Planting trees versus picking fruit: CTV and user acquisition

Where does CTV fit in your user acquisition strategy?

Performance marketing is picking apples off a tree, says Upwave CEO Chris Kelly in a recent Growth Masterminds podcast. They’re there, they’re ripe, they’re ready to go: they just need a little nudge and BOOM … you have a new user or customer. Brand marketing, however, is about planting baby apple trees that you can nourish and tend and eventually be able to harvest at some point in the future. While some businesses can survive off pure performance marketing because they reap existing demand fueled by basic human needs, long-lasting trends, or markets built by other companies, many also need to nurture seeds before they can pluck the produce.

So where does CTV fit? Hit play and keep reading …

CTV and user acquisition: AVOD growth

It’s pretty obvious that connected TV is growing fast.

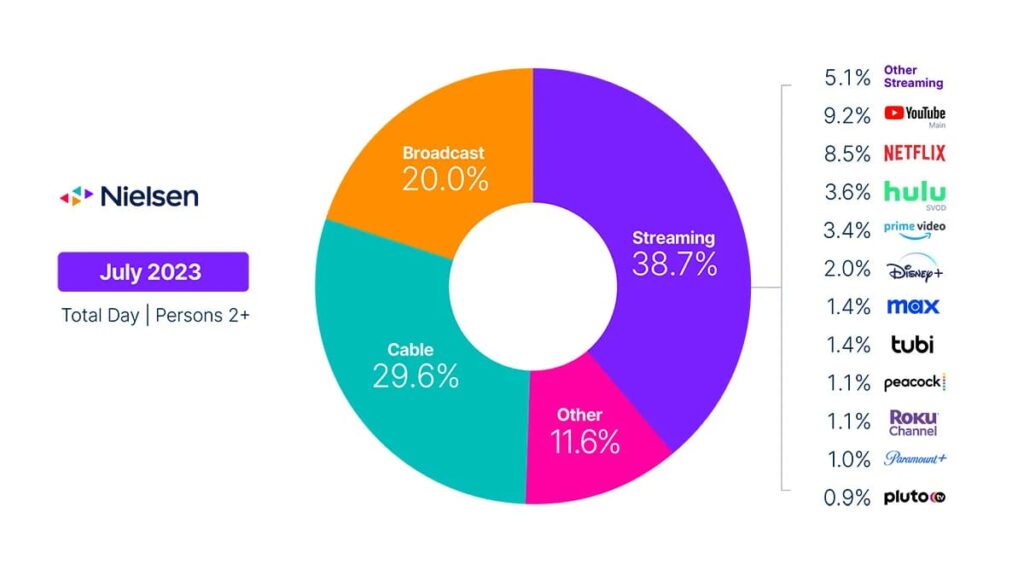

Streaming hit record highs this summer with almost 40% of all TV watching in July while broadcast and cable were both down. CTV is clearly on a path to 50% plus and eventual dominance, and AVOD (ad-supported video on demand) is a growing chunk of connected TV as Disney, Netflix, Max (former HBO), and Amazon Prime are all joining YouTube, Hulu, Peacock, Roku, Pluto, and others in offering discounted product tiers with ads.

But CTV is still only getting a fraction of the ad spend that traditional linear TV is getting. In 2023, Insider says CTV captured less than half the TV spend of linear TV.

- CTV ad spend: $25 billion

- Linear TV ad spend: $61 billion

When will the two converge? Possibly not until 2028 or later. That said, there’s an increasing amount of inventory in ad-supported CTV, and that means opportunity today. And, since AVOD is growing as a percentage of streaming while streaming is itself growing as a percentage of TV, the opportunity is growing fast.

CTV-based mobile user acquisition: opportunity?

That said, is there opportunity in CTV for mobile user acquisition? Clearly to some degree yes: we’re seeing it being used that way already. But it’s not a slam dunk for everyone, because by nature, CTV is less of a direct-response ad medium than a brand-building ad medium.

“The lazy reputation that most people would have about mobile is … it’s great for lower funnel, it’s great for direct response: get someone to click here and download, click here and make the purchase,” says Kelly. “Whereas CTV is being used more now … for upper funnel because of that storytelling ability, that immersive full screen storytelling ability … it’s very powerful for upper funnel.”

Of course, no-one is arguing that CTV can’t also be used for lower funnel as well.

In fact, Amazon’s betting on it.

The company announced in September that “starting in early 2024, Prime Video shows and movies will include limited advertisements,” which subscribers can opt out of by paying an additional $3/month.

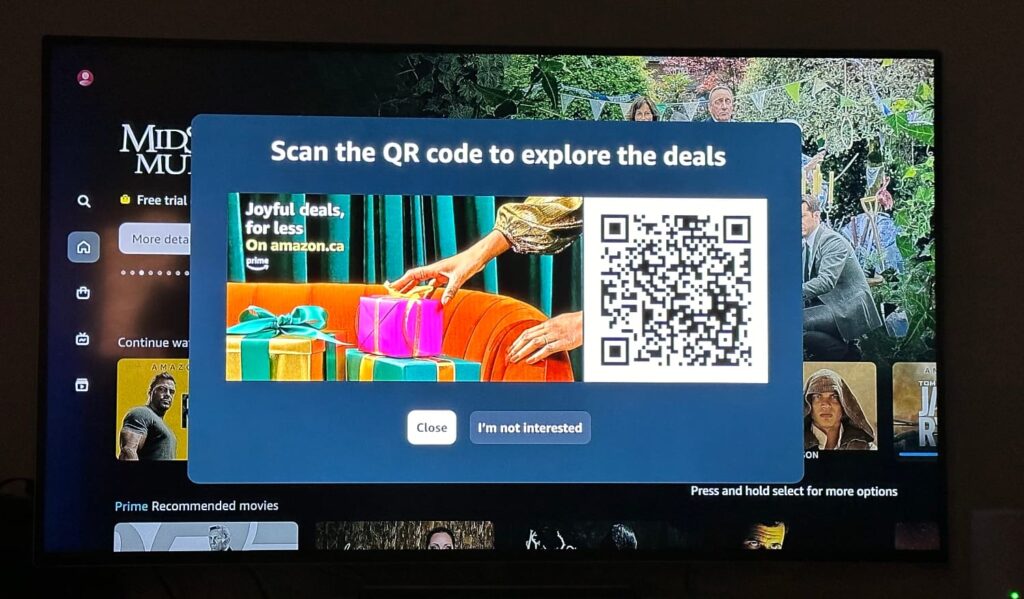

But Amazon is already showing ads today on Amazon Prime.

Just a week ago, Amazon Prime showed me this when I logged in to catch the new season of Reacher: a QR code direct-response ad for Christmas gift shopping on Amazon. So you can bet that Amazon wants Prime Video to be a down-funnel step for its own customers, regardless of whether it’s the very last purchase point or not, and probably a point of instant purchase.

Roku thinks this is the future too, having just rolled out a buy now button (ok, “place order”) in Roku Action Ads, a collaboration with Shopify. The experience will be reminiscent of Amazon: see an ad, click OK on your remote to learn more, and check out using Roku Pay. It’s an impressive integration, though Shopify is not nearly as powerful a partner as Amazon.

Of course, not all direct response is mobile user acquisition or app install: most of the above examples are retail. But we are seeing apps grow on CTV campaigns in Singular as well. Not all of those are looking for an immediate install, which makes sense.

“We think about the funnel like a football field actually, where we think it’s silly if marketers think that the success of every campaign is getting a sale,” Kelly says. “That would be like in an NFL context saying every play needs to get in the end zone and I’m just gonna look at my list of plays and see which one’s got me the end zone and only run those plays.”

In other words, not every ad should be a quarterback sneak.

Or a tush push/brotherly shove.

Targeting is a challenge, but not as much as it used to be

Targeting has been a challenge on CTV, with one study suggesting almost half the data used for CTV ad targeting is wrong. It’s getting better, however, Kelly says. And there are options in CTV targeting that old-school linear TV marketers, who basically operated off of age and demo, would kill to have.

“CTV brings what you’d expect from a digital first platform,” says Kelly. “So you do see advertisers using third party audiences … just like you would for a web campaign … you see people bringing their first party audiences.”

That means you can target people who are like those that you already have in specific ways, you can target people who have engaged in specific behaviors, you can do look-alike audiences, and that you can — if your first-party audience is big enough — retarget or remarket.

Plus, of course, all the demographic age and context data that comes along with specific audiences for specific shows.

But there is one key difference specifically in targeting on CTV versus mobile: person-to-household.

“Two [things that] are really interesting if you juxtapose mobile versus CTV as channels: one is reaching people versus households and the other is what part of the funnel you’re trying to move the consumer down, right?” says Kelly. “Mobile’s the most intimate device we have that’s right there to one person, one screen, and one person’s face. Television is not that case … you have a big CTV screen hanging in your living room and there could be 2, 3, 4, 5 plus people watching.”

Which means, of course, measurement has the same challenge.

Brand impact: higher than mobile ads?

There’s some research that suggests 1 CTV ad has similar brand impact to 6+ mobile ads, Kelly says.

That makes sense in some ways. When you’re watching AVOD, you get 3-4 sets of ads in an hour, and typically each set has just 1 or 2 ads in it. (This will probably change over time and become closer to linear TV’s current ad-fest!) That ad takes 15 to 30 seconds to watch, and you’re back to your content. Many mobile ads, on the other hand, might just whizz by in seconds or milliseconds, if they are banners or videos.

(Of course, rewarded ads and interstitials would be the exceptions to this rule, since they require your attention for at least a few seconds.)

That investment in brand marketing is a good idea, Kelly says.

“People don’t wake up in the morning and just know what your brand is,” he says. “CTV may not get you to click on the ad and download the app as fast as mobile … but that increased awareness is going to pay off.”

Which means, if you’re going to try CTV ad campaigns for mobile user acquisition, you better do them in concert with lower-funnel campaigns. The idea is to both generate and satisfy demand in a surround-sound marketing campaign that makes it feel like your brand is everywhere … while also making it easy for people to take action.

CTV ad campaigns: affordable to start

TV advertising makes me think of Super Bowl ads and millions of dollars per second. Of course, not all linear TV ad space is that expensive, but it’s generally significantly more expensive than CTV ads.

Which is good: brands can try them without breaking the bank.

“The barriers to entry to CTV are lower,” Kelly says. “So if you’re an advertiser coming from buying Facebook ads or buying Google ads, you’re gonna start CTV before you’re starting linear in most cases.”

Think 5-figure entry fees, not 6 or 7 figures.

The upshot: CTV ads for UA

So is CTV good for user acquisition? Sure, but there’s some nuance here.

From a branding perspective, bigger apps with larger campaigns who need multiple brand touches to generate high-LTV users/players/customers will find it easier to fit CTV into their marketing strategy. Smaller apps that are spending less: it’ll be harder to justify even taking a look at CTV as you haven’t even come close to maximizing your existing channels yet.

But even small apps could find utility and profitability here. Smaller apps that are in a very specific vertical and meet a very specific need that they can target on CTV could probably go very low-funnel on a CTV ad and generate near-immediate conversions.

Plus, there are certain apps that need to appeal to a number of different audiences to be effective. Kids’ apps for instance, need kids to be interested but also need adults to be aware before they can convert. CTV could provide an interesting opportunity to target households here that mobile ads can’t easily replicate.

So much more in the full podcast

Check out the full chat with Upwave CEO Chris Kelly on YouTube, or get our audio podcast on whatever podcasting platform you prefer.

We chat about:

- CTV ads

- CTV targeting

- CTV measurement

- Limitations of CTV

- Accessibility and affordability

- Optimization on CTV

- Performance vs brand marketing

Stay up to date on the latest happenings in digital marketing