What does SKAN 4 provide that SKAN 3 doesn’t?

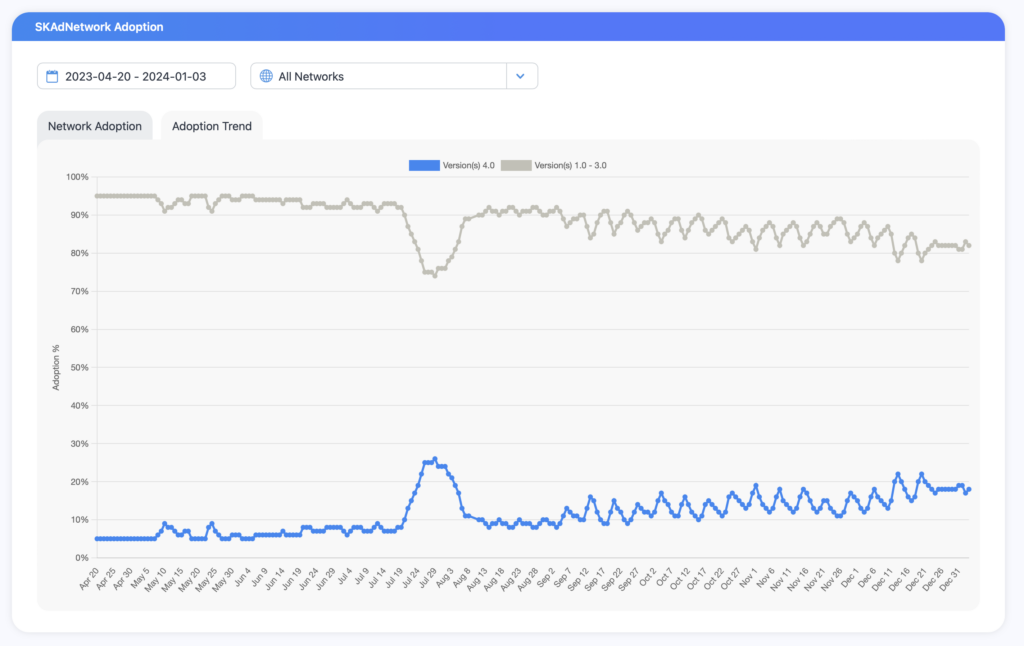

We are finally seeing sustained SKAN 4 growth again. It’s steady but slow, with SKAN 4 postbacks hitting the 20% threshold for the first time since the SKAN 4 CV reset bug in July of 2023. And while it’s slow, as big players adopt SKAN 4 this year, we’ll see massive jumps. Reddit was the most recent, and at some point in Q1 or Q2 of 2024, Meta will take the plunge (again), Google will slip a switch, TikTok will toggle a setting, and we’ll very quickly approach majority SKAN 4.

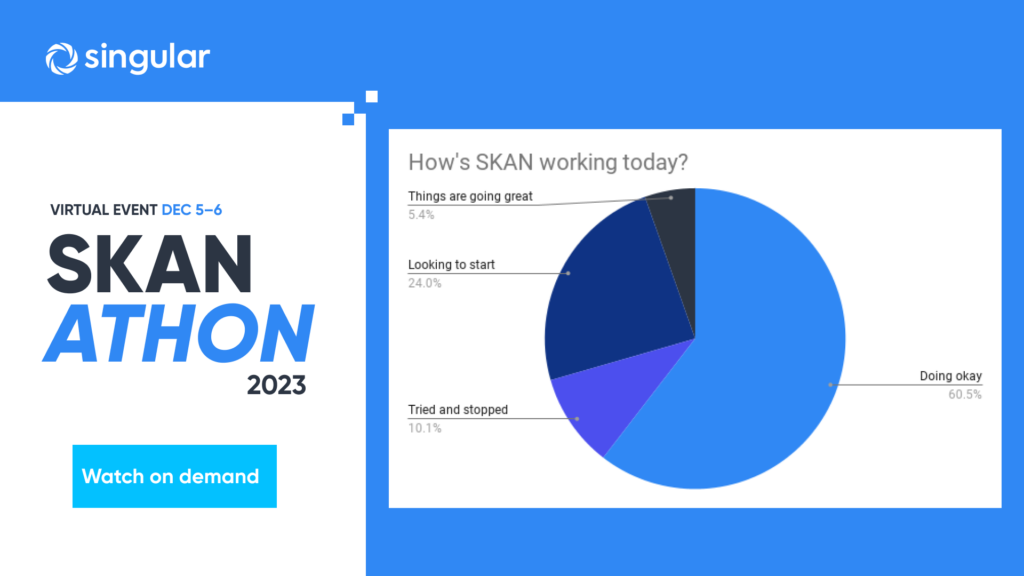

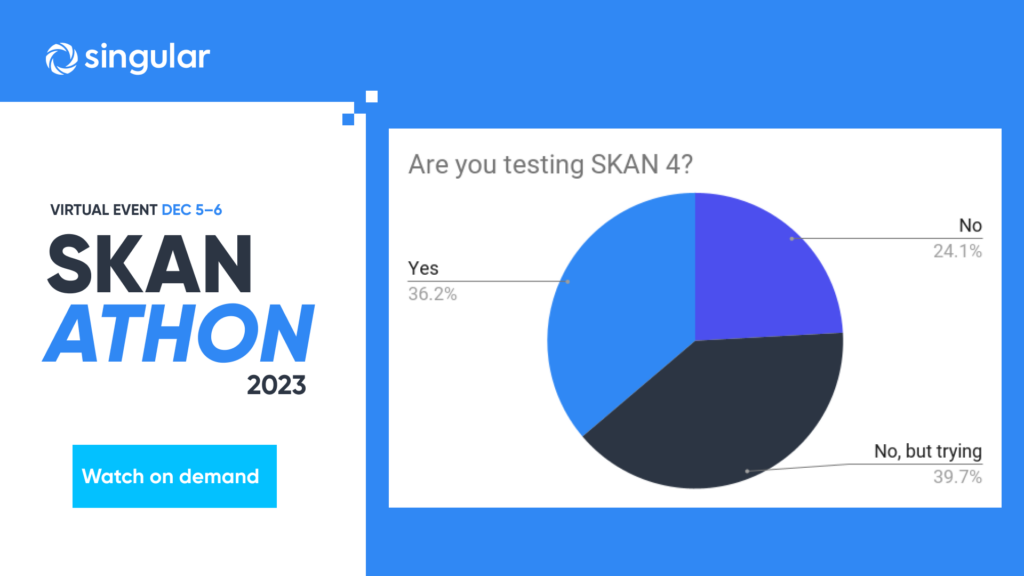

That’s why 66% of iOS marketers are working on or testing SKAN 4 right now, according to the survey numbers from one of our recent webinars.

(Take the number with a grain of salt: this is not a representative audience, necessarily. But it’s likely indicative: everyone knows SKAN 4 is coming.)

But what are 8 things SKAN 4 provides that actually give you what SKAN 3 does not? We asked 5 experts in a recent SKANATHON webinar to dig into SKAN 4 in 2024:

- Richard Eiseman, DraftKings

- Mollie Sheridan, Tinuiti

- Eran Friedman, Singular

- Itai Kafri, TikTok

- Matthew Ellinwood, Liftoff

Here’s just a small slice of what a few of them had to say:

1. SKAN 4 fixes SKAN 3’s volume limitations

Crowd anonymity is better for returning data than privacy thresholds: ad campaigns with lower volume get more data back.

“Basically any advertiser who just has initial budgets, they’re very familiar with the fact that they can’t get enough conversion values because they don’t pass the privacy thresholds,” says Singular CTO Eran Friedman.

SKAN 4 makes that better.

That makes optimization faster, and it reduces the need to consolidate spend into fewer and fewer campaigns, allowing marketers to test better.

“I think that the things that were missing in SKAN 3 were addressed to some extent, and they are mostly around the loss of cohorts and long-term conversion funnels,” says TikTok’s Itai Kafri.

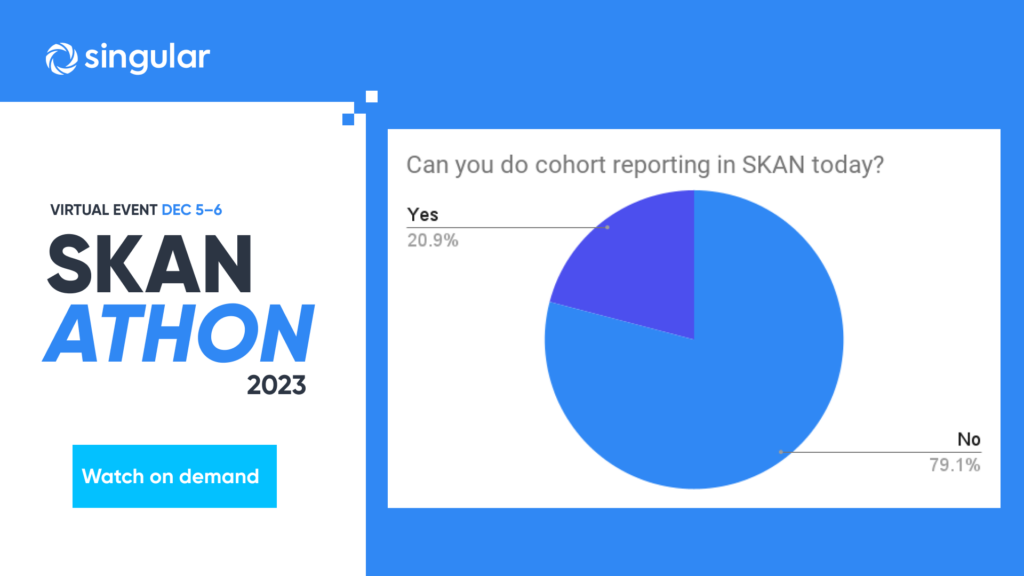

2. SKAN 4 adds a longer data collection time frame

SKAN 3 offers 1 postback which most people opt to get within 24 hours. That makes cohorts hard to compare and user value hard to compute.

“The big limitation that I hear all around from customers is just the limited time window to really understand the value of the user,” says Friedman.

SKAN 4 offers 3 postbacks for fast feedback plus updates around a week and a month, depending on whether you lock conversion values to get them earlier or not. That provides much more data to model cohort behavior, engagement, and revenue.

“With SKAN 4, you will have a longer attribution window or multiple attribution windows up to 35 days,” says Kafri. “That’s a huge change on its own. That change is so significant because the golden standard used to be a seven-day ROAS or seven-day CPA, and that was taken away a long time ago. We are now finally getting it back to some extent, and we can go back to that golden standard.”

3. SKAN 4 provides better creative optimization insight

SKAN 3 offers so little data it’s almost impossible to do creation optimization, forcing ad networks, agencies, and mobile marketers to rely on upper-funnel network metrics and reducing insight into creative’s impact on lower-funnel goals, conversions, and revenue.

“When you want to get to the creative level, now you need to do much more modeling or not really rely on SKAN as much, to be honest,” says Friedman.

At high levels of crowd anonymity under SKAN 4, the new source identifier will offer 4 digits of data on elements like publisher, placement, geo, language, and — if you wish — creative. That offers an opportunity to make SKAN relevant for creative optimization for the first time ever, really.

4. SKAN 4 provides data for more effective ad network optimization

Data for marketers is good and necessary. But attribution data is the end of the line.

To make mobile marketing better, ad networks need to be able to optimize live campaigns for targeting, reach, interest, engagement, and action. Without data, that’s hard to do, and top-funnel metrics aren’t always enough.

SKAN 4 provides what’s needed:

“Now that we have some adoption, we can already see how this can impact not only the reporting side, but also the delivery side and also the optimization and so on,” says TikTok’s Kafri. “And definitely, the accuracy of the modeling. So, there’s a lot of things that we’ve been able to add with SKAN 4 with all the additional data that we have.”

When ad networks have more signals, they have more data. More data means better and faster optimization.

5. SKAN 4 provides better measurement of reality

Measurement needs to measure reality. If it doesn’t, it’s either useless or misleading. And bottom line, rubber meeting road, SKAN 4 does a better job of measurement than SKAN 3.

Perhaps 17% better, says TikTok:

“After a big analysis that we’ve done, we’ve seen an increase of more than 17% in the number of conversions that we can capture because of the longer attribution windows, the threshold changes, and all that,” says Kafri. “And that is a huge differentiator.”

We always knew SKAN 3 was missing conversions, partly due to privacy thresholds and partly due to short measurement windows. SKAN 4 will be leaky too in that sense … but not quite as leaky.

6. SKAN 4 is more complex (yeah, not everything on this list is a positive)

On the downer side, SKAN 4 is more complex and harder to learn and implement. One of the early adopters I’ve talked to says SKAN 4 requires you to completely rethink iOS attribution after SKAN 3 … not necessarily a pleasant prospect.

“It’s an increase in complexity,” says Liftoff’s Ellinwood. “It’s just become much more challenging to handle an entirely new framework and an entirely new set of signals. So, I’d say it’s mostly good news, but with the good news comes some effort.”

So the silver lining doesn’t come without the cloud.

The good news is that there’s an easy button, sort of.

“Our focus is to build that big easy button, like you said, right?” says Singular’s Friedman. “So, anyone who’s just starting with SKAN, just click a button, you know, configure their initial conversion model, and boom, they get the reports as they expect to get them, seeing all your campaigns, any additional granularity that the networks would be able to provide, bits of the hierarchical ideas as we’ve mentioned, basically seeing all the costs, the installs, the KPIs, the events that you’ve done, and, of course, the cohorted rows that you’re used to across any cohorts that you’re trying to aim for.”

Singular is, he says, trying to “bring 2019 back” for mobile marketers.

7. SKAN 4 offers better reporting for subscription apps

Thanks to #2 in this list, SKAN 4 is just better for subscription apps … and any apps with a long conversion window.

“We’ve heard from many advertisers who are pretty excited about SKAN 4 because they’ve been struggling with the previous versions and it kind of opens up opportunities for them,” Friedman says. “Especially the ones who usually monetize after longer cohorts.”

8. SKAN 4 offers better reporting for low-user-count apps

Some apps are built on aggregating audiences of millions or billions and then making fractions of a penny off each individual user via advertising. Other apps are built on a small number of high-value users.

Think construction apps. Vertical-specific apps. Perhaps marketplace apps … apps where you might have just hundreds or thousands of customers, but each represents thousands or tens of thousands of dollars in value.

SKAN 4’s coarse conversion values could be their savior:

“There’s also cases we’ve seen of business models in which they don’t have such a high volume of users,” Friedman says. “I remember, speaking with a marketplace app, for example … they’re selling pretty expensive types of products, and they can’t pass the privacy thresholds with the required volume … with the coarse conversion values, they’ve been testing and seeing great success.”

Thanks to #1 on this list, these types of mobile developers and publishers are potentially back in the game.

Much more in the full webinar

As usual, there’s much more in the full webinar. Check it out (and the other SKANATHON webinars) right over here.

There’s a ton of insight we haven’t been able to share here that you can get on-demand, right now. In particular, Mollie Sheridan from Liftoff and Richard Eiseman from DraftKings shared insights on other, related topics.

Check out all their insights in the full webinar.