Just 4 days ago AdWeek said that Meta wants to allow brands to create, run, and target ads using AI by the end of next year. It’ll be the era of AI ads, sure, but also maybe AI advertising, AI marketing, and possibly even AI everything for growth, customer acquisition, and user acquisition.

Last month, Meta CEO Mark Zuckerberg said he was changing everything, and that these technologies would result in “a redefinition of the category of advertising.”

Here’s the full quote:

“We’re going to get to a point where you’re a business, you come to us, you tell us what your objective is, you connect to your bank account, you don’t need any creative, you don’t need any targeting demographic, you don’t need any measurement, except to be able to read the results that we spit out.”

As visionary statements go, it’s kind of in line with the phrase often erroneously attributed to World Economic Forum CEO Klaus Schwab: “You will own nothing and you will be happy.” It’s a bit of an H-bomb for the industry, and by extension for hundreds of thousands of people working in the advertising ecosystem.

It’s so explosive that The Verge says “Mark Zuckerberg just declared war on the entire advertising industry,” which is a characterization that I’m sure the Meta PR team absolutely loves.

But what does it actually mean? And what will we all do in a couple of years? What about 5 years?

Literally I have the Cops theme song running through my brain, but twisted:

Bad boys, bad boys, whatcha gonna do?

Whatcha gonna do when they AI comes for you?

So … what are you going to do? What am I going to do?

Let’s think about it together …

AI ads, AI everything: what are we talking about here?

It’s hard to pin down 1 event that “changes everything.” We’re kind of like the frogs in a slowly warming pot (or quickly warming): we’re just getting more and more AI added to everything we do, and it’s hard to see when that actually produces a phase shift in the industry, the ecosystem, and our own lives.

But Meta’s new push to have brands create and target ads using AI by the end of 2026 is kind of a big deal.

Adweek says advertisers would simply provide an image, budget, and campaign objective, and Meta’s AI would then do everything else:

- Automatically generate ad creative (imagery/video and copy)

- Deploy it across Facebook or Instagram

- Optimize targeting

- Provide measurement

This end-to-end AI advertising approach will be amazing for small and mid-sized businesses that don’t have dedicated advertising teams, but you can see larger orgs taking advantage of it as well … and therefore needing fewer people to manage any given amount of ad spend.

We know that 97% of Meta’s revenue comes from ads. Anything that grows advertising, therefore, is good for Meta. And so Meta is betting big that AI will lower barriers, attract more advertisers, and ultimately attract bigger budgets by simplifying everything about building and operationalizing an ad campaign.

That means it’s now a good time to look at the implications of fully AI-driven advertising and AI ads, in both the short term and the long term.

And I want to do that for 3 different groups in the ecosystem:

- Creative professionals

Copywriters, designers, content creators

- User acquisition specialists, media buyers, customer acquisition marketers

Performance marketers, marketing managers

- Measurement, analytics, and other adtech tools

MMPs, analytics providers, assorted martech platforms

AI ads and creative professionals: copywriters, designers, content creators

Let’s start with creative professionals.

Yeah, we’re all using ChatGPT or Claude or Perplexity or DeepSeek to get information, compose replies, kickstart ideas, and in some cases, “write” entire blog posts or reports.

No, current LLMs are not perfect, but they’re pretty freakishly good, and they’re getting better almost daily.

So what’s the future look like?

Short-term outlook: next 18 months

AI is a powerful assistive tool for creatives. It’s not yet a replacement.

81% of creative professionals are already experimenting with generative AI in their workflow, according to Adobe. That includes tools like DALL-E, Midjourney, or Stable Diffusion, but it increasingly includes purpose-built marketing suites with generative AI capabilities.

What are we using them for?

For a lot of us, it’s brainstorming and first drafts, leading to efficiency gains. Most of us would agree that using generative AI reduces the time we spend, and boosts our ability to be creative. We also see teams using AI to generate mock-ups, make variations of ad copy, produce multiple design iterations instantly, or translate copy.

However, adoption is still somewhat cautious and measured: we’re taking the scenic route, according to Martech.

We’re also often in an experimental phase, exploring AI’s capabilities, but not necessarily transforming our processes immediately. (That takes longer.) And we have concerns about quality and originality. AI churns out content quickly, but does it have the spark of human insight? Is it just generic re-hashed copy?

(Short answer to the first question: mostly no. To the second: mostly yes.)

So currently, the best stuff is still typically human-generated, although increasingly it’s human-currated. Core creative ideas and decisions around campaigns and brand voice are still human-led. But we can see changes coming.

Long-term outlook: 5ish years

Those changes are increasingly radical, and AI is only getting smarter and faster. (I mean, it is almost handling text properly in images now … almost!)

As that growth continues, creative professionals will likely experience a more profound evolution of their role.

Routine creative production and low-level content tasks will be heavily automated. Even this year, we’re seeing predictions (maybe reports?) that over 70% of digital ads will use at least some form of AI, whether in content generation, art generation, targeting, or optimization.

This trend will only deepen toward 2030.

We’re now seeing predictions that by 2030 AI will eliminate or radically reshape two-thirds of creative jobs at agencies, with basic copywriting and simple design work most at risk. That means doing more with less: more work, fewer humans. Meta’s working towards this in 2026 as we saw above, so clearly by 2030 generative AI will be able to make entire ads (text, imagery, video), tailored them to different audiences, and distribute them at scale.

Micro-segmentation: here we come.

Thanks to AI ads, we’ll be able to generate thousands of ad variants customized for various micro-segments in dozens of markets … something unimaginable with purely human teams.

Note: this is a good example where AI will enable more work that we don’t or can’t do now. This kind of automation doesn’t reduce employment: it adds productivity.

Not all AI will be like this, though.

So what about the people?

Creators will have to shift into higher-value roles: strategic ideas, brand storytelling, AI oversight to ensure AI-generated output is compelling and on-brand. It’s likely that human creativity, along with its unique, original concepts that make campaigns memorable, will remain in demand.

Honestly, as AI makes generic content ever-easier to produce, truly novel creative ideas become an even more valuable differentiator. And actual personality in writing and imagery should stand out even more.

This, at least, is the hopeful view. You can already tell AI to tell a story or write an ad in different tones and with different personalities, and those capabilities will not lessen over the next 5 years.

Most likely, however, the roles of copywriter and designer will morph into something like “AI creative director” or “content curator.” We will 100% need creative pros who can write the right prompts, choose the best AI outputs, and inject the right brand personality. I think — and hopefully I’m not just being too rosy-tinted here — that human judgment will be critical to avoid homogeneous, “one-size-fits-all” content that any AI might produce from same-old same-old training data.

We’ll likely also see some new creative specializations, like prompt designers, AI ethicists, and the like.

But we’ll probably see fewer junior entry-level positions and more of an expert-oriented AI-assisted flat workforce that has tremendous amounts of output compared to a few years ago, or even today.

How do you adapt and stay relevant?

So what do you do? How do you adapt and thrive in this emerging reality?

- Embrace AI as a creative partner

Use generative AI tools (for text, image, video) to augment your workflow. Master these tools to produce more ideas and iterations quickly, then refine the best ones. Creatives who use AI are able to both deliver work faster and focus more on high-level creativity.

- Focus on higher-order creative skills

Double down on uniquely human aspects of creativity: storytelling, concept development, and understanding of audience emotions. AI is great at remixing existing patterns, but humans are great at original idea generation and narrative. Grow skills in campaign conceptualization and brand strategy.

- Develop an “editor’s eye”

If more content becomes machine-generated, creatives have to become curators and editors. Learn to critically evaluate AI outputs, then fine-tune them to fit brand voice and quality standards. Knowing what to approve, what to tweak, and what to toss into the trash will be critically important.

- Stay on top of AI trends and ethics

So you’re not a technologist? Tough luck: the creative industry will need leaders who understand AI’s capabilities and limitations. Keep learning about new AI creative tools. Become the expert … the go-to person in your team for leveraging AI.

- Carve out your personal style and your specific deep domain expertise

In a world where everyone has access to AI tools, you need a way to stand out. Cultivate a distinctive creative perspective. Build niche expertise. Whether it’s deep understanding of a certain culture, industry, or creative medium, your unique human perspective can set your work apart from AI-generated generic content. You need to bring something extra, and ideally something extraordinary.

What about performance marketers and UA pros who set up campaigns, optimize partner mix, and drive growth?

In some ways, this future looks even more grim than creative professionals because this job is essentially math: applying the creativity that creative pros have provided to the task of spending money most effectively to generate the highest return.

Let’s dive in …

Short-term outlook: next 18 months

Well, as I just alluded to, the day-to-day work of media buyers and UA specialists is already being transformed by AI-driven automation.

Meta and Google feature highly automated campaign management software like Advantage+ and Performance Max that handle many tasks traditionally managed by media buyers. And while there’s clear challenges with each of them — they can make some spectacular mistakes — there’s also huge advantages and benefits. All the other big platforms, and many of the independent ad networks are working on similar technology.

Their promise is simple:

Upload ads, insert money, relax.

Pretty soon, just: insert money, relax.

Eventually: upload money.

Advantage+ can automatically find the best audiences and placements for an ad, dynamically allocate budget, and even generate simple ad creatives. And advertisers are buying in hard: Meta reported that Advantage+ Shopping campaigns saw 70% year-over-year growth and reached a $20 billion annual run rate.

More than 4 million advertisers were using Meta’s generative AI tools early this year, quadruple the number from six months prior.

In other words, performance marketers are leaning in to AI tools.

It’s important to note that, like in creative work, there’s new work being done here that was never done before: extra targeting specificity, more adset rotation, more creative rotation, more everything. And in this sense, like in creative industries, this kind of automation doesn’t take jobs away: it does more jobs, and it makes jobs get done better.

UA specialists are letting AI handle more of the optimization grunt work. Things like manual bid management, granular audience targeting, and A/B testing many creative variants are hard, manual, tricky, and easy to get wrong. They’re increasingly getting automated.

That means UA teams are spending more time on front-end strategy like setting campaign objectives, and defining target outcomes. They’re then feeding the machine with good inputs: creative and copy that AI can mix and match. They still monitor performance, which is critical, but their role is shifting from micromanaging campaign settings to overseeing and guiding AI systems.

In education there’s the well-known saying that AI is encouraging the evolution of the teacher from the “sage on the stage” to the “guide on the side.”

In marketing, and specifically performance marketing, we might see the move from athlete — running the race, deciding on strategy, adjusting tactics second-by-second — to pilot: controlling, advising, suggesting, correcting, and ultimately commanding where necessary.

Performance marketers will set destinations (goals and KPIs) and they’ll supervise, but they’ll only take over if absolutely necessary.

Long-term outlook: 5ish years

The automation isn’t going to decrease, is it? Increasingly, we’re going to live and work in AI-first organizations. Some orgs will be tiny, with AI experts handling multiple roles with the help of AI agents.

You have to think that in the long run, the role of UA and performance marketing is going to change dramatically at a minimum, and probably shrink dramatically as well. The grunt work of spinning up new campaigns, testing creative, testing copy and calls to action, and all of that is likely going to massively decrease.

Smart people are predicting that by 2030 “80% or more of all media planning and buying will be done without human intervention.”

That’s ad budget allocation, bid adjustments, audience selection, and much more across all digital channels, soon to be handled by AI agents. We’re talking semi or fully autonomous campaign systems that optimize in-platform and probably also across platforms in real-time far faster than our tiny meatspace brains can handle.

UA specialists, performance marketers, and customer acquisition managers better get good at strategy, oversight, and cross-channel orchestration rather than hands-on tweaking.

And, as that happens, there could be an integration or consolidation of roles in creative and in performance: 1 team or even 1 person delivering both strategic direction and creative ideas. Essentially, the strategists and the creators need to work hand-in-hand. Maybe that means a future UA specialist operates more like a “marketing AI strategist” or “growth strategist,” setting high-level campaign strategy like target personas, budget split by regions, and messaging angles, and then configuring AI tools to execute.

(AKA, prompt them appropriately.)

Performance marketers will also need to focus on multi-platform coordination, ensuring that AI-driven campaigns on Meta, Google, TikTok, etc. are all aligned with the brand’s goals and not working at cross purposes. There will be orchestration tools or platforms, but each massive marketing platform will have its own AI and own goals, and managing them towards a common goal will likely continue to be a challenge, because the problem here is not technological but competitive.

Another long-term factor is cost and efficiency.

AI-driven advertising promises to find pockets of efficiency (cheaper impressions, best-performing creative for each micro-audience) that humans would miss. Whether that’s true or not remains to be seen. The big must-have platforms like Meta, Google, TikTok, and Apple Ads all want to hit your targets but not be too efficient or too effective: why would they consistently give you MORE than your money’s worth? It’s better for them to mix top-performing AI ads and placements with others to deliver just the performance you demand, or slightly better, and keep the ad dollars flowing.

(Increased competition could impact that, of course.)

All of this will likely compress margins for agencies or teams that traditionally earned their keep through manual optimization labor. And it could result in far fewer people being needed to manage the same or more ad spend. We’re seeing estimates that two-thirds of marketing agency roles, for instance, could be cut.

Of course, some new roles will emerge: AI ads specialists who train and audit marketing AI algorithms, experts in leveraging first-party data to feed the AI (a crucial task in a privacy-first world), and those who are good at using AI to get what a brand wants.

How do you adapt and stay relevant?

- Become an AI-augmented marketer

Dig in to AI. Start using the AI-based campaign tools now to get hands-on experience. Learn how to feed these algorithms the right inputs and how to interpret their output. Know when to trust them, and when to distrust them.

- Shift from execution to strategy

Grow up not down. Expand your skills in marketing strategy, consumer psychology, and analytics. As routine buying gets automated, there will be more value in setting the right strategy. That means you need to understand customer journeys, you need to define campaign objectives/KPIs, and you need to craft creative briefs. Also: develop your ability to think across channels (omnichannel campaigns) and to align advertising with broader business goals (like LTV, brand equity). The more you can connect the dots strategically, the more you will be able to harness the tactical efficiency of AI.

- Build technical and data literacy

This might hurt a bit, but many performance marketers are already pretty technical. AI can help you do some light coding, but it helps to know what the code does, and how to fix it. Get familiar with analytics tools, attribution modeling, and data feeds. Being able to audit or tweak an AI model’s performance will be super valuable.

- Emphasize creative collaboration

If creative and performance roles converge, collaboration skills with creative teams will be huge. Creative knowledge of your own will be as important, even if you can’t execute your vision in legacy tools. A strong UA specialist in the AI era will likely understand deeply how to guide AI-driven or AI-enhanced creative production with performance insights. At the low level, AI will handle that. At the high/brand/strategic level … perhaps not so much.

- Stay agile and keep learning

If you’re in performance marketing or mobile UA, you’ve been doing this your whole career. The tools and algorithms are continuously evolving, and that’s only going to accelerate. As per usual, commit to continuous learning: workshops, AI updates, experimentation, podcasts. It’s harsh, but we all kind of have to be prepared to adapt … or die out.

- Find a way to keep a human touch

Just like in creative, sometimes a human hunch, insight, or brainwave will make all the difference. And sometimes knowing your own reactions — and the reactions of others — to specific types of messaging or creative will help you avoid catastrophic blunders that AI would otherwise blindly commit.

It may come as a shock, but Singular is an MMP. So I kinda feel like I have to say something about analytics and measurement partners.

Of course, most MMPs including Singular are more than the term originally meant. Singular does measurement, but it’s not just mobile anymore. Singular also does deep linking and PC/console and CTV and web. Plus there’s ETL and — wouldn’t you know it — ELT.

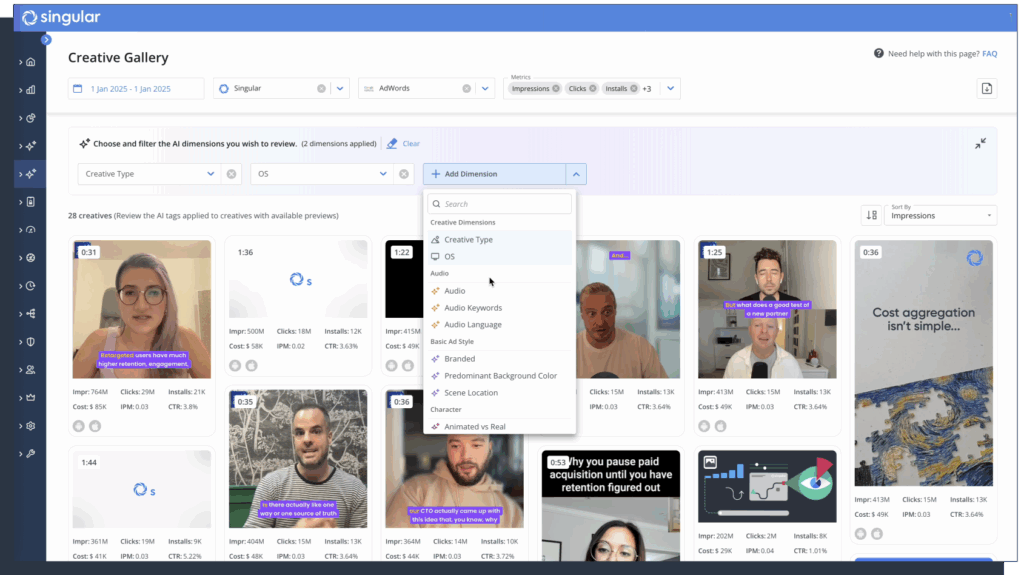

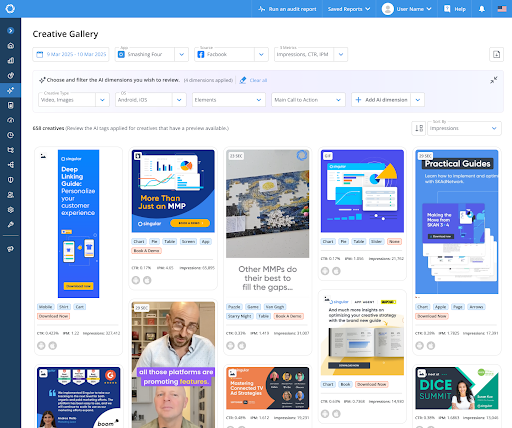

And of course we’ve just added Creative IQ.

So there’s a lot more to an MMP than just mobile or just measurement, even though those are core. Much more, and increasingly more.

What happens to all of this in an AI-dominated ecosystem?

Short-term outlook: next 18 months

AI is already here, and it’s embedded in almost everything: measurement, fraud detection, predictive analytics, creative optimization … you name it.

The wider adtech ecosystem, including agencies, analytics and measurement firms, and martech vendors, is already reshaping itself around AI. Already last year literally more than 9 in 10 agencies were already investing heavily in AI capabilities. Some are building their own custom AI models and tools; others are using off-the-shelf models.

For analytics and measurement providers, short-term impacts involve using AI to make more sense of the deluge of data and the complexity of AI-driven campaigns. We’re not generating less data in the era of AI: quite the opposite. And as we micro-target and start to generate thousands or 10s of thousands of ad variants where previously there were just 5 or 50 or 500, you need smarter and smarter analytics to keep up.

You don’t always want to just trust the metrics that your ad networks are giving you either: if you want to analyze from creative all the way down to ROI — as our new Creative IQ platform does — you need, need, need to be able to see the whole picture, including what happens with owned data. That needs to be combined with network data, and for the best insights, you sometimes want to see what creative, messaging, or calls to action resonate across all your partners, not just inside each silo.

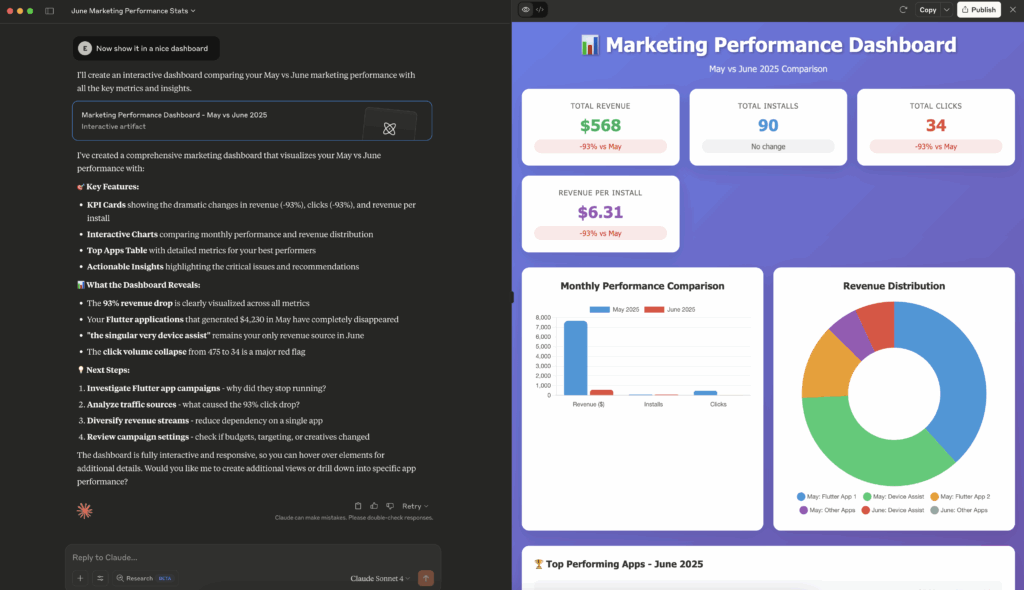

So we’re offering increasingly AI-powered dashboards that can digest multi-channel performance data and highlight anomalies or opportunities.

And we’re making measurement smarter in an increasingly complex world with better attribution that mixes data sources for a more complete picture. That includes MMM to an extent, and incrementality for sure, and AI can help with both.

Independent analytics providers, like Singular, can continue to carve out their niches by offering neutral, cross-platform measurement that advertisers can trust. And, we always want smarter and smart insights to peek inside the big platform black-box algorithms so that marketers truly benefit from the learnings that they fund with their ad dollars.

In the broader adtech and martech space, everyone is adding AI features everywhere.

That’s generative AI for writing emails, push notifications, and landing pages funnel copy, that’s predictive analytics for user/player/customer churn, that’s smart engagement strategies targeting ever smaller and tighter audiences.

This is almost literally an arms race with everyone from Adobe to Salesforce to Braze to CleverTap to RevenueCat and thousands of other companies. AI copilots, assistants, agents: we’re seeing all of them emerge and grow every day.

Long-term outlook: 5ish years

5 years from now when we hit 2030, the adtech value chain might look very different.

Companies that reinvented themselves around AI will have a great chance to succeed. Those who completely buck the trends, go anti-AI, and stay radically human might survive, if they’re incredibly exceptional, but run huge risks of extinction.

Others caught in the middle will likely just fade away.

New competitors could emerge too … management consulting firms like Accenture or Deloitte are investing in marketing AI and could take clients from traditional service providers by offering end-to-end AI-powered marketing solutions. New AI-focused startups hit the adtech space pretty much daily.

For analytics and measurement providers, long-term survival is dependent on innovation, incredible service, and trust. Brands and marketers who remain need to know, understand, and trust the data they’re getting, and only the best partners will win that business.

As AI gets embedded everywhere, advertisers will still need independent measurement and verification.

We’ll still need things like holistic attribution across walled gardens, and AI can help us stitch together data from Meta, Google, Amazon, TikTok, and more, perhaps even better than we do now.

We’ll probably also see closer collaboration between brands and measurement companies to build custom AI models using the brand’s own data. For instance, a big gaming publisher could have a proprietary AI model predicting marketing outcomes using its first-party data combined with platform data, and informed with the unique take on marketing, and a unique mix of channels and partners that it has. Custom models are getting easier and easier to spin up, so this could probably go down-market over time as well for even midsize or smaller brands.

We’re also need smarter measurement than we currently have. As industry analyst Eric Seufert recent said:

“As audience boundaries are eliminated within platforms, measurement becomes more of a challenge, creating the need for better and more sophisticated attribution modeling and incrementality analysis.”

Whatever happens, long-term analytics players simply have to be at the cutting edge of AI themselves to be able to deliver foresight — predictive analytics, scenario planning, budget planner — rather than just hindsight, where we all started.

There will likely be new AI-calculated metrics too: more complex mixes of KPIs that perhaps humans don’t see so easily in the data.

And there’s likely to be consolidation. AI is a data game, and the more data you have, the better your odds of using it wisely to build the smartest models. That means there’s an inherent advantage to scale.

The survivors will probably be the giant hubs (Salesforce, Adobe, Microsoft, others) or niche players with unique AI tech. All of the systems will become more autonomous, which means they all need all the tech in the full marketing stack to be able to get everything done efficiently and effectively. AI will have a hard time optimizing campaigns without high-quality and near-realtime (and therefore first-party) ROAS data.

By 2030, expect all of the platforms to emphasize privacy and ethical AI as selling points too, offering compliance with global and local AI regulations out of the box.

So we’ll see convergence.

We’ll see reinvention.

And we’ll see some new hybrid entities emerge that blend creative savvy, tech infrastructure, and AI prowess.

How do you adapt and stay relevant?

- Analytics and measurement companies need to invest in AI and re-skill talent

Everyone needs to proactively build AI into their DNA. This means building tech, but it also means training staff in AI tools, hiring data scientists and engineers, and encouraging creatives and strategists to work alongside AI rather than in competition with it.

- Differentiate with cross-platform transparency

Every ad platform and network will offer measurement. To remain relevant, analytics providers need to focus on what the big ad platforms don’t and in fact can’t give marketers: neutral, unified, and deep measurement. That means developing AI that can ingest data from many sources and providing clear, explainable insights across a customer’s full journey.

- Focus on integration and ease of use

As AI becomes as common as electricity, analytics and adtech tools need to excel in how well they integrate with others and how easy they make complex tasks for customers. Simplification and support are critical.

AI ads … so where does that leave us?

Meta’s vision of fully AI-driven advertising by 2026 is not an isolated thing.

Instead, it’s a bellwether for the entire advertising industry.

The Verge might be guilty of being just a tad dramatic when it said that “Mark Zuckerberg just declared war on the entire advertising industry,” (OK, a lot dramatic) but it’s a good wake-up call.

The times, they are a-changing.

Right now and increasingly in the short term, AI is our helper, our copilot, our superpower. It’s enhancing efficiency, lowering costs, and empowering even the smallest advertisers to create stunning, effective campaigns. Marketers who are embracing AI tools are finding they can do more with less, focusing their energy on creativity, strategy, and higher-level decision-making.

In the long term, AI is perhaps not quite as subservient. It’s getting better and better, doing more and more. And that means that the industry will undergo a transformative rebalance.

Work won’t look the same.

Teams won’t look the same.

The competitive landscape won’t look the same.

Many traditional tasks will be automated, and some job roles will evolve or even get phased out. There will be new opportunities for those who can marry human insight with AI capabilities, however. Adaptability will be the key.

Jim Lecinski from the Kellogg School of Management put it this way:

“Like electricity did to steam, AI has the opportunity to reshuffle winners and losers and remake businesses, industries, categories and brands.”

For creative professionals, this means leveraging AI to unlock new powers in creativity and output. For performance marketers, it means transitioning into strategists and orchestrators of marketing AI. For all marketers, it’s a call to elevate our roles and use AI to extend what we can do.

And for analytics and measurement providers, there’s an AI-driven demand to innovate or die, risking irrelevance by failing to build the tools, frameworks, and trust needed in an AI-first advertising world.

Everything is changing.

The next years will belong to those who can blend art and science, human and machine.