If last-touch attribution were a witness in a courtroom, it would confidently raise its hand and say, “I was there at the end.”

That testimony, though accurate, is also incomplete.

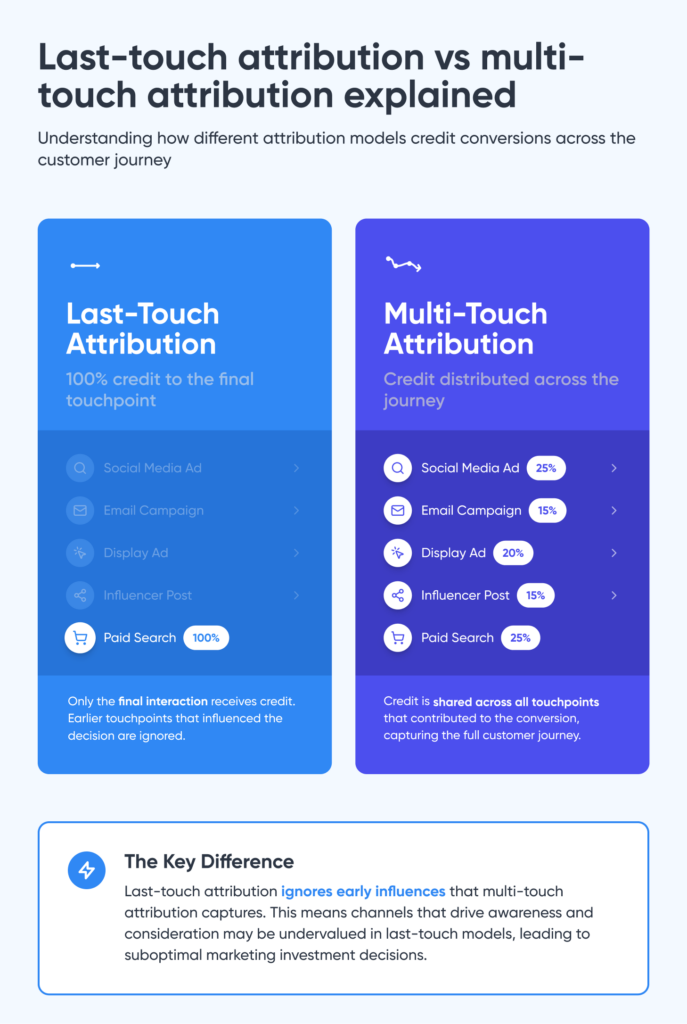

Last-touch attribution has long been the backbone of mobile measurement. It tells marketers which channel gets credit for an install, which campaign gets optimized, and how spend is reconciled. When it comes to enabling operational clarity, last-touch attribution still does its job extremely well.

But marketers are increasingly asking a different question: Which channels actually drove growth through influence, exclusive traffic, or a combination of the two?

Answering that question requires multi-touch attribution, a methodology designed to measure influence across the full user journey rather than just crediting the final interaction.

As part of our work on the upcoming ROI Index (launching March 2026), our data science team analyzed performance through a multi-touch attribution lens and compared it with last-touch attribution.

In this post, we’re sharing early benchmarks from that work, based on analysis by Singular’s data science team and using Meta’s mobile gaming performance as a case study. The goal isn’t to promote a specific channel, but to illustrate how different attribution methodologies can materially change how performance is interpreted — and what mobile marketers should consider once they see the fuller picture.

As a certified mobile measurement partner of Meta, Singular works closely with Meta’s product and engineering teams to ensure mobile marketers have accurate, transparent, and fair interpretations of campaign performance across Meta’s advertising suite. While the analysis shared here was conducted independently by Singular’s data science team, these results are part of an ongoing collaborative partnership between Singular and Meta focused on advancing measurement standards, attribution methodologies, and the tools marketers rely on to efficiently grow their apps.

Why multi-touch attribution shapes the story you think you are telling

Modern mobile growth does not follow a straight line. It looks more like a relay race where the baton changes hands several times before anyone crosses the finish line.

A user might see a social ad, keep scrolling, later search for the app, click an app store ad, and finally install after one last reminder. Every touchpoint plays a role, even though only one receives credit under last-touch attribution.

Last-touch attribution answers an operational question.

Who closed the deal?

Multi-touch attribution answers a strategic one.

Who made the deal possible?

Last touch tells you who closed the deal. Multi-touch attribution tells you who made the deal possible. – Omri Gal, Head of Data @ Singular

The solution is not choosing one model over the other. It uses both last-touch and multi-touch attribution, each for the questions they are best suited to answer.

The types of questions that multi-touch attribution answers better than last touch

Attribution models are specialists, not competitors.

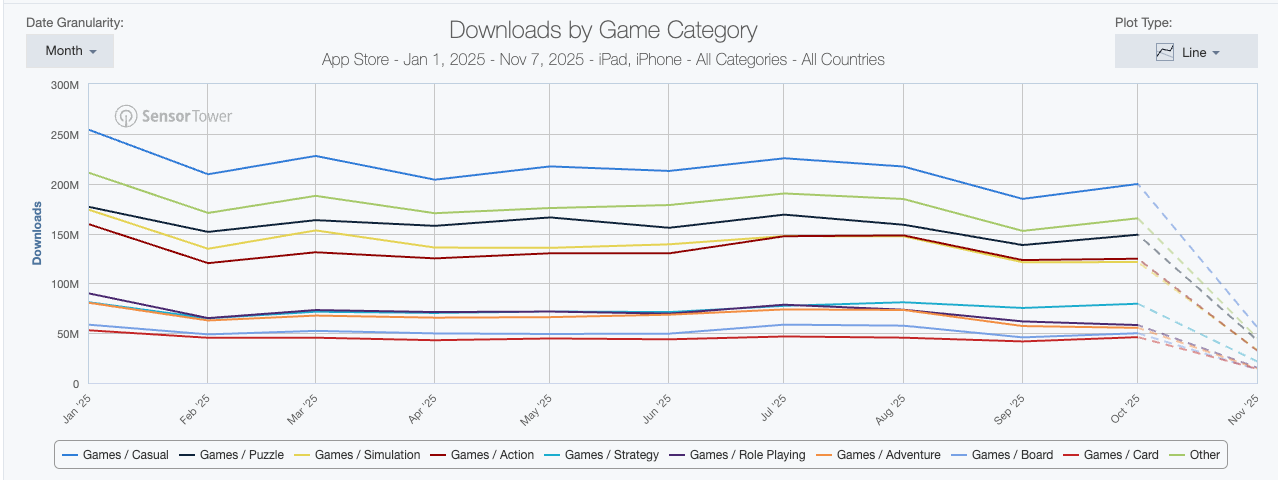

Why discovery and community channels rely more on multi-touch attribution

Not all channels are designed to play the same role.

Some channels capture intent. Others create it.

Intent-based channels like paid search often look strong under last-touch attribution because they appear at the moment of conversion. Users arrive informed, motivated, and ready to act.

Discovery and community-driven channels, including social platforms like Meta, TikTok, Snap, and Pinterest, influence users much earlier. They introduce brands, shape perception, and build familiarity over time. Their impact often happens well before the final click.

Under last-touch attribution:

- Intent channels often look highly efficient.

- Discovery channels often appear “undervalued”.

Under multi-touch attribution:

- Intent channels still get credit for closing.

- Discovery channels get credit for influence, assists, and incremental reach.

Discovery channels rarely look their best at the finish line because their job is to get users into the race. – Steph Pilon, CMO @ Singular

Using multi-touch attribution to separate efficiency from incrementality

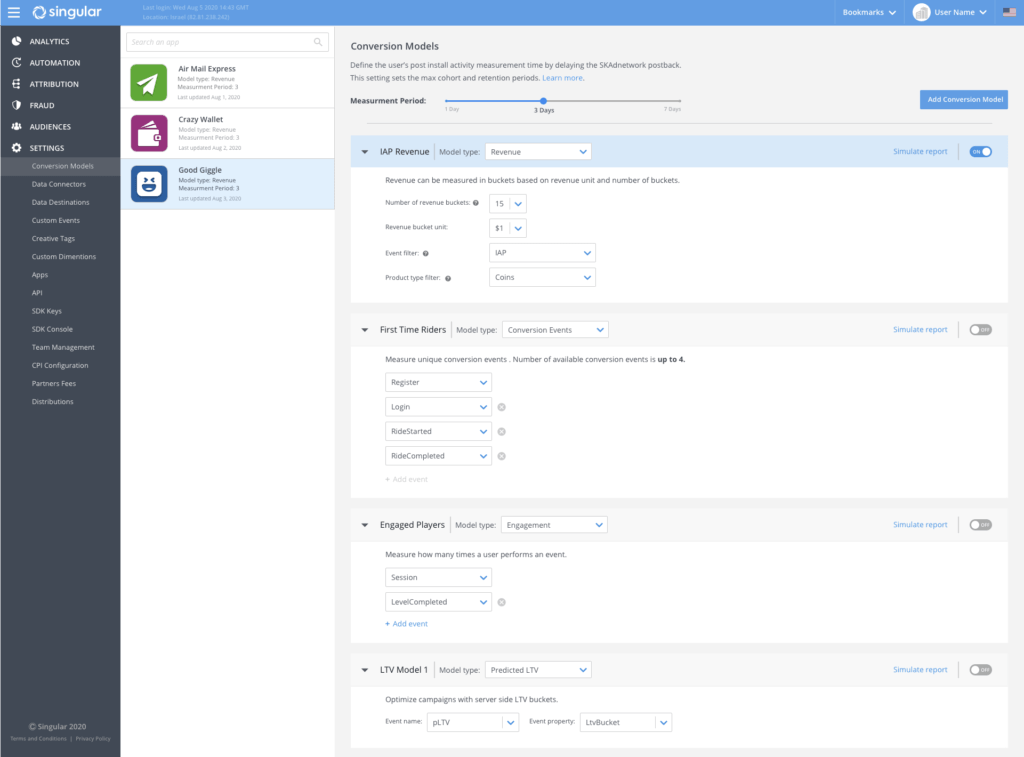

Singular’s Advanced Assists framework brings multi-touch attribution directly into measurement, allowing marketers to evaluate performance across multiple dimensions:

- Single-attributed installs

- Co-attributed installs

- Assisted installs

- Modeled MTA metrics such as MTA CPI and ROAS

Together, these metrics reveal what last touch alone isn’t able to tell you. They show audience uniqueness, channel overlap, and true contribution across the funnel.

What the data shows when viewed through multi-touch attribution

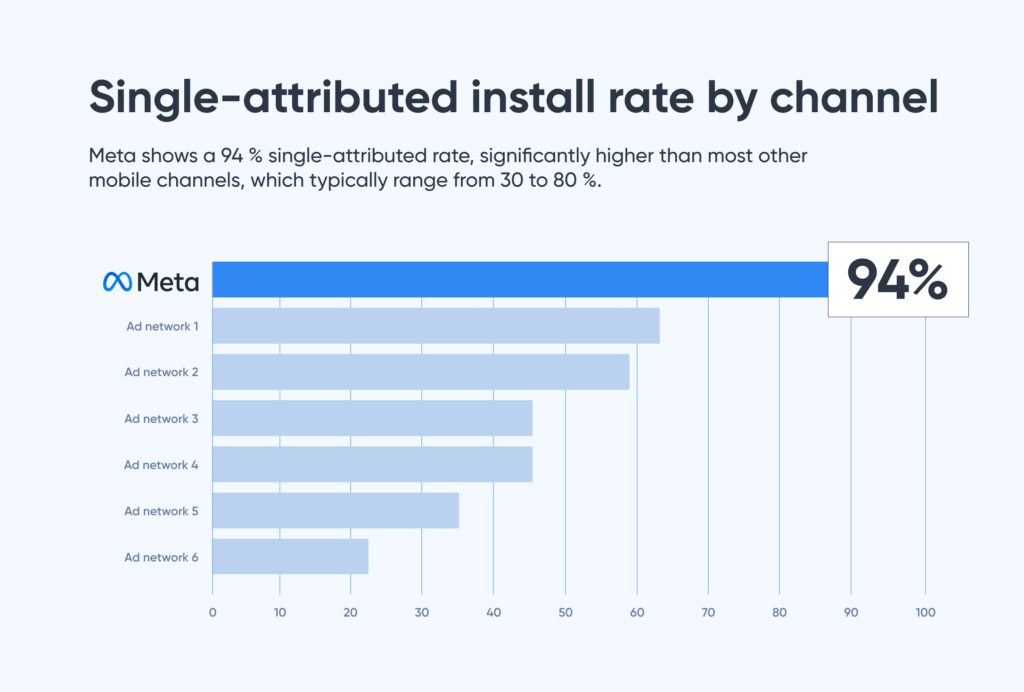

Meta shows one of the highest single-attributed install rates

Across mobile gaming advertisers, Meta demonstrated a 94% single-attributed install rate.

Single-attributed installs happen when the attributed install had no prior touchpoints from other channels.

High single-attribution rates often signal incremental reach, not just efficient conversion. – Eran Friedman, CTO & Cofounder @ Singular

Why this matters for mobile marketers: If a channel consistently appears alone in the user journey, it is more likely to create demand rather than compete for credit.

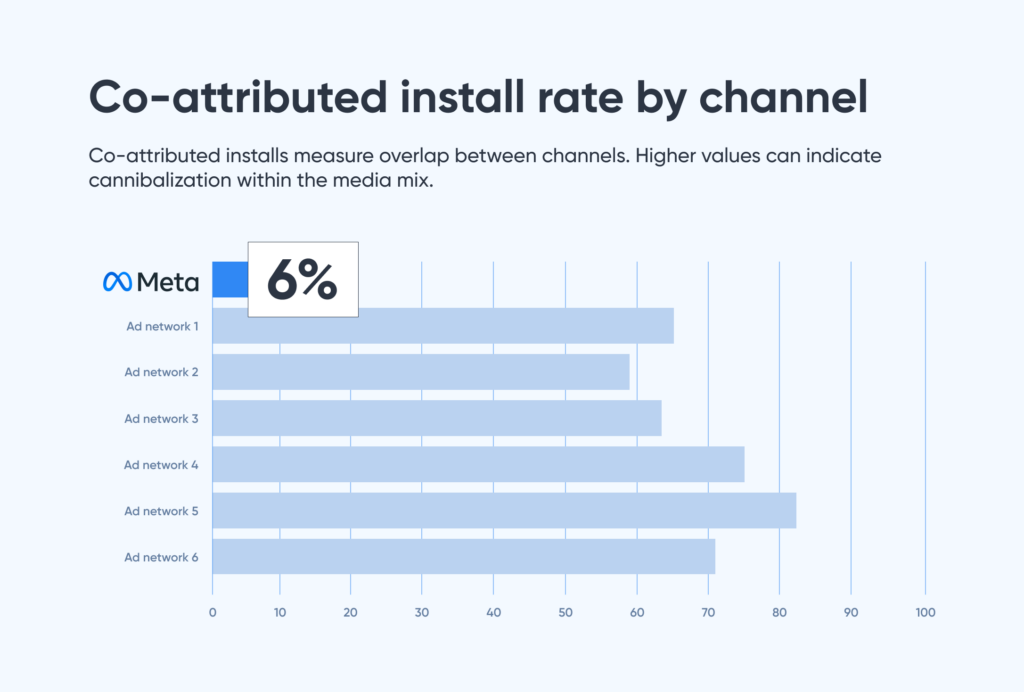

Low co-attribution suggests minimal cannibalization

Meta also showed a 6% co-attributed install rate.

Co-attributed installs happen when a channel receives last-touch credit, but another channel influenced the user earlier.

Why this matters for mobile marketers: Low co-attribution means incremental spend is less likely to displace value created by other channels.

Assist rates reveal value hidden by last-touch attribution

In several gaming datasets, Meta generated up to 29% additional assisted installs.

Assisted installs happen when a channel influenced the install but did not receive last-touch credit.

Assists are not “missed conversions.” They are proof that influence happened earlier. – Omri Gal, Head of Data @ Singular

Why this matters for mobile marketers: Assist rates highlight channels that drive discovery and intent, even when they don’t convert.

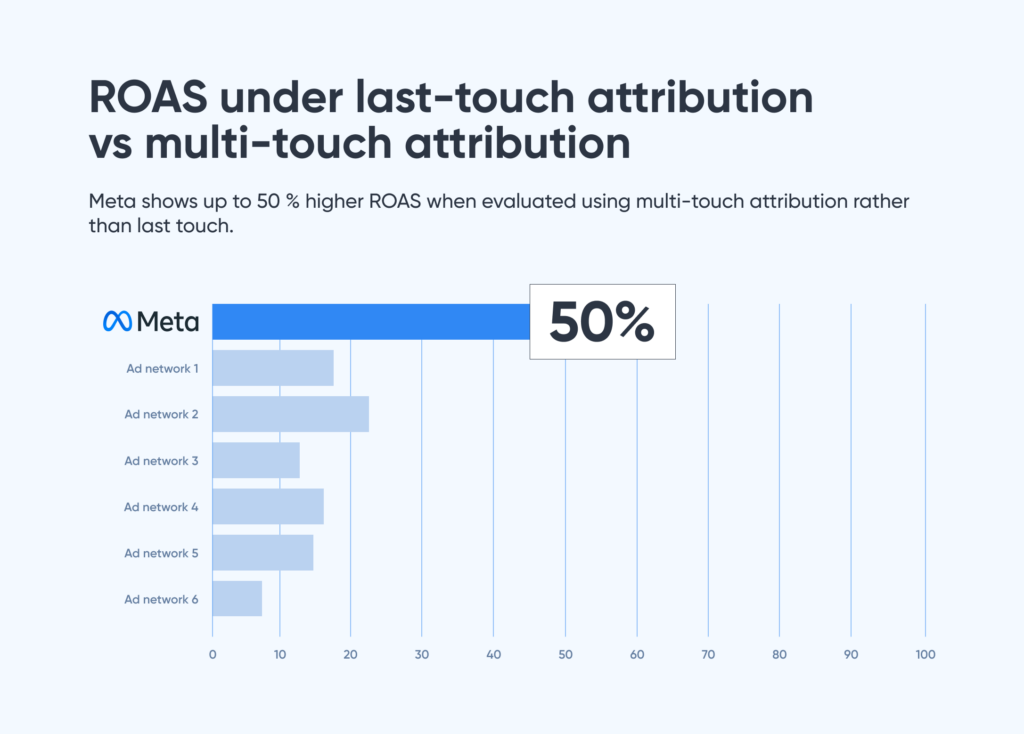

Multi-touch attribution modeling changes ROAS outcomes

When Singular’s multi-touch attribution model is applied, Meta showed up to 50% higher ROAS compared to last-touch attribution.

Multi-touch attribution does not inflate performance; it reallocates it. The model assigns full credit to single-attributed installs, reduced credit to co-attributed installs, and partial credit to assists based on configurable weighting.

Why this matters for mobile marketers: Improved ROAS under MTA often indicates a channel was undervalued, not over-credited.

Last-touch attribution and multi-touch attribution are teammates, not rivals

Multi-touch attribution is not designed to replace last-touch attribution.

Last touch remains essential for billing, partner accountability, and day-to-day optimization. Multi-touch attribution is designed to inform your strategic decisions, like budget allocation, overlap detection, and long-term growth planning.

If last touch shows where the ball crossed the goal line, multi-touch attribution shows how it got there. – Steph Pilon, CMO @ Singular

What mobile marketers should do with these findings

The value of multi-touch attribution is not in the metrics themselves, but in the decisions they unlock. When marketers understand how channels contribute across the full user journey, budget conversations become clearer and more strategic. Based on what we see working with some of the fastest-growing apps in the world, these rules of thumb help turn attribution insight into action.

- Do not evaluate channels solely on last-touch ROAS.

- Use multi-touch attribution to identify undervalued contributors.

- Monitor co-attribution rates before scaling spend.

- Treat high assist rates as signals of influence, not inefficiency.

- Configure MTA models to reflect your business goals.

Bringing multi-touch attribution into everyday decision making

With Singular’s Multi-Touch Attribution and Advanced Assists capabilities, marketers can move beyond fragmented reporting and evaluate every channel’s role in the full customer journey.

This does not change how partners are paid.

It changes the confidence in your decisions.

And as this analysis shows, when you change how you measure performance, the story you tell about growth often changes with it.

Methodology

Singular data analysts summarized the data from trillions of ad impressions, billions of clicks, and billions of installs. As part of Singular’s role as a certified mobile measurement partner of Meta, these independently produced findings were later shared with Meta to support ongoing collaboration on measurement accuracy, transparency, and innovation for mobile advertisers.