What are the top 50 mobile games of 2024 so far? I thought you’d never ask! We’ve just updated the list for January.

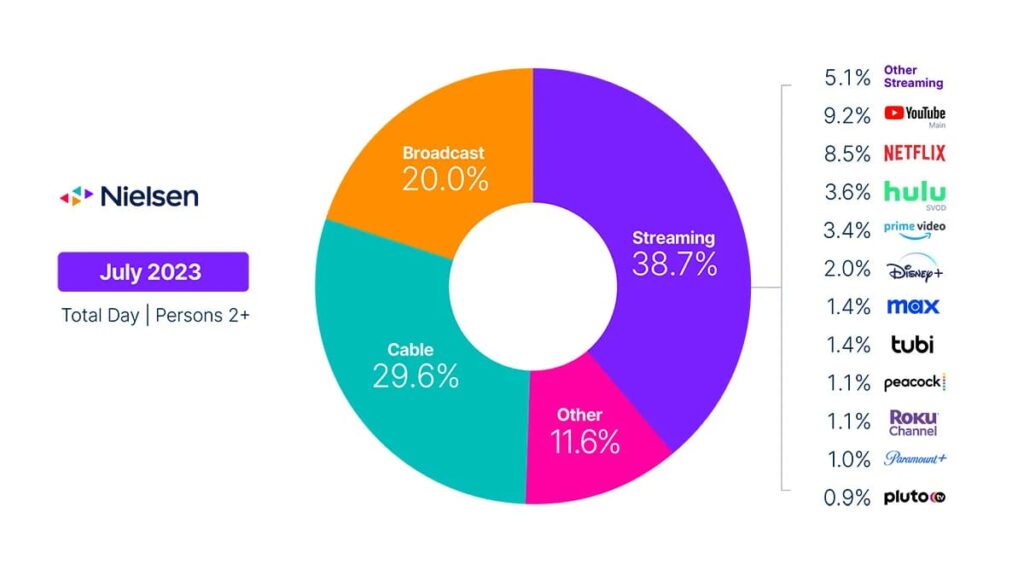

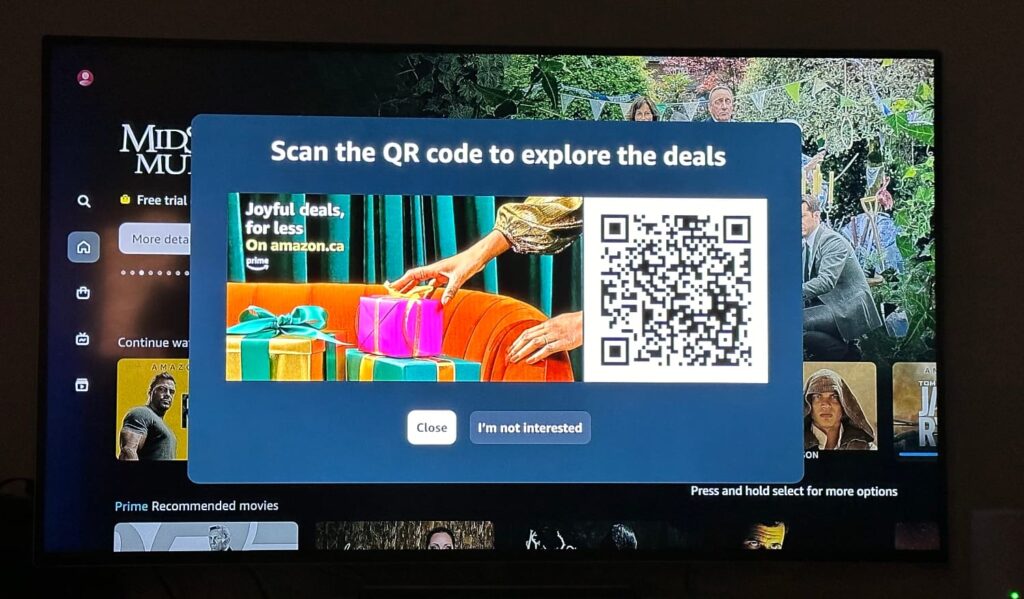

Globally we downloaded almost 300 billion mobile apps in 2023, according to Statista, and more than half of them were games. That’s up almost 50 billion app installs from the previous — an almost 20% increase in mobile app downloads — and we might be in for an additional jump in 2024. While apps recently finally surpassed games in the U.S. for the first time ever in terms of revenue — thanks to streaming media and subscriptions — the reality is that both globally and in both the U.S., games are both the vast majority of smartphone downloads and massively significant in terms of mobile revenue.

All of which means: it’s time to share the top 50 games of 2024 so far. Note: these are U.S. numbers.

Most downloaded mobile games so far in 2024

So far, according to Data.ai data, the top games of 2024 (so far) by downloads include some familiar names, but also some new ones.

On Android, the leaders are:

- Monopoly Go!

- Help Me: Tricky Story

- Roblox

- Match Frenzy: 1 Line Draw

- Block Blast!

- Traffic Escape!

- Royal Match

- Dice Dreams

- Last War: Survival Game

- Wood Nuts & Bolts Puzzle

On iOS, the top 10 games so far by downloads are:

- Monopoly Go!

- Twisted Tangle

- Royal Match

- Wood Nuts & Bolts Puzzle

- Roblox

- Last War: Survival

- Block Blast!

- Outlets Rush

- Call of Duty: Mobile

- We Are Warriors!

Note that these are the most downloaded games right now in early 2024. That’s a list that can be pretty volatile as different game publishers spend more or less to advertise their games to new players. It will change over time. But it’s still a major accomplishment to appear on this list.

Perhaps the biggest accomplishment: Monopoly Go! is a game just created and released in 2023, and right now very early in 2024 it’s a top game on both the App Store and Google Play. Another big one: the Wood Nuts & Bolts Puzzle game is just over a month old, and it’s already a top game by downloads. We’ll have to see if it keeps its momentum.

Important question: are the most downloaded games really the top ones?

Each of those mobile games has a lot of downloads, but number of installs alone can’t be enough to make the list of the top 50 mobile games of 2024 so far. Scale is good — getting a lot of installs is completely necessary for a game to be on top — but engagement and active players and actual usage is probably much more important. And probably most important is: are these games good enough and interesting enough and addictive enough to make players pull out their metaphorical credit cards and buy stuff? (Or, yes, allow Apple or Google to take a chunk out of your bank account.)

As we’ve built these lists over the years, we’ve felt the best way to determine the top games of 2024 so far is a combination of both:

- how many installs a game received

- how revenue a game is generating

That combination is important.

A top game should still be relevant to new players: it should be adding new people, or else it’s just slowly dying. Maybe that’s OK for a big studio: they’ve made their money. But it certainly takes them out of the top games sweepstakes. In addition, a top game should also keep existing players engaged, interested, and having fun for at least months, and preferentially years.

That makes it fresh enough for newbies, and still interesting for veterans.

The reality is that it is only the very unusual, extraordinary game that gets released years ago — even a decade ago, Subway Surfers! — and is still big. It’s an even more extraordinary game, like Clash of Clans, Roblox, or Call of Duty, that is still at or near the top of the revenue charts years and years after its initial release.

iOS, then Android, then combined

First, we’ll look at iOS.

iOS might seem small. After all, it only accounts for about 20% of global downloads: about 60 billion app installs for 2023 versus 240 billion for Android. But even so, iOS still takes credit for more than half of all in-app mobile revenue … thanks largely to the geographies where Apple owns market share: typically richer countries in North America, Europe, and certain parts of Asia.

Then we’ll look at Android, where the vast majority of app and game installs happen, especially in massive Android-centric countries like India. (And China, but data is hard to come by there thanks to the proliferation of third-party app stores.)

And finally, we’ll combine scores to arrive at an overall list of top 30 games of 2024 so far.

Note: the data will be US-centric. For installs, I’m looking at recent data from Data.ai: games that are hot right now, but the top grossing component of the score will bias towards games with some track record. And I’m weighting the scores about 2:1 in favor of revenue as a stronger engagement metric than pure downloads.

iOS: top 30 games of 2024 so far by downloads

Here are the top 30 mobile games on iOS by downloads.

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Happy Match Cafe: Draw & Find |

| |

| |

| |

| |

| GTA: San Andreas - NETFLIX |

| |

| Magic Tiles 3: Piano Game |

| |

| |

| |

| |

| Travel Town - Merge Adventure |

| |

| |

| |

| NYT Games: Word Games & Sudoku |

| |

| Woodoku - Wood Block Puzzles |

Note that 1 is from Netflix (GTA San Andreas) and 1 is from The NY Times … both nontraditional game publishers. We’ll likely seem more of that as we go further in 2024.

Also interestingly, many of these top iOS games by downloads are very familiar:

- Roblox

- Subway Surfers

- Fishdom

- Wordscapes

Android: top 30 games of 2024 so far by downloads

Here are the top 30 mobile games on Android by downloads so far in 2024:

| |

| |

| |

| Match Frenzy: 1 Line Draw |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Weapon Master: Gun Shooter Run |

| Tile Family: Match Puzzle Game |

| |

| |

| Devil May Cry: Peak of Combat |

| |

| |

| |

| |

| |

| Nobody's Adventure Chop Chop |

| |

| |

| |

| Toca Life World: Build a Story |

No fewer than 7 of the top 50 games on Android are casino/Vegas/gambling games, compared to 5 on iOS.

More striking, perhaps, is the overlap between iOS top games and Android top games. Exactly half — 15 of the top 30 games — are tops in downloads on both the iOS and Android games lists:

- Monopoly Go!

- Roblox

- Royal Match

- Block Blast!

- Last War: Survival Game

- Wood Nuts & Bolts Puzzle

- Subway Surfers

- Dice Dreams

- Township

- We Are Warriors!

- Candy Crush Saga

- Magic Tiles 3

- Tetris

- My Perfect Hotel

- Wordscapes

That makes sense on a lot of levels: good games rise to the top, big marketing budgets help make both the iOS and Android versions of a game to get popular, and everyone releases for both major platforms. Also, for battle games that require a critical mass of players to form clans or teams, or to match up in fights, being big on one platform tends to help a game get big on the other. Plus, of course, when a game gets popular it starts to generate its own buzz, and both people and platforms tend to start promoting it.

This is kind of a big deal. It means most big studios that publish in the U.S. market are publishing for both Android and iOS, and they’re experiences similar levels of success on both platforms, at least for their biggest games.

We’re also seeing a good amount of genre diversity, including strategy (Monopoly Go!), puzzle (Candy Crush Saga, Tetris), action (Roblox), and simulation (Township). Note: genres are hard to identify these days, as many games have many different elements of gameplay that bear little relationship to what category they’re actually published in.

And, clearly, while we’re seeing existing long-term leaders like Subway Surfers, Tetris, and Candy Crush Saga, we’re also seeing some newer games like My Perfect Hotel and Dice Dreams.

Top games on iOS by revenue

Revenue is an entirely different animal than downloads. You need downloads to get revenue, but you need much more: engagement, passion, longevity, and great gameplay.

Here are the top games on iOS by revenue in 2024 so far:

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Jackpot Party - Casino Slots |

| |

| |

| |

| |

| |

| Age of Origins: Tower Defense |

| Lightning Link Casino Slots |

| |

| |

| Cashman Casino Las Vegas Slots |

| |

| |

| DoubleDown Casino Slots Game |

| |

| |

| |

Interestingly, no fewer than 21 games are on the top revenue list but NOT on the top downloads list. In many cases, that’s because they are games that have been around for years, have a devoted following, and make huge revenues without having to spend massive amounts of marketing dollars. In others, it’s because casino and strategy/battle games have very high earning potential compared to more casual or hypercasual titles.

- Candy Crush Saga

- Pokemon GO

- Coin Master

- Gardenscapes

- Toon Blast

- Clash of Clans

- Homescapes

- Age of Origins: Tower Defense

- Jackpot Party – Casino Slots

- Evony

- PUBG Mobile

- Puzzles & Survival

- Candy Crush Soda Saga

- Project Makeover

- Cashman Casino Slots Games

- Lightning Link Casino Slots

- Clash Royale

- RAID: Shadow Legends

- DoubleDown Casino Vegas Slots

- Free Fire: Winterlands

- Triple Match 3D

Top games on Android by revenue

| |

| |

| |

| |

| |

| |

| Jackpot Party Casino Slots |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Cashman Casino Las Vegas Slots |

| |

| |

| |

| |

| June's Journey: Hidden Objects |

| Slotomania Slots Casino Games |

| Lotsa Slots - Casino Games |

| |

| |

| Lightning Link Casino Slots |

| |

| Doubledown Casino Vegas Slots |

While 21 games are on the highest-revenue but not most-downloaded for iOS, only 17 are in the same scenario on Android:

- Candy Crush Saga

- Coin Master

- Jackpot Party Casino Slots

- Solitaire Grand Harvest

- Bingo Blitz: Bingo Games

- RAID: Shadow Legends

- Cashman Casino Las Vegas Slots

- Clash of Clans

- Homescapes

- Toon Blast

- June’s Journey: Hidden Objects

- Slotomania Slots Casino Games

- Lotsa Slots – Casino Games

- Genshin Impact

- Lightning Link Casino Slots

- Puzzles & Survival

- Doubledown Casino Vegas Slots

Combined iOS and Android: top 30 mobile games of 2024 so far

At last, here are the top 30 mobile games of 2024 so far based on Android and iOS and number of installs plus amount of revenue, which is a proxy for players, usage, and engagement. The combined score is based on their ranking in both top downloads and top revenue lists, with revenue being weighted 2X as much as downloads.

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Jackpot Party Casino Slots | |

| | |

| | |

| | |

| | |

| | |

| Age of Origins: Tower Defense | |

| | |

| | |

| Jackpot Party - Casino Slots | |

| | |

New apps for 2024 that did NOT appear on the top apps of 2023 list include:

- Monopoly Go!

- Whiteout Survival

- Dice Dreams

- Block Blast!

- Wood Nuts & Bolts Puzzle

- Last War: Survival

- Twisted Tangle

Congratulations to those games for cracking the list. But a lot of games that were top performers in 2023 are still top performers so far in 2024, which is also deserving of congratulations:

- Royal Match

- Roblox

- Candy Crush Saga

- Coin Master

- Township

- Gardenscapes

- Pokemon GO

- Clash of Clans

- Bingo Blitz

- Homescapes

- Call of Duty: Mobile

- Candy Crush Soda Saga

- Fishdom

- Evony

- Jackpot Party Casino Slots

- RAID: Shadow Legends

- Jackpot Party – Casino Slots

Interestingly, 7 of the 30 highest-revenue games on Android were gambling games, while 5 of the same list on iOS were. Clearly, there’s a lot of money to be made here, and game publishers are pursuing it aggressively.

Closing thoughts on the top games of 2024

My current favorite game is now 7 years old and didn’t make the list, although I see the publisher has a new game on the top list for 2024. So if your game didn’t make the list, you’re in good company.

There are plenty more ways to find and list the top games of any year, including 2024.

A good option would be to check all the game reviews of the year and see which ones are the highest rated by reviewers on Google Play and the App Store. I think I’ll try that sometime.

It’s also interesting to think about why a game might make the most downloaded but not the most profitable lists, and vice versa. Top-grossing games, for instance, might be in a monetization phase: they’ve gathered a huge number of players, and now they need to make some money back for all their development and marketing. And top games by installs that don’t hit the top-grossing list might just be in a category that doesn’t monetize super well — casual games, I’m looking at you — or might be focusing on scale rather than revenue.

In any case, if your favorite game didn’t make the list, that’s probably because with 10 million apps in Google Play and the iOS App Store, there’s a lot of choice. There’s something for everyone. And that’s probably a good thing.