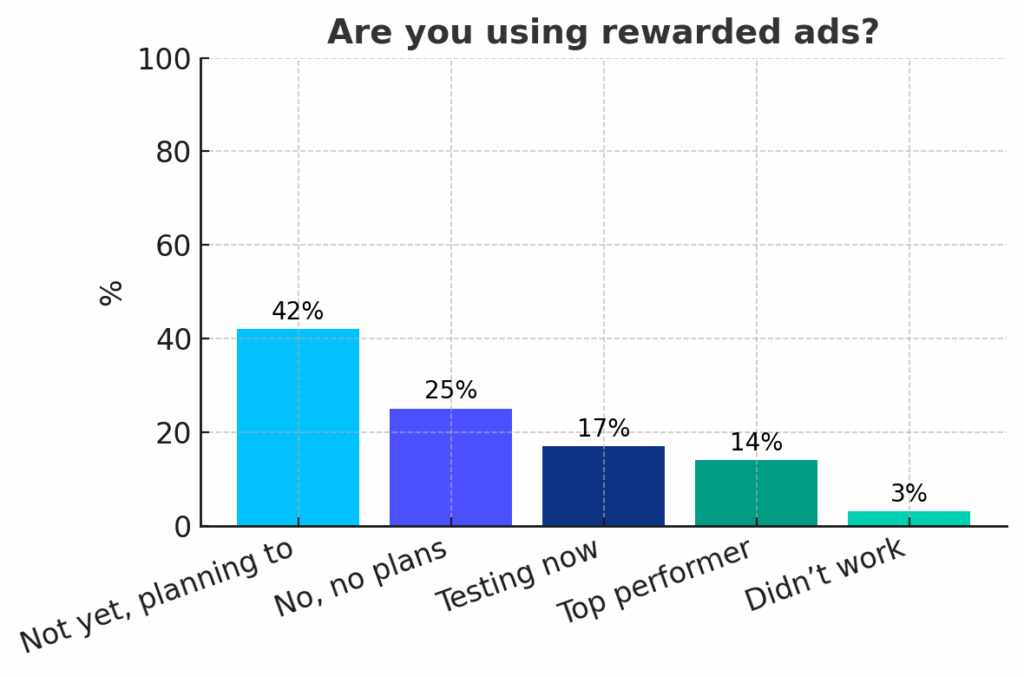

6. Retargeting and re-engagement multiply ROI

Acquisition is expensive, but re-engagement makes it profitable.

Retargeting campaigns, whether paid or owned media like push notifications and email, turn churn into renewed revenue. The smartest marketers are blending both: using paid channels for high-value reactivations and owned media for cheap wins at scale.

The result is not just better retention but stronger lifetime value across the board. Without re-engagement, you’re letting your most valuable users slip away.

7. Segment smarter and use behavior triggers for better mobile app marketing

One-size-fits-all retargeting is dead.

Blasting every lapsed user with the same message just annoys people and hurts performance.

Successful retargeting is behavior-driven: segmenting users by engagement level, spend, and churn risk, then triggering outreach based on actual behavior. Timing matters, too: retargeting a day-2 churned user is a different game than winning back a 6-month dormant subscriber.

The difference is massive ROI uplift versus wasted impressions.

8. Blend organic ASO and paid UA at launch

There’s (almost) no such thing as a purely organic hit anymore. That’s why mobile app marketing is a thing.

The path to millions of users and massive monetization almost always involves paid campaigns in addition to ASO, SEO, and — increasingly — AIEO or GEO.

App store optimization builds the foundation, ensuring visibility and conversion, while paid UA provides the fuel to climb charts and boost organics. Together, they form a growth loop that compounds: better ASO improves paid performance, and more installs from paid drives stronger ASO. Ignore one, and you’ll stunt your launch.

9. Test incrementality at scale

Just because you bought an install doesn’t mean you won that user, player, or customer.

Incrementality testing is how marketers know that campaigns are driving true net-new growth … as opposed to just cannibalizing organics and other channels.

Increasingly, incrementality isn’t optional in mobile app marketing. The top growth teams are running tests continuously, boosting spend only for ad partners that prove incremental value. It’s the only way to be sure you’re not just paying for users you would have gotten anyway.

10. Take advantage of web2app

More and more iOS marketers are shifting spend to web-to-app campaigns.

Why?

Because web-based landing pages give you more control, better tracking, and more opportunities to collect first-party data before the install. They also let you craft journeys that match your funnel, not Apple’s.

If you’re still only running in-app campaigns, you’re missing one of the biggest UA shifts of 2025.

11. Accept higher costs … and make them worth it

Yes, media costs are rising. CPMs are up, CPIs are higher, and inventory is more competitive.

But smarter analytics and stronger creative can make those higher costs worthwhile. Today the goal isn’t cheap installs .. it’s profitable users. Marketers who accept the new cost reality and focus on increasing LTV are still hitting impressive ROI.

And that’s how you scale UA today.

12. Prioritize creative intelligence

Creative is the one lever you still fully own in mobile app marketing.

(Correction: mostly. Most platforms are building more generative AI ad options. You’ll likely have options, however, about how much you lean into them.)

Platforms are automating bidding and targeting, but they can’t totally replace great hooks, compelling visuals, and high-performing narratives.

Marketers using AI-driven creative analytics are learning faster, testing more variations, and finding winners sooner. The more you invest in creative intelligence, the more leverage you’ll get from every dollar of UA spend.

13. Make retention a key part of you mobile app marketing strategy

Retention isn’t just a KPI. It’s a key growth driver.

Apps with high day-30 and day-90 retention rates can afford higher CPIs, scale faster, and outlast competitors. In 2025, the best-performing apps are those that build retention into the product roadmap and marketing strategy.

The math is simple: keeping users is cheaper than replacing them.

14. Double down on first-party and zero-party data

Privacy rules mean third-party identifiers are scarce.

That makes the data you own — behavioral, transactional, or even survey-based — more valuable than ever. And zero-party data, like a food-delivery customer telling you they are vegan, is gold for segmentation and personalization.

The marketers building deep data foundations now will have the edge for years to come.

15. Fragmentation is bad. Fragmentation is good.

SKAN, GAID, modeled attribution, IDFV … the measurement ecosystem is fractured.

Winning teams don’t wait for a single perfect solution. Instead, they build systems to triangulate across multiple signals and evolve when APIs or rules change.

Doing that right can make today a golden age of marketing measurement in mobile app marketing, with deeper and broader insights than when you have every IDFA you wanted.

In 2025, agility and breadth of data sources are your best hedge against fragmentation.

16. Track vertical-specific growth patterns

It’s shocking, I know, but not every app category behaves the same.

Our latest study of over 2,000 apps shows that consumer apps are surging while games are stabilizing. More and more consumer dollars are pouring into apps, and apps are becoming the monetization kinds of mobile … which games owned for the better part of a decade.

Smart marketers are adjusting UA strategies based on vertical dynamics instead of following industry-wide averages.

Where you spend your UA dollars needs to change when consumer behavior changes. Being open to new partners and new channels is critical for successful mobile app marketing.

17. CTRs are broken on iOS

Click-through rates on iOS gaming ads have ballooned to absurd levels … over 100% in some cases.

Why?

Because how ad networks use SKOverlay blurs the line between impressions and clicks, with lightweight App Store views popping up mid-ad.

The result: CTR is no longer a clean performance metric. That means smart marketers treat CTR on iOS almost like impression counts … directionally useful, but not a super-reliable measure of engagement.

18. Add independent and long-tail partners for higher-ROI mobile app marketing

Big networks still matter, but long-tail and regional ad networks are proving to be strong performers.

Smaller platforms can sometimes deliver higher ROI because they focus on niche audiences or regions the big guys ignore.

Adding them to your mobile app marketing mix diversifies your risk and can unlock unexpected growth. In fact, some of the biggest ROI wins in our ROI Index came from outside the usual suspects.

19. Also, more ad partners = better ROI

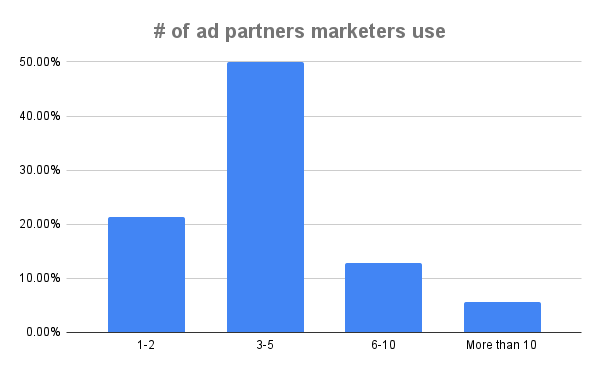

Our research shows that advertisers using six or more ad networks consistently outperform those who rely on fewer.

The benefits are clear: higher ROI, lower CPIs, and in many verticals, even stronger retention. It’s not always easy to scale partner relationships, but the payoff is massive, and MMPs like Singular help.

Diversification isn’t just about geos or platforms … it’s about your ad network mix too.

20. Waterfalls are dead, and mediation is UA

AppLovin MAX killed waterfalls in mid-2025, replacing them with real-time bidding.

That means you no longer control who buys your inventory and at what order: everyone bids simultaneously. While this simplifies operations, it also ties monetization directly to UA: your mediation partner influences both ad revenue and user acquisition opportunities.

Choosing mediation is no longer just a monetization decision; it’s a growth strategy. The good news is that increasing competition from multiple partners is giving you options.

21. Keep optimizing around ATT and SKAN

Years after ATT, SKAdNetwork is still a dominant framework for iOS attribution.

No, it’s not perfect and never will be. But … it’s a core part of the iOS measurement playing field. The marketers who understand it, embrace it, and use it as part of their measurement mix are miles ahead of those still waiting for an easier solution.

Good news: Singular’s a big Easy button for SKAN.

So you can get the benefits without doing all the hard yards yourself.

22. Move faster on creative and UA cycles

The half-life of a good creative is shorter than ever. Campaigns that once ran profitably for months now burn out in weeks. The best UA teams are running shorter test cycles, pivoting quickly, and feeding AI tools with new creative constantly. Slow iteration means falling behind.

(Source: Scaling mobile UA strategy)

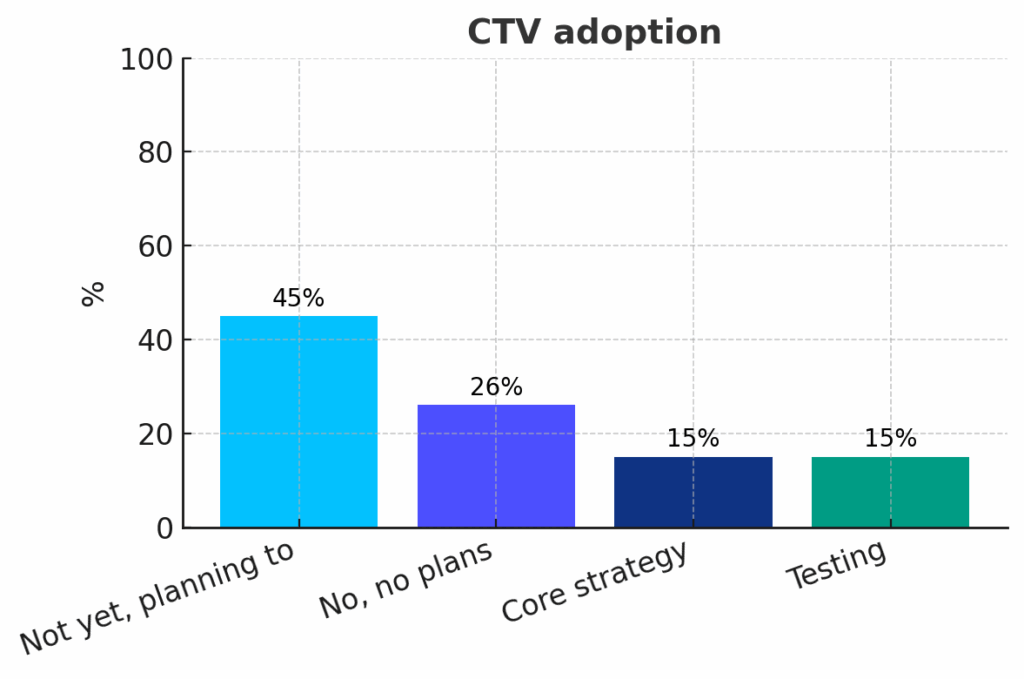

23. CTV is now a performance channel

TV used to be a brand marketer’s playground. Just like old-fashioned linear TV.

But not anymore.

With video-level targeting powered by AI, you can now match creative to content with precision: think fitness apps advertising on American Gladiator reruns or fishing gear companies showing up during bass tournaments.

Campaigns using this strategy have seen up to 5X lifts in brand favorability, and yes, that matters for performance.

CTV in 2025 is not just awareness: it’s a top-of-funnel rocket booster for app growth.

24. Use web2app journeys for control and margin

Owning your funnel is owning your destiny.

Web2app journeys let you collect first-party data, personalize onboarding, and bypass some app store friction. They also give you more control over attribution.

In 2025, the best marketers are designing these flows as carefully as in-app experiences. This is especially powerful for subscription apps, because you can both segment your new potential customers and pre-customize your in-app experience … along with accepting payment outside the App Store or Google Play to maximize your revenue and profitability.

25. AI is redefining performance marketing roles

When Meta says you’ll soon be able to “just give us money and an objective,” you know things are shifting.

AI is automating campaign setup, targeting, bidding, and creative production. That doesn’t make UA managers irrelevant, but it will force you to evolve. Now performance marketers are becoming AI strategists: setting goals, feeding systems with creative direction, and interpreting modeled outputs to guide growth.

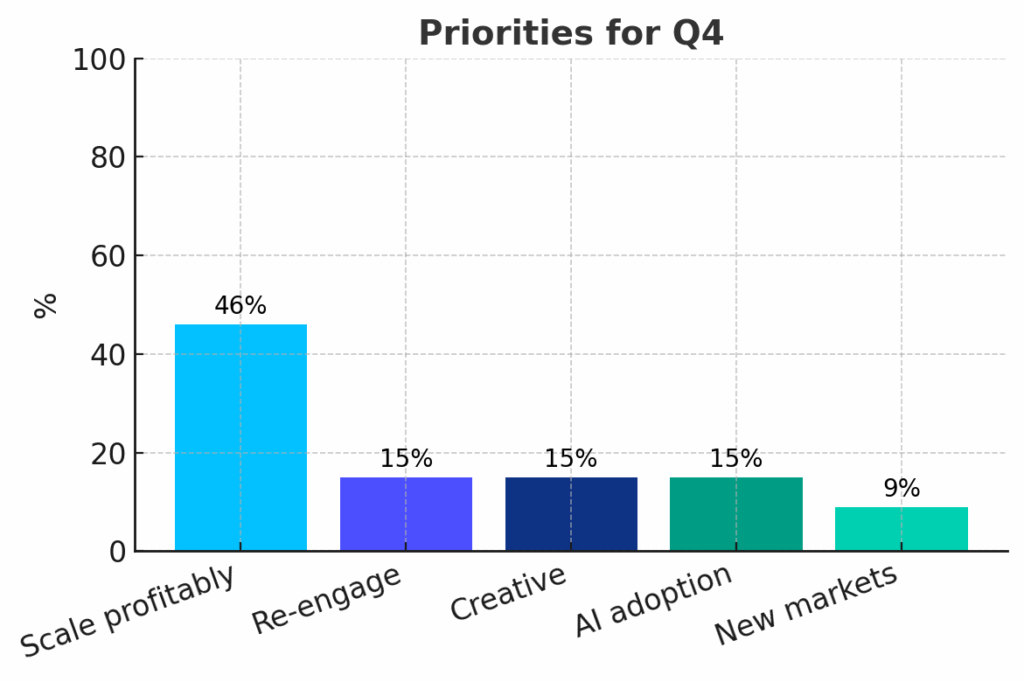

Wrapping up: fast, flexible, AI-infused marketing

Mobile app marketing in 2025 is faster, more flexible, and more automated than ever.

Privacy walls are still high, costs are increasing, and diversification is essential. But the flip side is a new golden age of opportunity: smarter analytics, powerful AI, new monetization models, and more partners than ever to work with.

Marketers thriving in this environment aren’t clinging to the old playbook. They’re experimenting constantly, diversifying spend, leveraging AI, and staying brutally flexible.

That’s how you win right now.