Content

Stay up to date on the latest happenings in digital marketing

Summary

-

Leverage the Singular ROI Quadrant: Use the Singular ROI Quadrant to evaluate mobile ad networks based on campaign cost versus revenue, identifying high-value opportunities in Quadrant 3 (fair value) and Quadrant 4 (best value) while avoiding wasteful investments in Quadrants 1 (waste) and 2 (distraction).

-

Balance Scale and Experimentation: Integrate a strategic mix of larger, reliable networks (like Google and Meta) for consistent returns with smaller, niche networks that may yield unexpected growth. Experiment with a blend of investments, such as 80/20 or 50/50 between scaling and growth-focused campaigns.

-

Data-Driven Decision Making: Prioritize data over intuition by utilizing insights from the Singular ROI Index and your analytics to guide user acquisition strategies. Regularly test and iterate on new partners, formats, and creatives to optimize performance while localizing approaches based on regional market dynamics.

How do you find the best value in mobile ad networks?

As usual, it depends.

As a user acquisition manager, what you want from a mobile ad network depends a lot on what you need to achieve now. It might be quality users. It might be quick profitability. It might be scale: you need a lot of new users, stat. And let’s be honest … sometimes it’s just good numbers you can report upstairs and check a box, even if you kinda sorta really know that it’s just an illusion.

So how do you get what you want?

And how do you know which mobile ad networks will deliver the best value for your unique goals?

One way is the Singular ROI Quadrant:

The Singular ROI Quadrant for mobile ad networks

In our recent Singular ROI Index, we introduced the concept of the Singular ROI Quadrant. It’s a simple 2 x 2 chart that tracks ad campaign cost versus ad campaign revenue.

- Quadrant 1: Quadrant of waste

Initially impressive numbers: high cost, low revenue, no lasting value - Quadrant 2: Quadrant of distraction

A big nothing-burger: low cost, but also low revenue … waste of time - Quadrant 3: Quadrant of scale

Fair value: high cost, but also high revenue … here’s where you scale - Quadrant 4: Quadrant of growth

Best value thanks to low cost and low revenue … take it when you can get it

Note that “high” and “low” are relative terms here … high cost is when return is low. You spent $1 and got $0.25 back.

The same cost could feel low if the returning revenue is high: you spent $1 but got $5 back.

Quick wins?

If you’re looking for quick wins that make it look like you’re doing a great job, but you don’t care about the revenue side, choose mobile ad networks in Quadrant 1. Most of your installs will be low-quality if not downright fake, but you can sure report some impressive top-funnel metrics. (And let’s be honest, sometimes your boss wants this to show traction, or to try to juice organics from app stores.)

Viral sensation?

Obviously, everyone wants high revenue at low cost, but it’s rare, and it often doesn’t scale. That said, we see some publishers who consistently hit the Quadrant of Growth, getting high-quality users or players for minimal investment.

When you can get this, it’s clearly the best value possible from mobile ad networks.

Lasting growth curves?

Most of the time, you’re spending a fair amount: reasonably high CPIs for quality players, customers, or app users. This is fair market value: you are getting what you paid for.

Scale: what does the ROI Index reveal about mobile ad networks that scale?

Let’s look at scale first … Quadrant 3 type mobile ad networks.

To scale, you pick large ad networks that have higher costs, but generally return good quality users. And they consistently do this at high volume. You know the names of the networks involved here, because they are massive and in most cases basically global:

We’re talking the kinds of networks that top the list of our Singular ROI Index leaderboards:

- Meta

- TikTok

- Apple Search Ads on iOS

Those are the biggest names, but those aren’t the only ad networks that scale. We also saw players like these hit the leaderboard:

- Moloco

- AppLovin

- ironSource

- Liftoff

- Unity

- Moloco

Viral, cheap, or unexpected growth: which networks over-deliver?

What about growth? Viral growth, or more-than-you-bargained-for kind of growth?

Typically, you’re looking at smaller ad networks here. And often, you’re looking for regional players. They have focus and often fill specific niches, giving them opportunities to stand out.

For 2025, those niches include:

- Fintech

- Games

- On Demand

- Shopping

And the mobile ad networks that we found to be in the Quadrant of Growth include these players …

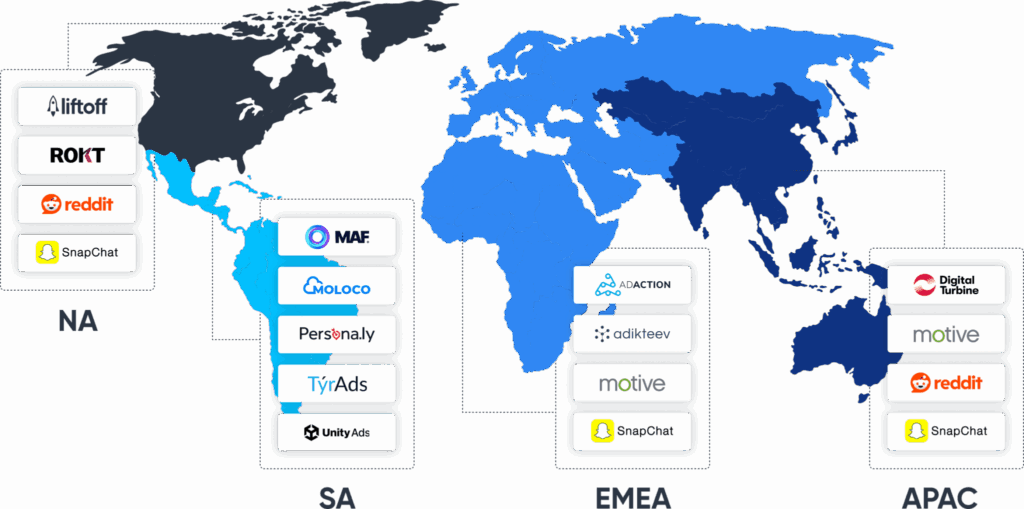

APAC

- Digital Turbine

- Motive Interactive

- Snap Ads

EMEA

- AdAction

- Adikteev

- Motive Interactive

- Snap Ads

North America

- Liftoff

- Rokt

- Snap

South America

- MAF

- Moloco

- Persona.ly

- TyrAds

- Unity Ads

Obviously, this doesn’t mean that every campaign with these mobile ad networks is perfect, amazing, and delivers vastly outsized results. It does mean that on average, we saw impressive user acquisition campaigns with these players.

Dollars for value: so now what?

So how can you use insight like this to craft a user acquisition strategy, or growth campaign? Here’s 5 steps you can take to make it useful:

- Don’t chase scale blindly

Big networks are tempting, but ROI can erode if you’re not optimizing. Always compare cost vs. return. - Hunt for hidden value

Smaller networks in Quadrant 3 often deliver surprising results—especially for niche apps or geos. - Test and iterate

It’s not like you haven’t heard this 1 before, but yeah … testing matters. The Growth Quadrant is where innovation happens. Test new partners, formats, and creatives regularly. - Use data, not hunches

I mean, I like my gut too, but data is generally better. Leverage the Singular ROI Index and your own analytics to make decisions. Gut feel is good, but data wins. - Localize your approach

Returns shift by region and vertical. What works in APAC may not work in North America.

Get all the insight in our most recent Singular ROI Index, and use it to inform your plan.

Some of the best campaigns blend scale and experimentation. Maybe you’ll go 80/20 Quadrant of Scale vs Quadrant of Growth: most of your investment is where you know you’ll get a consistent return, but some of it is for exploration of potentially super-lucractive campaigns.

Maybe you’re more adventurous, and can manage greater numbers of smaller mobile ad networks thanks to your Singular integrations. Then you might try 50/50, or even higher on Quadrant 4 networks.

Follow the data!