Scaling ad spend is HARD. When you find something that works — the right creative, offer, and ad network — you’d hope that scaling ad spend would be as simple as inserting more cash into the coin-op user acquisition machine.

But it’s not that simple.

What’s super-optimized at niche spend levels generally becomes unprofitable at scaled spend levels. First off, you need to find your unicorn creative that will remain ROI-positive even as you add zeros to your budget, as I learned from Lukas Szanto earlier this year.

But you also sometimes need to add new channels.

That’s horizontal scaling as opposed to vertical scaling, or increasing spend with existing partners. Recently, I sat down with Vytis Bareika, founder and CEO of Defined Chase, to talk about scaling. He should know: he’s spent over $100 million on ads and helped mobile games hit over a billion downloads.

Hit play to see our convo, and keep scrolling for the top learnings:

Scaling ad spend: horizontal vs vertical

First up, what does Bareika mean by horizontal and vertical scaling?

When you find an ad network that works, you scale ad spend until it doesn’t. That’s vertical scaling, and for a game or app that monetizes well, it’s an infinite money hack: insert UA capital, get users, make more money, re-insert UA capital.

But at any given ad network, ad spend scales until it doesn’t.

Then you need more fishing poles, and you need to fish in different streams. That’s horizontal scaling.

When you’ve hit a point where increasing budget on Meta or Google doesn’t give better returns, it’s time to diversify: new partners, new formats, and sometimes even new platforms like web or CTV.

All the top ad-scaling tips

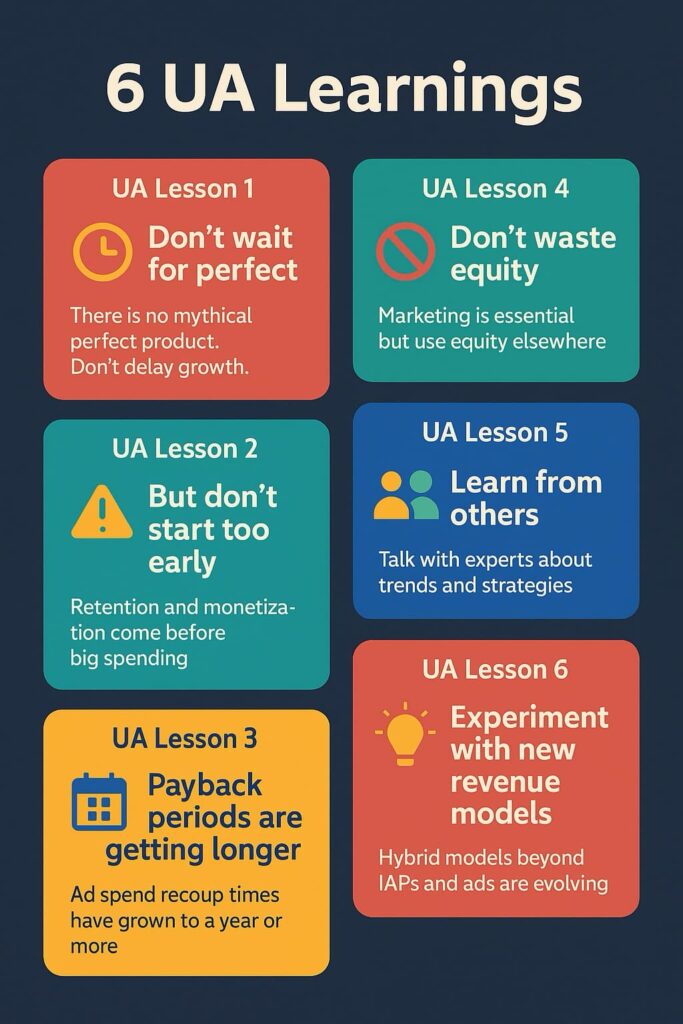

What do you need to know when you’re going to scale ad spend? Here’s a good starter list, at least:

Or, if you prefer to read your tips the old-fashioned way:

- Know when to start scaling horizontally

Watch for diminishing returns on current channels. - Scale horizontally and vertically at the same time

Keep scaling on your best-performing campaigns on your top channels while also looking for new channels. - Validate new channels for incrementality

Ensure you’re getting net new users. - Research before testing

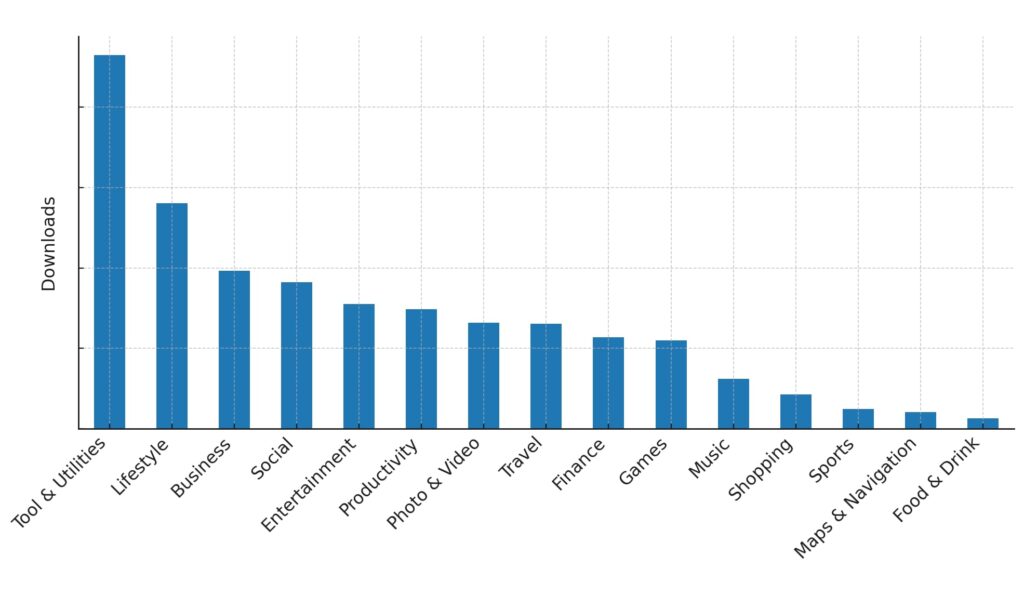

Don’t just test randomly. Check reports like the Singular ROI Index to look for your best options. - Test with meaningful budgets

Don’t underinvest in tests … for the U.S. you need a minimum of $500/day. - Build a relationship with your ad reps

They know tips and tricks for their platform, and often those are unpublished. Avoid learning the hard way. - Customize your creative approach for each channel

TikTok and Google aren’t the same, and everyone knows it. But IG is different too, and Snapchat needs its own approach. - Build a creative testing system

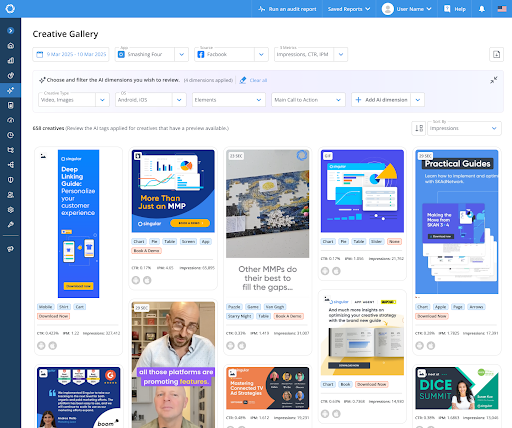

Don’t just go by your gut. Structure your creative output in multiple dimensions (quantity, angles, offers, etc.) and track each. - Analyze creative performance deeply

Use AI-powered tools like Creative IQ to deeply understand what’s happening with your ad creative. - Expand your team or tools

As you scale ad spend, you scale workload. You will need to expand either your toolset or your team, or both. - Consider brand awareness

Scaling brings advantages, and 1 of them is increased brand awareness. Leverage that for re-engagement, retention, and trust. And note that high-frequency low-CPM ads can help build brand awareness quickly. - Leverage web-to-app funnels

Even if you’re not taking payments here, take advantage of better tracking and soft closes on the web. And use quiz funnels to warm up users and collect emails before your app is installed.

Smart diversification means testing for incrementality

Choosing the right ad networks and platforms is key, of course.

But you need to test that they’re incremental before scaling on them.

That means controlling campaigns, creating differential spend patterns and then looking for matching results, as well as potentially going all-in on hard-core incrementality testing.

The key is finding ad partners that access a new audience. Otherwise you’re just throwing more hooks into the same pond and getting more of the same fish.

Want to go deeper with incrementality testing for scaling ad spend? Check out a detailed step-by-step resource here.

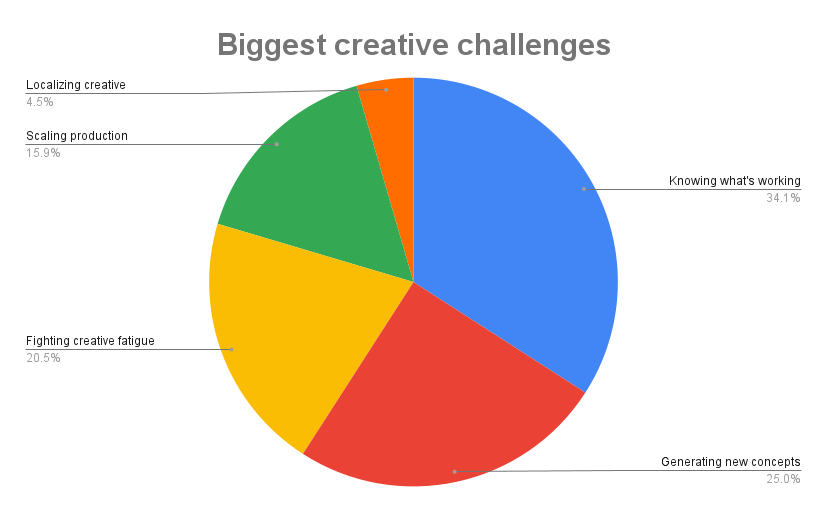

Creative is the key to scaling ad spend

Every marketer knows ad creative is super-critical for positive ROI. That’s especially true when scaling ad spend.

As you test each ad partner for incrementality — try $500 to $1,000 per month to start — also be testing creative. You’re looking for a unicorn creative that is literally 10X better than the alternatives.

Why 10X?

Because as you scale spend on that creative, performance will naturally degrade as your ad partner shows it to more and more people, including some who are just on the fringes of your ideal target audience.

Also, customize each creative element to the platform you’re publishing on.

“Snapchat is different from Google. TikTok is different from Meta. You need dedicated creative per channel,” says Bareika.

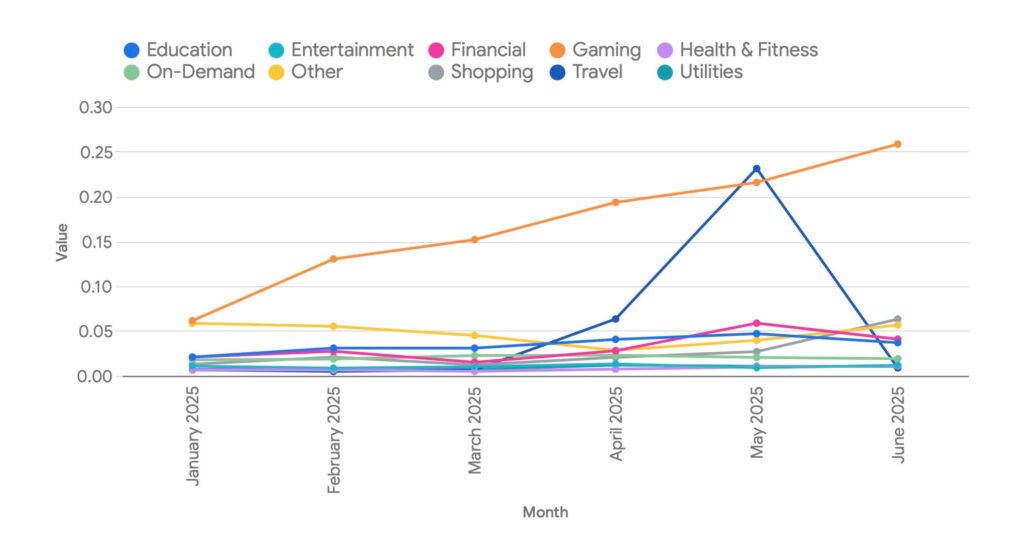

Facebook still works great with static ads (check the webinar I just did with a bunch of experts who said that Ye Olde Static Banner Ad is still working, still effective, and still ROI-positive. Unity, AppLovin, and other programmatic networks excel with playables. TikTok and Instagram work well with UGC and AI-enhanced UGC, though each has slightly different preferences due to age range differences as well.

The key learning: don’t reuse one-size-fits-all creatives.

Also, structure your creative efforts.

“Some teams create based on feeling,” says Bareika. “Better teams have systems: how many creatives per week, what angles, what emotions?”

Be a better team. Have a plan. Check in regularly to see that the plan is working … or not. Use a tool like Creative IQ to enlist AI on your side to optimize your creative faster and better than you can alone.

Get nerdy.

Sometimes the most trivial things have big consequences:

“We did AI analysis of thousands of creatives,” says Bareika. “If the character looked left instead of at the user, conversions dropped 20%.”

And don’t forget, if you’re scaling ad spend, your creative production has to scale too. Try different angles based on user psychology: social proof, relaxation, problem-solving, and more. Use generative AI to multiply variations and test faster. Set weekly output goals.

And don’t forget web2app

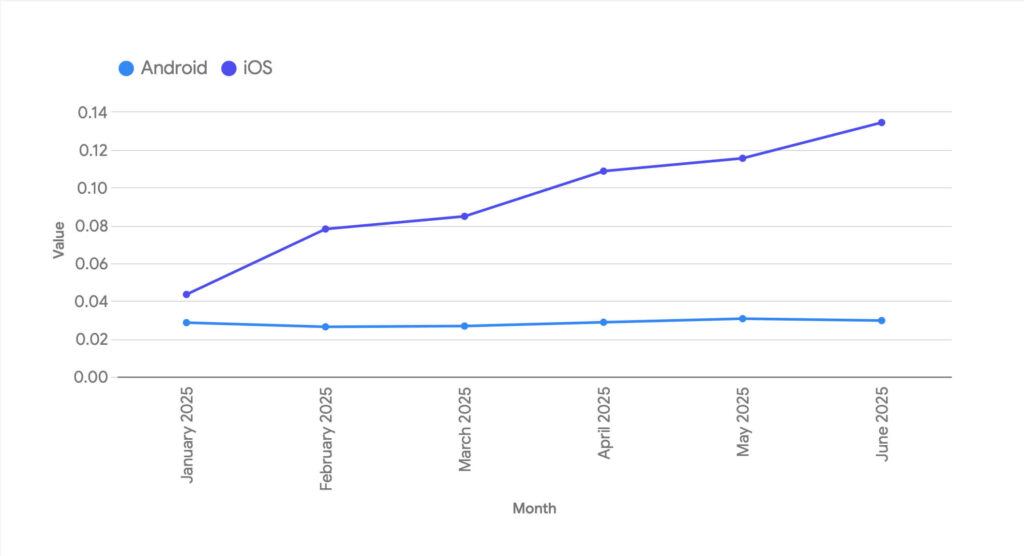

Web can be cheaper, which is good. It also provides more data, at least than iOS, and that’s also good.

And you can do quiz funnels to really prep potential buyers for your solution.

“With quiz funnels, you make the problem feel bigger,” says Bareika. “By the end, users are ready to solve it.”

Quiz funnels also take advantage of sunk-cost psychology: after 15–20 questions, people feel invested … and they trust you more. A big bonus: you can collect emails or phone numbers even before the install, allowing you to set up for retargeting and lookalike marketing even if they don’t complete the install and sign-up right away.

So much more in the full podcast

Hey, there’s so much more about scaling ad spend profitably in the full podcast. Check it out above, subscribe to our YouTube channel, or get it wherever you get audio podcasts.

What you’ll get:

- 00:00 Introduction to Growth Masterminds

- 00:34 The Journey to Managing Massive Ad Budgets

- 02:10 Understanding Horizontal Scaling

- 04:40 Strategies for Adding New Partners

- 07:22 Creative Strategies for Different Channels

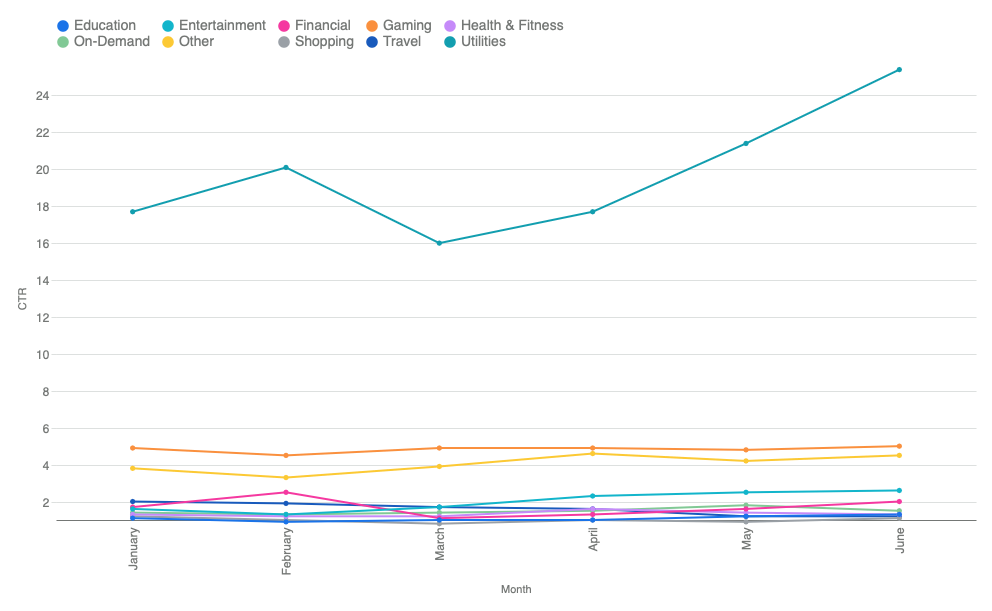

- 09:37 Analyzing User Engagement and Creative Performance

- 12:09 Hidden Gems in Apple Search

- 12:38 Singular’s Quarterly Trends Report

- 13:16 The Importance of Brand Awareness

- 16:14 Re-engagement Strategies

- 17:33 Web to App Marketing

- 23:24 Future Trends in UA Performance Marketing

- 24:34 Conclusion and Final Thoughts