What are the top finance apps on the planet?

It’s pretty clear by now that fintech is the future of finance. New banks, new finance, loan, insurance, and banking apps are growing super fast, and most of the innovation in the personal financial world is being driven by top finance apps. That means a huge number of banking, budgeting, loan, investment, and finance apps are now available. Many of them are following in the footsteps of the biggest Chinese apps and becoming super-apps with many fintech features but also shopping, mini-apps, and much more.

But which are the best?

It’s hard to say, because this is not a small space:

The entire world is rapidly shifting toward digital, mobile-first financial solutions. New technology including instant payments, embedded finance, AI-driven personalized budgeting insights, and cryptocurrency are fueling this seismic shift.

There’s also not a single answer here, or a single set of best fintech apps. Finance is a heavily regulated space, so fintech apps are regional or even country-specific. We’ve looked at the top 100 fintech apps previously, but now I want to look at fintech regionally: what’s hot and happening in fintech, finance, budgeting, and banking apps all around the world.

So here we’re going to review the top finance apps by 7 key regions:

Top finance apps in Africa

The fintech scene in Africa is huge and busy.

Sub-Saharan Africa is one of the world’s most active mobile money region, with 1.1 billion registered mobile money accounts and 286 million active users at the beginning of 2025.

M-Pesa has been around for years now and has transformed everyday finance, enabling millions of unbanked people to send, save, and receive money on basic phones. The number of mobile money transactions in Africa is enormous, with M-Pesa alone handling 30 billion transactions worth $309 billion in 2024.

Key growth drivers include a young mobile-first population, high demand for remittances and payments, and supportive policies targeting financial inclusion. Telcos and fintech startups are expanding beyond payments into lending, savings, and insurance, creating fintech super-apps.

Top finance apps in Africa right now

- M-Pesa (Kenya, East Africa)

M-Pesa is a pioneering mobile money app that lets users deposit, withdraw, and transfer money via their phones. M-Pesa has over 50 million users in Kenya alone and processes up to 61 million transactions daily. It is hugely popular for peer-to-peer transfers, merchant payments, and utility bill pay. Core features include a mobile wallet, bill payments, airtime purchase, savings (M-Shwari), and small loans, so it’s an all-in-one financial tool for many, including those who were previously unbanked.

- MTN MoMo (Pan-African)

The MTN Mobile Money service (“MoMo”) operates in multiple African countries including Ghana, Nigeria, and Uganda via the MTN telecom network. Momo offers a wallet for transfers, airtime, bill payments, and retail purchases. As of mid-2024, MoMo had close to 70 million active users across Africa. It drives inclusion by enabling basic phone users to send money and pay bills, works via USSD menus (Unstructured Supplementary Service Data on GSM networks) or a simple app, and offers a network for cash in/out.

- Orange Money (West/Central Africa)

Orange Money is, not shockingly, a mobile money service by Orange, a telecom with a strong presence in French-speaking Africa such as Côte d’Ivoire, Senegal, and Mali. It provides wallet services similar to M-Pesa with instant money transfers, merchant payments, and bank integration, and has 10s of millions of users regionally. It’s known for cross-border remittances and is a key driver of cashless transactions.

- OPay (Nigeria)

OPay is a fast-growing super-app and mobile wallet in Nigeria that offers payments, banking, and on-demand services. OPay’s platform enables peer transfers, utility and merchant payments, and even ride-hailing and food delivery as it too approaches “super app” territory. Opay has over 40 million active users in Nigeria and processes millions of daily transactions. Core financial capabilities include savings accounts, debit cards, and micro-loans, which means OPay is working to be a full-service digital bank alternative.

- PalmPay (Nigeria)

PalmPay is another popular mobile wallet and payment app. It’s known for its user-friendly interface and financial inclusion focus, and supports P2P transfers, airtime and bill payments, and merchant QR payments. PalmPay has achieved over 30 million customers by 2024, and users praise its smooth transfers and cashback rewards. PalmPay also offers savings services (fixed deposits)..

- Chipper Cash (Pan-African)

Chipper Cash offers cross-border payments for free or at very low-cost across 21 African countries and further international destinations such as the US and the UK. Chipper Cash is popular among young professionals and freelancers for sending money between Ghana, Kenya, Nigeria, South Africa, and other countries, and has a user base of several million. Chipper Cash also supports crypto trading and investments in-app, along with free no-fee P2P payments, international remittances, bill paying, and a recently launched Visa card linked to the Chipper Cash digital wallet.

- Kuda (Nigeria)

Kuda is a leading Nigerian neobank app that offers a mobile-only bank account with no fees. Kuda provides digital checking accounts, free transfers, savings tools, and low-cost loans to around 5 million users, mostly in Nigeria. It has a high app rating due to its clean UI and reliable services. Kuda’s differentiation is in budgeting insights and spending notifications, helping users manage finances. It also issues virtual and physical debit cards and supports bill payments.

- TymeBank (South Africa, entering other markets)

TymeBank is South Africa’s fastest-growing digital bank and combines a low-fee bank account accessible via mobile app with an extensive kiosk network for cash deposits. The app offers no-monthly-fee accounts, and a high-interest savings tool, along with SendMoney vouchers to send money to any phone number.

- Paga (Nigeria)

One of Nigeria’s earliest mobile money platforms, Paga is now an app with millions of users. Paga allows users to transfer money to any phone number or bank, pay bills, and buy mobile airtime. In-app, Paga offers a multi-wallet experience (for personal or business funds), savings options, and merchant payments via QR codes.

- Fawry (Egypt)

Fawry is Egypt’s leading digital payments platform, used by over 35 million Egyptians via its app and agent network. Fawry started as a bill payment kiosk network and evolved into a mobile app for utility bill pay, mobile recharge, government fees, and e-commerce payments . It supports card-on-file and wallet functionality. Fawry’s app is top-rated in Egypt for its convenience – users can scan bill barcodes or select services in-app to pay instantly. The platform has also expanded into banking services, offering micro-loans and savings in partnership with banks.

Top finance apps in Asia

I’m not including China and India in this list: they are massive, ginormous countries that are almost universes to themselves, so even though some include them (especially China of course) in Asia, I think they deserve their own spotlight.

Across Asia fintech adoption has skyrocketed with the rise of super-apps and e-wallets.

Why?

In Southeast Asia in particular, a young population coupled with high smartphone penetration have fueled a cashless payments boom.

Some are calling it a golden age, largely because we’re seeing almost 20% growth annually in digital payments that should reach $1.7 trillion by 2029 in Southeast Asia alone. Countries like Indonesia, Philippines, and Vietnam have jumped straight from cash-heavy economies to mobile-first finance thanks to government support like Indonesia’s BI-Fast and Thailand’s PromptPay.

We’re seeing a huge proliferation of Buy Now Pay Later (BNPL) services, plus increasing integration of crypto and remittances features into wallets. Importantly, Southeast Asia’s super-apps like Grab and GoTo integrate payments with ride-hailing, delivery, and more, providing everyday apps for (almost) everything.

Top finance apps in Asia right now

- GCash (Philippines)

GCash is a dominant finance super-app in the Philippines with mobile wallet payments, banking, and more. It has almost 100 million users and covers about 70% of Filipino adults, providing bill payments, bank transfers, QR retail payments, savings accounts, loans, investments, insurance, and even a credit score.

- Maya (formerly PayMaya, Philippines)

Another leading Filipino fintech app is Maya, which combines a digital wallet with a digital bank. Maya has tens of millions of users well over 5 million banking customers. It enables P2P transfers, bills, and QR payments like GCash, and also offers a fully licensed digital bank with savings, loans, crypto trading, and a credit card.

- Grab (GrabPay) – Southeast Asia

Grab is Southeast Asia’s ubiquitous super-app and its GrabPay e-wallet is among the top payment apps in the region. GrabPay is integrated into the Grab app for ride-hailing and food delivery, but also used at merchants online and offline, sometimes via QR code. It supports P2P transfers, mobile recharge, bill payment, and Buy Now Pay Later (PayLater by Grab). Grab also launched a digital bank (GXS Bank) in Singapore and Malaysia, so the app now includes bank accounts and savings features. With tens of millions of users, GrabPay’s popularity is tied to Grab’s everyday services, loyalty rewards, and tie-ins like insurance and investments accessible from the app.

- GoPay (Indonesia)

The integrated wallet in the Gojek super-app GoPay is one of Indonesia’s most popular mobile finance apps, having processed over 100 million payments. It began as a way to pay for Gojek rides and deliveries, and now is used for everything from paying bills and merchants (via QRIS national QR code) to investing in mutual funds (GoInvestasi). GoPay has around 38 million monthly average users and is known for its cashback promotions and extensive offline merchant network. Through its GoPayLater service, it also offers BNPL lending. Security is solid with PIN and biometric features, and the app’s integration with Gojek’s services drives daily engagement.

- OVO (Indonesia)

Another top Indonesian digital wallet, OVO is accepted widely for retail payments and was one of Indonesia’s first unicorn fintechs. It has over 60 million users and was the #3 e-wallet by awareness in 2023. OVO’s core is an e-wallet for P2P transfers, QR payments, and loyalty rewards. OVO also offers access to investments (OVO Invest for mutual funds) and insurance in-app.

- DANA (Indonesia)

DANA is a rapidly growing Indonesian wallet platform, reportedly reaching 170 million users last year, which would make it one of Southeast Asia’s largest e-wallets. DANA enables fund transfers, bill and e-commerce payments, and has features like escrow for marketplace payments. The company recently introduced a DANA Visa card and offers an installment BNPL service.

- ShopeePay (Indonesia, Malaysia, Thailand, etc.)

Shopee is massive in Southeast Asia, and so is its payment functionality, ShopeePay. ShopeePay is used for online shopping checkouts, P2P transfers, and QR payments offline. It often offers generous cashback rewards for use, driving adoption. Key features include free bank transfers in some markets, contactless QR payments, and a seamless link to Shopee’s shopping app. With Shopee expanding into food delivery and travel, ShopeePay is evolving into a general-purpose wallet beyond e-commerce.

- MoMo (Vietnam)

Vietnam’s leading finance app, MoMo, has surpassed 40 million active users as of 2025. MoMo started as a mobile wallet and expanded into a more comprehensive super-app with functionality like instant P2P transfers, utility and bill payments, mobile top-up, and offline QR payments at over 100,000 locations. Recently, MoMo has added a marketplace for loans, investments, and insurance where users can invest spare change, buy insurance packages, or get small loans right in the app. It also offers lifestyle services like movie and travel bookings, like other superapps.

- bKash (Bangladesh)

bKash is Bangladesh’s leading mobile financial service, with 330,000 agents, 550,000 merchants, and a customer base of nearly 80 million. Initially an SMS-based mobile money service, bKash now offers a full app for sending money, mobile recharges, utility payments, and merchant QR payments, connecting millions of unbanked Bangladeshis to financial services. bKash has also integrated with banks and provides savings schemes and digital loans through partnerships. The app has added new features like an education fee payment portal and in-app remittance receiving options.

- Easypaisa (Pakistan)

The first and most popular mobile wallet in Pakistan, Easypaisa has over 10 million monthly active app users. The app enables a full suite of services: money transfers (to any phone or bank), utility bill payments, mobile top-ups, QR payments, and an array of financial products including savings accounts, micro-loans, insurance, and a Visa debit card linked to the wallet.

Top finance apps in China

As 1 of the 2 largest countries in the world by population, China deserves to be broken out.

China’s fintech environment in 2025 is highly developed and at scale. It’s also more regulated and consolidated than it was just a few years ago. In other words, it’s no longer the wild wild East: this is a mature market now.

Digital payments are utterly mainstream: 9 in 10 Chinese smartphone users make mobile payments, and cash is rare in cities. As most people know, the market is dominated by two super-app ecosystems: Alipay and WeChat Pay, each with over a billion users … which means most people have both. These platforms grew from payments apps into full financial ecosystems offering loans, investments, insurance, and beyond.

(Plus, of course, since they’re super-apps, they also do much more, offering mini-apps for games, shopping, ordering food … pretty much anything you can imagine.)

Since late 2020, regulators have tightened oversight on the fintech giants to reduce risk in the finance and banking spaces. That hasn’t changed how Chinese people use fintech apps, however: fintech services remain deeply embedded in Chinese life.

One major factor is the launch of the digital renminbi (e-CNY) … a potentially significant development for the future. Undergoing testing as early as 2021, the e-CNY began to be in limited use in 2023. The goal here is to at least partially replace cash.

Top finance apps in China right now

- Alipay (Zhifubao)

The largest mobile finance app in China, Alipay has over 1 billion active users and is, of course, an omnipurpose super-app. Alipay is now used for basically everything: scan-and-go payments at stores, P2P transfers, ride-hailing, food delivery orders, hotel bookings, utility bill payments, and much more with huge numbers of mini-apps from brands that can be used to access thousands of services. Alipay’s core is its wallet linked to bank cards, but it also offers savings, investments, a credit card and BNPL functionality, micro-loans, insurance products, and even credit scoring via Zhima Credit. As a payments platform, Alipay processed an estimated 200+ trillion CNY ($30+ trillion) in transactions in 2024 (including bank transfers and QR payments). It’s hard to overstate Alipay’s ubiquity: “Alipay or WeChat?” is the default question instead of cash or card, which you might have in the West.

- WeChat (WeChat Pay)

WeChat is China’s other “everything app. While it started as primarily a social/chat app, it also features WeChat Pay, the second-largest mobile payment system. Called Weixin in Chinese, WeChat has 1.3 billion monthly active users, and most of them use WeChat Pay. Any user can link their bank card to WeChat and start paying friends or merchants, and WeChat Pay is accepted nearly everywhere in China, often via the same QR codes as Alipay. WeChat’s mini-app ecosystem allows for in-app purchases, ride hailing, food delivery, e-commerce, etc., all paid by WeChat Pay. Financial services via WeChat are delivered through WeBank or partners, and people can get micro-loans, wealth management products, and insurance through WeChat’s Wallet section.

- UnionPay (Cloud QuickPass)

The official mobile app by China’s UnionPay card network, known as Yunshanfu, UnionPay This app recently had a surge in downloads and is a top global app by virtue of its adoption in China. UnionPay can connect multiple bank cards from different banks and supports UnionPay QR code payments, NFC tap-to-pay, and P2P transfers. Heavily promoted by state banks, it’s essentially a more bank-centric counterpart to Alipay/WeChat. The app also aggregates offers/coupons, bill payments, and transit card features.

- ICBC Mobile

ICBC Mobile is the mobile banking app from Industrial and Commercial Bank of China, the world’s largest bank. ICBC’s mobile app user base is enormous: as of 2024, ICBC had 588 million mobile banking customers, with 260 million monthly active users on its mobile app. (The crazy part: in China, this is almost small compared to the leaders above.) ICBC Mobile allows customers to do all banking transactions (transfers, deposits, credit card management, loan applications) from their phone. In addition, it offers lifestyle services like utility bill payments, investments (ICBC Wealth management products), insurance purchase, and even concert ticket bookings. It’s all part of Chinese banks’ strategy to stay relevant. The ICBC app is consistently ranked first among bank apps in China for its functionality and user experience.

- Agricultural Bank of China (ABC) Mobile

ABC is another “Big Four” bank app serving a vast client base, including rural customers. Like ICBC Mobile, ABC has about 500+ million mobile users and is known for a user-friendly interface. The app provides comprehensive banking (transfers, account opening, and loans) and supports payment scans just like the big fintech apps. ABC leverages its network to encourage rural users onto the app, including integrating with the national rural payment network.

- WeBank (WeBank App)

WeBank is China’s first online-only bank, launched by one of China’s biggest tech companies, Tencent. Many WeChat users access WeBank’s services via WeChat, but WeBank also has its own standalone app. WeBank provides digital deposit accounts, consumer loans, business loans, and wealth management, serving over 300 million consumers.

- MyBank (Ant Group)

Similar to WeBank, MyBank is Ant Group’s internet bank focusing on small and medium-sized businesses, and microloans to people. Its consumer-facing app isn’t super-prominent because MyBank primarily issues loans via partners (like Alipay). However, it has a sizable user base among Taobao merchants and small entrepreneurs, and is piloting innovative services like lending based on commerce data and allowing rural users to open accounts via face recognition on the app.

- Ping An Pocket Bank

Ping An Bank’s mobile app is another bank app in China. It provides the usual banking features plus a wealth management supermarket and unique personal finance tools like budgeting and expense analysis. While not exactly a super-app, it also integrates health services from Ping An Good Doctor, blurring lines between finance and healthcare.

- Ant Fortune

A specialized investment and wealth management app by Ant Group, Ant Fortune aggregates hundreds of mutual funds, fixed-income products, and insurance from various providers. For users who want more than the basics found in Alipay, Ant Fortune provides advanced tools like fund screeners, community discussions, and robo-advisory portfolios. It has attracted almost 200 million users.

- JD Finance (JD Digits/JD Pay)

JD is one of China’s e-commerce giants. It has a fintech arm with an app that combines payments like JD Pay, consumer credit, and wealth management. JD has branched into offline retail and salaries and its finance app has grown significantly.

Top finance apps in Europe

As you’d expect, the European fintech scene in 2025 is fairly mature, though still evolving in southern and eastern Europe, and heavily influenced by regulation.

It’s increasingly integrated with traditional banking, but digital payments that are ubiquitous in China and other countries are much more rare in Europe, and usage numbers are nothing like China’s or India’s. Traditional financial tools like credit cards are much more common, and of course the population in European countries is much lower.

Key drivers in Europe for fintech include open banking initiatives, with apps like Revolut, Monese, and Emma using bank data to offer holistic money management. Crypto has cooled in the European fintech space, but payments and digital wallets, along with wealth management apps, are on the rise.

Personal budgeting and financial planning apps are also growing.

Top finance apps in Europe right now

- Revolut (UK, EU-wide)

Revolut is a bit of a European fintech super-app with banking, payments, investing, crypto, travel insurance, budgeting. It has somewhere around 40 million users, most of whom are in Europe, and is well regarded. Revolut offers P2P payments and bill splitting, stock trading, and offers some BNPL services in the UK.

- PayPal (EU-wide)

PayPal, while originally American, also operates in Europe as a digital wallet for online payments, P2P transfers, merchant payments. It’s one of the most-used wallets, with perhaps 75 million users in Europe, and a good reputation. It also has P2P payments (pretty much the original use case for PayPal!), and has merchant check-out features, savings in some countries, crypto currency in some as well, and BNPL.

- Wise (UK, EU-wide)

Formerly TransferWise, Wise focuses on international money transfers, plus multi-currency accounts, plus a credit card card: the Wise Card. Wise has about 16 million users globally, the majority of whom are in Europe. Wise also offers budgeting tools and peer-to-peer transfers, as well as foreign exchange transfers.

- N26 (Germany, rest of EU)

N26 is a digital bank — a neobank if you will — that primarily operates in Germany, France, Spain, Italy, and a few other countries. It offers free accounts, credit cards, budgeting tools, savings, and investing options, and has perhaps 8 million users. It also offers crypto trading in some countries.

- Bunq (Netherlands, rest of EU)

Bunq is a digital bank with focus on sustainability, multi-currency accounts, and travel. It has perhaps 10 million users, focusing on the Netherlands, is well rated, and offers functionality for banking, P2P payments, savings, joint accounts, a travel card, budgeting, and investments in ETFs. It also offers “Green Goals” and plants trees in return for usage.

- Lydia (France)

Lydia is a popular app in France for P2P payments, mobile banking, and credit cards, especially among younger people. It has about 7 million users, handles P2P payments, offers banking accounts, allows users to trade crypto, brokers loans, and offers BNPL services.

- Satispay (Italy, France, Germany)

Satispay is an independent mobile payments network competing with PayPal and credit cards. It has about 4 million users, mostly in Italy, and focuses on offline merchants. Capabilities include P2P payments, merchant payments, bill paying, budgeting, donations, and savings.

- Twint (Switzerland)

Twint is the dominant mobile payments app in Switzerland, with about 5 million users. It offers P2P payments, QR merchant payments, bill splitting, ticket purchases, loyalty integrations, and transit payments

- Other payment apps of interest include

- Trade Republic is mostly in Germany and does investments, crypto, and savings

- Bitpanda is in Austria and elsewhere, and focuses on crypto and stocks

- Emma is mostly in the UK and is a budgeting and financial aggregation app offering bank aggregation, budgeting, subscription tracking, savings insights, plus net worth tracking

Top finance apps in India

India’s fintech ecosystem in 2025 is super dynamic and, along with China, arguably the most advanced on the planet in terms of digital payments and fintech adoption.

The Unified Payments Interface (UPI) is a real-time mobile payments network that has become a way of life, processing billions of transactions every month. In 2024 alone, India saw 208.5 billion digital payment transactions, largely driven by UPI. Fintech apps in India benefit from this interoperable infrastructure: any UPI app can pay any other, meaning there’s a somewhat level playing field for competition and innovation.

Over 75% of urban adults and a growing share of rural users now use mobile payment apps. Thanks to India’s massive population and open APIs for KYC, payments, and data sharing, the big apps have hundreds of millions of users.

These apps are generally shifting towards super apps with many varied offerings.

India has several homegrown fintech giants, and global players tailor their offerings for India, with Google Pay being a prime example (it’s a very different app in India versus the United States, for instance). India’s consumers benefit from intense competition: almost all fintech apps offer zero fees, instant service, and an expanding suite of capabilities.

Like China, India is piloting a central bank digital currency, and has been experimenting with it since 2023.

Top finance apps in India right now

- PhonePe

PhonePe is India’s top digital payments app by volume and reach, having surpassed 500 million users in 2023. PhonePe offers a UPI-based mobile wallet for instant bank transfers, QR code payments in shops, bill payments, and more. Initially focused on simple UPI transfers, PhonePe has evolved into a full fintech platform: people can buy gold (!!!), invest in mutual funds, purchase insurance, pay taxes, and even shop within the app via mini-apps. It’s supported by a huge network of over 35 million merchants.

- Google Pay (GPay)

A close competitor to PhonePe, Google Pay in India is very different than Google Pay elsewhere. Leveraging UPI for seamless payments, Google Pay has about 36% of India’s mobile payments market with a chat-like interface, making sending money as easy as texting. Google Pay users can pay anyone via UPI, tap & pay via NFC, pay bills, and recharge phones. Google Pay has also added personal finance features to track spending and bills, and integrated wealth products like stocks. Interestingly, Google Pay has far more success in India than in any other country.

- Paytm

Paytm was once synonymous with digital wallets in India. Now Paytm is a broad fintech app with payments, banking, and commerce with over 96 million monthly average users as of 2024. Paytm offers UPI transfers, its own wallet payments, bill payments, movie and travel bookings, and merchant QR payments. Paytm is essentially a bank: users can hold savings and earn interest. It also offers mutual fund investments, stock trading, insurance, BNPL, and Fastag toll payments, making it a financial super-app.

- YONO SBI

YONO (You Only Need One) is the mobile banking and lifestyle app by State Bank of India, India’s largest bank. With SBI’s vast customer base, YONO has a huge user count, with goals to hit 100 million as of last year. The YONO app is differentiated in blending banking with a marketplace, allowing SBI customers to check accounts, transfer funds, open deposits, apply for loans or credit cards, and also check shopping deals and travel bookings. YONO features “YONO Cash,” a cardless ATM withdrawal using the app. As a banking app, it has strong security and now even incorporates budgeting and personal finance management tools.

- Bajaj Finserv

Bajaj is an app by Bajaj Finance, which is India’s leading non-bank lender. It has become a top fintech platform for loans, payments, and investments. The Bajaj Finserv app has massive adoption: as we noted, it was among the top 20 fintech apps by downloads globally in 2025. Bajaj users can apply for personal loans, get consumer durable loans, manage their Bajaj EMI card, pay bills via UPI, and buy insurance or invest in fixed deposits.

- Airtel Thanks

Airtel Thanks is an app by telecom operator Bharti Airtel that evolved into a combined telco self-care and fintech app. It’s used by a large portion of Airtel’s 360 million subscribers in India for mobile recharges and plan management, and it doubles as the app for Airtel Payments Bank, which offers UPI payments, a savings account, and a digital wallet.

- CRED

CRED is a niche but influential fintech app focusing on credit card management and rewards. CRED targets high-net-worth Indians. It has about 13 million monthly active users and allows members to manage and pay all their credit card bills in one place. In return for on-time payments, users get points that can be redeemed for products, discounts, or lottery-style jackpots. CRED has expanded into lending, investment products, and e-commerce with a members-only store.

- MobiKwik

One of India’s original mobile wallets, MobiKwik has reinvented itself in the UPI era and still has over 40 million users. The app supports wallet payments, UPI transfers, bill and recharge payments, and it has a large biller catalog. MobiKwik also offers a BNPL product, giving eligible users a short-term credit line for purchases. Additionally, MobiKwik offers mutual fund investments and digital gold.

- Groww

Groww makes stock market and mutual fund investing easy for India’s millennials. With over 40 million users, Groww is highly popular for commission-free stock trading, direct mutual fund investments, fixed deposits, and US stock investing, all in one app.

- Kotak 811

Kotak 811 is the digital banking app/initiative of Kotak Mahindra Bank, one of India’s prominent private banks. The Kotak 811 app allows anyone to open a zero-fee digital savings account. Users get a full-fledged bank account with a virtual debit card, which they can use for UPI payments, transfers, and online shopping.

Top finance apps in South America, Latin America, Central America

South America, Central America, and Latin America is one of the fastest-growing fintech markets in the world. There’s massive growth in digital payments and transfers, super-app and ecosystem plays that offer multiple fintech solutions in a single app, crypto and alt-currencies, and more.

Millions of people are getting their first financial account ever via a smartphone app rather than a bank branch, as large populations of unbanked people are gaining access to multiple digital financial tools. Supportive regulations, like Mexico’s fintech law, Brazil’s open banking and Pix instant payment, have helped.

The result is people increasingly using mobile apps for everyday finance, from paying bills to buying groceries. Some countries in the region also embrace crypto relatively more, driven by inflation and currency instability in countries like Argentina and Venezuela.

Top finance apps in South/Latin/Central America right now

- Nubank

Nubank is the poster child of Latin American fintech. Originally a Brazilian digital bank, Nubank has become one of the world’s largest neobanks with over 118 million customers across Brazil, Mexico, and Colombia. The Nubank app offers a no-fee digital bank account, a credit card, personal loans, investments, insurance, and more. Customers can do instant Pix transfers, earn interest on deposits, and invest in mutual funds or crypto. In Mexico, Nubank has gained millions of users via its credit card under the Nu brand.

- Mercado Pago

Mercado Pago is the fintech arm of the e-commerce giant MercadoLibre in Argentina, Brazil, Mexico, and other countries. Mercado Pago started as an online payment method for MercadoLibre but is now a comprehensive wallet and digital bank with at least 64 million monthly active users. The Mercado Pago app lets users save money, pay at stores via QR code, pay bills, top-up phone plans, and send P2P transfers. It’s widely used by small merchants and offers loans, investments, and insurance products.

- PicPay

PicPay is a Brazilian mobile payments and digital wallet app that has become extremely popular with youth, with over 60 million registered users and around 35 million active users. PicPay enables transfers to friends and to merchants, but also offers a digital account with Mastercard, bill payments, an in-app marketplace to buy gift cards and transit tickets, and a lending platform. It also has some crypto trading and an investments hub.

- PagBank (PagSeguro)

PagSeguro is a Brazilian fintech known originally for its mobile point-of-sale devices for merchants. The PagBank app has become a full consumer digital bank with over 30 million customers, offering digital checking accounts, a Visa card, Pix transfers, bill payments, mobile top-ups, and other financial services like personal loans and investments.

- Banco Inter

Banco Inter is yet another Brazilian digital bank success. Originally an offshoot of a small bank, Inter exploded by offering a free app for banking, investing, and shopping cashback, reaching 35 million clients in 2024. Inter also offers no-fee checking and savings, credit cards, loans, investments, insurance, and — of course — shopping. There’s also an AI-powered financial assistant, and Inter’s strategy of combining finance and e-commerce has increased user engagement: customers can scroll looking for deals and then pay with their Inter card or account.

- C6 Bank

C6 Bank is a relatively new but rapidly growing Brazilian digital bank with about 35 million customers by the end of 2024. Similar to Nubank and Inter, C6 Bank’s app offers a range of financial products: accounts, debit/credit cards, a loyalty program, investments, and lending. C6 also offers a toll tag for cars, business accounts, and a marketplace for telecom top-ups and gift cards.

- Nequi

Nequi is a leading digital wallet in Colombia with around 22 million users. The Nequi app offers a digital savings account and a chat-based interface for banking. Users can send money, pay bills, get virtual cards for online purchases, save in subaccounts or “pockets,” and get short-term loans. Nequi recently added a marketplace for third-party services and deeper integration with Colombia’s QR payment network..

- Ualá

Ualá is an Argentine fintech unicorn offering a personal finance app and prepaid Mastercard. It has over 9 million users across Argentina, Mexico, and Colombia, and allows users to open an account, top up via cash deposits, send bank transfers, and pay with the Ualá card or app. The app has a personal lending product, and Ualá has begun offering investments and BNPL products. Ualá expanded to Mexico in 2020 and more recently Colombia, often targeting youth and unbanked populations. It also offers crypto trading in counties with less stable national currencies..

- Bitso

Bitso is the most prominent cryptocurrency platform in Latin America, originating in Mexico and also operating in Argentina, Brazil, and Colombia. Bitso’s user base passed 9 million in 2024, allowing people to buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, and a variety of local stablecoins (for example, MXN or ARS-pegged tokens). Bitso focuses on real use cases like remittances in crypto, and converting salaries to stablecoins to escape high inflation. The app integrates with local banking systems so users can deposit and withdraw in local currency.

- Daviplata

Daviplata is a Colombian mobile wallet launched by Banco Davivienda with about 15 million users. Daviplata allows anyone to open a basic electronic account using their ID, receive and send money, pay bills, and withdraw cash at ATMs or partner stores. It gained massive usage when the government used Daviplata to distribute emergency subsidies to millions during COVID-19. It also offers services for international remittances, contactless payments, and micro-loans.

Top finance apps in North America (US & Canada)

In North America, especially the US, fintech is about innovation but also integration into mainstream finance, which is large, dominant, and mature. Unlike fast-growing regions where fintech apps replace traditional banking or enable banking for those who are previously unbanked, in North America fintech apps augment what the traditional financial marketplace has usually offered, or specialize in something that it has missed.

That often means apps that focus on budgeting, credit scores, investing, or peer-to-peer payments.

But it also means neobanks, commission-free stock trading apps, and crypto apps. There’s also a large BNPL or “buy now, pay later” ecosystem of providers like Affirm or Klarna, and robo-advisors like Wealthfront or Betterment for managing investments.

Canada’s fintech scene is smaller, with strong incumbent banks, but apps like Wealthsimple (investing) and Koho (spending and savings with prepaid cards) have gained traction among millennials.

North American consumers expect convenience coupled with capability, so fintechs tend to partner with banks or get bank charters so they can offer everything digitally. North America’s fintech apps have typically tended to be more siloed or specialized, but the trend now is aggregation … so we may start to see financial super-apps in North America as well as other parts of the world.

Top finance apps in North America right now

- PayPal

A pioneer of digital payments, PayPal remains one of the top finance apps in North America with over 400 million global active accounts, including around 80 million in the U.S. The PayPal app lets users send and request money domestically and internationally, pay online merchants, and manage a PayPal balance or linked bank accounts/cards. It also offers PayPal Credit and a Buy Now Pay Later installment option at checkout. The PayPal app is adding more personal finance features like a savings account and crypto trading for Bitcoin/Ethereum.

- Venmo

Owned by PayPal, Venmo is the app for peer-to-peer payments among young Americans with about 85 million users. It has a social feed for payments, links to bank accounts or cards to send money instantly, and has a Venmo Mastercard debit card, the ability to pay at online merchants, and check cashing. In 2025, Venmo added teen accounts for young users with parental oversight and Venmo crypto. Venmo processes a huge volume: over $240 billion in 2024. It continues to grow, but it faces competition from Zelle and Cash App, as well as products from Apple and Google.

- Cash App

Cash App is a popular finance app with 57 million monthly active users. Users can send or receive money instantly, and they get a unique “$cashtag” ID to share for payments. Cash App also offers a Cash Card, or free Visa debit card, and has expanded into commission-free stock investing, Bitcoin trading, and tax filing. Some people use Cash App as an alternative bank. They can do direct deposit of paychecks into Cash App and receive tax refunds there as well.

- Zelle

Zelle is the banking industry’s answer to Venmo … it’s an instant bank-to-bank payment network embedded in most major US banking apps. But it also has a standalone app that allows free instant transfers directly between bank accounts using an email or phone number. Zelle is massive, handling hundreds of billions of dollars of transfers.

- Chime

Chime is the leading U.S. neobank. It’s a fintech company that offers banking services via app without its own banking license by partnering with banks. Users can open a deposit account in minutes with no credit check, get a Visa debit card, and manage money with a focus on low fees (no monthly/overdraft fees). Chime has over 15 million customers and is particularly popular among those fed up with traditional bank fees or who don’t qualify easily for big bank accounts. The app also offers direct deposit for paychecks, automated savings by percentages or round-ups on purchases, and more.

- Robinhood

Robinhood remains a top finance app in the US (it’s not available in Canada) due to its role in democratizing stock trading. It has over 22 million funded accounts and provides commission-free trading of stocks, ETFs, options, and crypto, with a slick, gamified user experience. Robinhood also offers a cash account, a retirement product, and social features like seeing what others are trading.

- Coinbase

Coinbase is the leading cryptocurrency exchange app in North America. During the crypto peaks it topped download charts, and as of 2025 it still has a strong user base of around 100 million verified users globally. As you’d expect, the Coinbase app enables buying, selling, and holding of dozens of cryptocurrencies. It also supports features like recurring buys, crypto staking, and a Coinbase Card to spend crypto.

- Mint

Mint is a long-standing budgeting and personal finance management app. It’s an OG in the budgeting and finance sectors, having launched way back in 2007. Mint remains highly popular for aggregating all of a user’s finances in one place. It connects to bank accounts, credit cards, loans, and investments, and updates balances and transactions automatically. Mint also provides budgeting tools and credit score monitoring, bill reminders, and tips on saving.

- Credit Karma

Both Mint and Credit Karma are owned by Intuit, and Credit Karma is an app focused on credit score monitoring and credit product recommendations. It gives users weekly updates of their TransUnion and Equifax credit scores, along with the full credit report details. With over 110 million members in the U.S. and Canada, Credit Karma is very popular. Credit Karma essentially acts as a personalized financial marketplace, showing users offers for all kinds of financial tools, products, and services. The app also features a high-yield savings account and tax filing.

- SoFi

SoFi (short for social finance) is a U.S. fintech that started in student loan refinancing and has become a broad-based financial app … essentially a modern bank + brokerage + lender, all in one. SoFi offers checking and savings accounts, stock and ETF trading, robo-advisory investing, crypto trading, credit cards, personal and student loans, mortgages, and even insurance, making it something of a financial super-app. It has a member base of over 5 million users.

Finance planet: so much innovation

So we’ve looked at finance app trends globally, divided in 7 key regions:

- Africa

- Asia

- China (broken out from broader Asia)

- Europe

- India (also broken out from broader Asia)

- North America (US & Canada)

- South America/Central America/Latin America (with Mexico)

What can we say about the big picture?

1. Mobile finance is the new default

Apps are the primary channel for financial services, even in traditional and cash-heavy countries. Whether it’s digital wallets like M-Pesa in Africa, Paytm in India, or Cash App in the U.S., of just e-transfers from any bank app, consumers now expect 24/7 financial access from their phones.

2. Super apps are pretty super (and growing)

Super-apps that combine banking, payments, investing, and more are dominant in many markets. We see Revolut and Paytm in Europe and India, WeChat and Alipay in China, Nubank in Latin America, even SoFi in the United States.

But how they’re built varies.

In China, super apps are part of mega-ecosystems from huge tech companies. In Europe and North America, they’re built through modular features or integrations with multiple companies. And in Africa and parts of Asia, super apps often combine digital features with physical, human agent networks for cash-in/cash-out.

3. P2P payments are foundational

Peer-to-peer payments are the key building block for fintech apps. Globally, we expect instant, free, social money transfer as a core function, whether it’s Venmoor Zelle in the U.S., Lydia in France, bKash in Bangladesh, or Twint in Switzerland.

Or, of course, red envelopes in China.

Inflation, high interest rates, and economic uncertainty have pushed many of us toward savings automation, loan access, and budget visibility. That might mean saving pots, or pockets, in India, LATAM, or Africa. It could mean microloans. It could also mean credit scores in North America.

5. Wealth and investing features are going mainstream

Everyone can be banked. Everyone can invest. Everyone can save. Everyone can buy crypto. Everyone can budget.

Basically, everyone can access almost every kind of financial tool they want, all via mobile.

6. Crypto is stabilizing

Crypto functionality hasn’t disappeared, but it’s less hyped. And it’s more carefully integrated with other financial tools.

We see that in Revolut, PayPal, N26, Bitpanda, Coinbase, and Lydia. It’s less speculative, more regulated, with limited asset classes: crypto is now a checkbox in app portfolios, not a growth rocket.

Or a get-rich-quick-scheme.

7. Agent networks remain critical for inclusion in some markets

In regions like Africa, South Asia, and parts of LATAM, digital finance still relies on agent-assisted infrastructure.

We see M-Pesa, Fawry, Easypaisa, Paga, and other top fintech apps real-world agents for onboarding, cash handling, and trust along with their digital tools.

8. Open Banking and API connectivity fuel smarter apps

Especially in Europe, India, parts of Asia, and parts of LATAM, Open Banking standards like PSD2, UPI, and Open Credit Enablement are powering account aggregation, credit scoring, and smart lending and personalized recommendations.

9. Localization matters

Almost everywhere, the top fintech apps are deeply localized to cultural, regulatory, and infrastructure realities. It’s hard — though possible in Europe, Southeast Asia, and LATAM in particular — to build 1 app that serves multiple countries, languages, and regulatory environments.

10. Trust, security, and regulation shape everything

This is finance. It involves money.

Trust is essential for everything.

Globally, users are concerned about fraud, privacy, and misuse of financial data. And regulators are tightening up regulations. We see that in the EU with PSD3, the AI Act, and the Digital Markets Act. In India, we’re seeing stricter KYC and data localization. And in LATAM we’re seeing new central bank mandates for fintech licenses.

This is still a massively growing space.

There is still tons of opportunity.

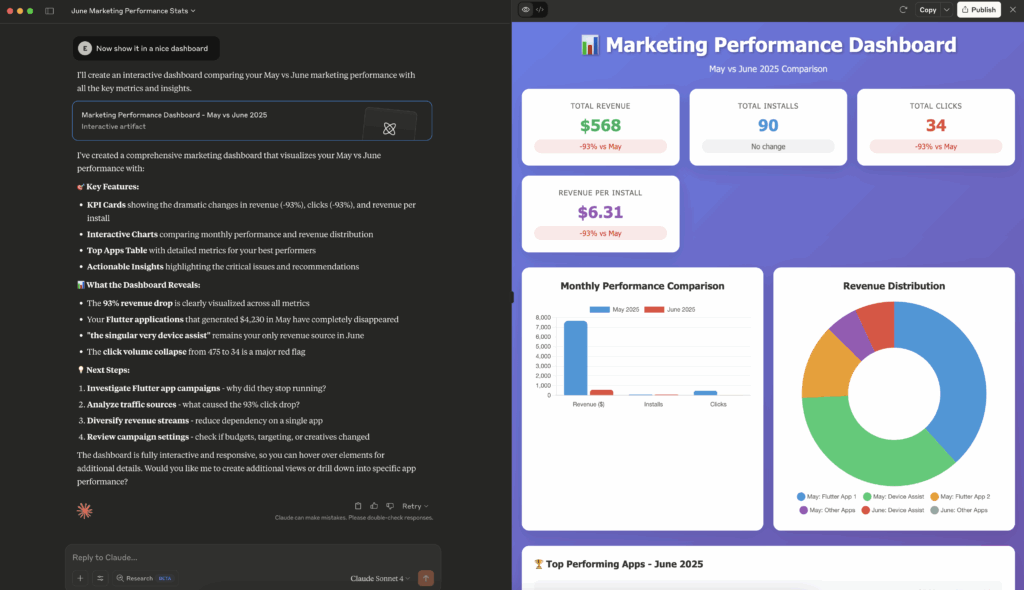

To turn these global trends into scalable success, it’s crucial to have a unified view of your marketing data. See the analytics platform built for the world’s leading finance apps