Table of contents

- Introduction

- Leaderboards: top ad networks and platforms

- Global ROI Index leaderboards

- Regional ROI Index leaderboards

- Top ad networks by number of placements

- Insights: what the 2025 Singular ROI Index reveals

- The age of scale: the golden 9

- The Singular ROI Quadrant

- Small networks do slightly better

- The tsunami of rewarded/incentivized networks is real

- Reddit is a platform on the move

- X Ads: still relevant, especially in 2 key categories

- Apple Search Ads: mighty on iOS

- Moloco: stealthy success

- Search: high-ROI ad networks by vertical & geo

- Highest ROI verticals by geo

- CTV continues to grow

- Marketers: an important note

- Insights from the market

- See also: Quarterly Trends Report

- Methodology

Introduction

Data scientist Gaston Laterza

Author John Koetsier

This report is also available in: Portuguese, Spanish, Korean and Chinese.

Welcome to the 2025 edition of the Singular ROI index. It’s a pivotal moment in mobile, adtech, and marketing as we see the ongoing evolution of the massive global ad platforms and the increasingly successful adjustment advertisers are making to App Tracking Transparency.

Use the Singular ROI Index to hunt for your next partner.

The data here is based on tens of billions in spend, billions of installs, and trillions of ad impressions across thousands of ad networks in millions of campaigns.

But take it with a grain of salt: what drives growth for you will always be some combination of what is happening in the industry and your ad partners plus how you set up, measure, and optimize your campaigns.

Some of the key things we’re seeing from our view of adtech:

- Age of scale: 9 names to watch

While no-one matches Google and Meta, TikTok and Apple Search Ads are not far off. And now there are 5 other ad partners with global reach across a wide range of verticals, giving you more choices for scaling spend. - Singular ROI Quadrant

As you consider cost versus return, check the Singular ROI Quadrant. While generally you get what you pay for in quadrant 2, the Quadrant of Scale, there are some bargains in 4: the Quadrant of Growth. - Scale versus return

Don’t overlook smaller networks. That’s often where you can find pockets of outsized profitability. They may not scale like the heavy hitters, but they can sometimes punch above their weight class. - The rewarded ad network tsunami is real

Almost a third of the growth class of ad networks are in the rewarded or incentivized space. And some of them are so big we had to classify them with the large networks and platforms. - Reddit is on the move

While it’s not yet with the big 9, Reddit continues to show growth in users, time on platform, and ad load. And it doesn’t show any signs of letting up. - X Ads is still relevant

There’s been a lot of turmoil over at the former Twitter, and advertisers haven’t always felt welcome there in the past few years. But there’s still a lot of spend on X, and there are several categories where it leads. - Apple Search Ads

If ASA was on Android too, it’d be among the biggest players in mobile user acquisition. Even being only on iOS, it’s impressive. ASA is the only platform to offer high-value service in all geos and all verticals. - Don’t sleep on Moloco

AppLovin gets all the headlines, and there are good reasons why. But Moloco is by some measures even more successful.

In addition, for the first time in the Singular ROI Index, you’ll be able to select a geo and a vertical, and get back a list of advertisers who we’ve seen outperform in that space.

There’s much more: check it all out below.

Leaderboards: top ad networks and platforms

Here they are: the best of the best.

Singular has analyzed data on trillions of impressions, hundreds of billions of clicks, and billions of installs from thousands of ad networks and platforms. These ad networks consistently outperformed all of the rest.

We have divided each category into two parts: Scaled Ad Partners and Growth Ad Partners. It isn’t fair to compare ad partners with billions in spend to those with millions. But there is value in both: huge scale in the first and—sometimes—standout ROAS in the second.

Each list is in alphabetical order.

An important note:

We worked hard to choose the very best 15 ad networks and platforms for each category. However, where we felt that there were fewer than 15 that we could award placement to, we’ve listed the ones we can fully recommend.

Making this list is no small feat. Every ad network that makes even one list is doing many things right.

Aarki

AdAction

Adikteev

Adjoe

Almedia

Appier

Apple Search Ads

Applovin

AppSamurai

Aura from Unity

Bigabid

Digital Turbine

Exmox

Fluent

GameLight

Google Ads

Hang My Ads

Influence Mobile

InMobi

IronSource from Unity

Jampp

Kakao Ads

KashKick

Liftoff

Line Ads

MAF

Mintegral

Mistplay

Moloco

Motive Interactive

Persona.ly

Prodege

Remerge

Revu

Rokt Ads

Rtb House

Scrambly

Skyflag

Smaad

Smadex

Snapchat

Tiktok

Tnk Factory

Tradingworks

Tyrads

Unity Ads

Upyeild

X (Twitter)

YouAppi

Global ROI Index leaderboards

Scaled Ad Partners

iOS + Android

All platforms, all verticals

In alphabetical order

All platforms: gaming

In alphabetical order

All platforms: non-gaming

In alphabetical order

Android

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

iOS

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

Growth Ad Partners

iOS + Android

All platforms, all verticals

In alphabetical order

All platforms: gaming

In alphabetical order

All platforms: non-gaming

In alphabetical order

Android

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

iOS

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

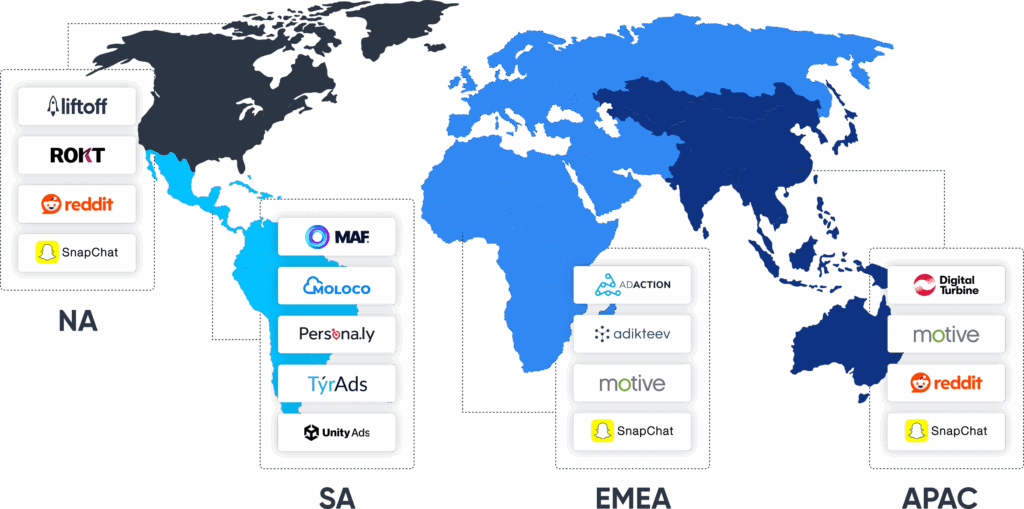

Regional ROI Index leaderboards

Under SKAN, there’s limited geographical data available for most iOS installs, and that which is available is inside each advertiser’s own slightly customized SKAN conversion model. So our regional data is largely Android-based.

APAC Scaled Ad Partners

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

APAC Growth Ad Partners

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

EMEA Scaled Ad Partners

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

EMEA Growth Ad Partners

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

North America Scaled Ad Partners

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

North America Growth Ad Partners

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

South America Scaled Ad Partners

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

South America Growth Ad Partners

All verticals

In alphabetical order

Gaming

In alphabetical order

Non-gaming

In alphabetical order

Note for regional ROI Index leaderboards

Under SKAN, there’s limited geographical data available for most iOS installs, and that which is available is inside each advertiser’s own slightly customized SKAN conversion model. So our regional data is largely Android-based.

Top ad networks by number of placements

Scaled Ad Partners

Among scaled networks and platforms, here are the leaders with the most placements on Singular ROI top lists:

Network

# of rankings

21

21

21

21

21

21

21

21

21

20

14

14

13

12

8

7

6

6

Growth Ad Partners

Among growth networks and platforms, here are the leaders with the most placements on Singular ROI top lists:

Network

# of rankings

18

18

17

17

16

15

14

13

13

13

12

11

11

10

9

9

8

8

7

6

6

6

6

6

5

4

4

3

2

2

1

1

1

1

Insights: what the 2025 Singular ROI Index reveals

The age of scale: the golden 9

2025 is the age of scale in the mobile advertising ecosystem. It’s no longer the case that there are only 2 networks to choose from if you want global reach and global scale. Whereas before it might only have been 2, now so many more ad networks have legitimately good all-round offerings on a global scale.

In 2024, 6 ad networks and platforms ranked on every single regional list in the Singular ROI Index.

In 2025, that list has expanded to 9 ad partners:

- AppLovin

- Google Ads

- ironSource from Unity

- Liftoff

- Meta Ads

- Mintegral

- Moloco

- TikTok for Business

- Unity Ads

(Yes, there’s also Apple Search Ads, which has immense scale. But ASA comes with the important caveat that it is only for iOS, which is why it ranks on fewer top lists, and why it doesn’t show up in this Golden 9. See more about ASA later in this report.)

Elephant in the room

Of course, for absolute scale, you can’t easily beat Google and Meta.

They are the undisputed heavyweight champions of the division, capturing more spend, installs, conversions, and revenue than any others. But just below that top tier, you have TikTok, the only player close to being in the same league as big social and big search.

Emerging elephants

And in 2025 there are 6 additional players that have large enough scale and global enough reach that they are now globally ranking players in growth. That’s good news for mobile marketers who are looking for growth partners: there’s more choice, more options, more diversity of audiences and targeting.

They’re led by heavyweight contenders like Moloco and AppLovin.

Everyone knows the story of AppLovin, which has used unprecedented insights from mediation to drive massive growth. Generating perhaps less noise is Moloco, which was among the first independent mobile adtech companies to fully mobilize AI and machine learning to accelerate relevance.

Both are impressive, but the market doesn’t really seem to have a clue how large Moloco actually is. More on Moloco later in this report.

This year Mintegral has joined the club, plus Unity, which has a trifecta of highly successful offerings in Unity Ads, ironSource from Unity, and Aura from Unity. Unity has significant assets and cards to play, and has huge potential for growth thanks to its software being embedded in so many mobile games.

Snap and Liftoff are right on their heels. Liftoff has been a quality ad partner for years, and now with its Vungle merger firmly in the rearview mirror should be able to focus more on growth in 2025 and 2026.

Snap’s recent innovation in marketing measurement has been a major factor, including CAPIs which unlocked significant direct response revenue. Snap has also added SKOverlay ad formats, matchmaking tools to connect marketers and creators, a 7/0 delivery optimization window which has boosted profitable app installs, and value optimization campaign options for non-SKAN bidding on iOS.

These 9, plus Apple Search Ads, capture 95% of the spend that Singular measures.

But as we’ll see, there are still interesting and growing possibilities in the remaining 5%.

The Singular ROI Quadrant

What is the perfect ad partner for an advertiser? A low cost ad network that delivers high quality users, players, or customers that monetize well.

That’s the dream: the perfect world.

And that’s quadrant 4 in the new Singular ROI Quadrant: the Quadrant of Growth.

Of course, in the real world, you generally have to pay for what you get. That’s the Quadrant of Scale, a very valuable space that you’ll be in most of the time with high quality ad partners and smart campaigns.

Sometimes, unfortunately, you don’t get what you pay for. That’s the Quadrant of Waste, with high cost but low return.

The good news: unicorn ad networks in quadrant 4, the Quadrant of Growth, do exist. The not-quite-as-good news: they are typically niche offerings. They typically function at a lower scale than the biggest ad platforms on the planet. But those scaled ad platforms are also incredibly valuable and completely necessary.

Quadrant 4 ad networks get your motor started. Quadrant 2 ad networks get you to the finish line: global scale.

Small networks do slightly better

Quality small networks tend to perform slightly better than larger ad networks on the Singular ROI Quadrant.

Here’s a high-level view of advertisers’ performance on the thousands of ad networks we measure:

On the left, you have advertiser performance on ad networks that Singular measures more than $5 million in ad spend for. On the right, ad networks below that mark.

Several things are immediately apparent:

- Most advertisers cluster in the Quadrant of Scale

Most quality ad networks provide decent value for your money: spend X, and you’ll get some multiple of X back. You see the line: results tend to scale with spend. Relatively few ad networks are a complete waste of time in the Quadrant of Distraction, and even fewer are completely fraudulent or ineffective in the Quadrant of Waste. - Quality smaller ad networks trend (slightly) to better performance

When using smaller ad partners, most advertisers shift just slightly to the right, deeper into the Quadrant of Scale, where you get what you pay for, and more into the coveted Quadrant of Growth, where you get MORE than you paid for. This is a largely a function of 3 things:- Focus

Small ad networks tend to focus more on specific niches, whether verticals (genres) or horizontals (type of ad network) or both. - Size

The bigger platforms attract almost every advertiser on the planet. Therefore, almost by definition they therefore revert to the mean in terms of overall performance, despite the ability of smarter advertisers to deliver outsized gains on their scaled platforms. - Visibility

Smaller ad networks tend to deliver smaller campaigns for smaller clients. That means there’s less room to hide, and less budget to screw up with. Everything is just more visible.

- Focus

- There’s generally no free lunch

Yes, there are a few advertisers that live in the Quadrant of Growth, where costs are low and revenue is high. But in general, ROAS tracks with spend, which is why the overall trend is up and to the right at about 45 degrees, right through the axis of the graph. Important caveat: this chart shows the average of all advertisers across all ad networks … the smartest and best can in fact far outperform the average.

Verticals often found in the Quadrant of Growth

Some verticals just tend to hit the sweet spot of lower costs and higher revenue.

They include:

- Fintech

- Games

- On Demand

- Shopping

Verticals that seldom manage to crack the Quadrant of Growth include:

- Education

- Health & Fitness

- Travel

- Utilities

The first set of verticals are in demand and provide high monetization capability. For that reason, they’re also red oceans of competition, with many tough and smart players. The second set is a bit quieter in terms of Education and Utilities, but just as competitive in the Health & Fitness and Travel space, where it can be harder to build long-term loyalty with customers and users.

Interestingly, platform does not matter for this analysis.

Despite the fact that we know that iOS users tend to monetize better than Android users, there is no real platform advantage 1 way or the other in terms of apps hitting the cheap-but-lucrative Quadrant of Growth.

Likely, that’s due to the fact that though returns might be less on Android, so — in general — are costs.

Ad networks in the Quadrant of Growth

Again, small networks have an advantage over larger networks here. For each region, here’s a few networks we’re seeing land in and around the Quadrant of Growth, giving you more than you paid for:

APAC

- Digital Turbine

- Motive Interactive

- Snap Ads

EMEA

- AdAction

- Adikteev

- Motive Interactive

- Snap Ads

North America

- Liftoff

- Rokt

- Snap

South America

- MAF

- Moloco

- Persona.ly

- TyrAds

- Unity Ads

The tsunami of rewarded/incentivized networks is real

Separating growth ad partners from the scaled ad networks and platforms makes a few things obvious: there are a lot of new names here, and primarily we can thank the rewarded or incentivized ad space for that.

In general, ad offerings are much more differentiated at the growth level, with players who focus on specific geos and/or niches.

In terms of rewarded/incentivezed, of course, Kashkick and Exmox are already so big we included them on the large networks & platforms leaderboard, where Kashkick lands on 8 top lists and Exmox on 6. Prodege also has some significant rewarded/incentivized properties, including SwagBucks and InboxDollars.

Impressive!

Adjoe is even more impressive, ranking on 14 lists, though rewarded is only a piece of what Adjoe does.

But on the growth board we see others:

- There’s MAF, the former MyAppsFree, on a massive 17 top lists in the growth category, and SKYFLAG

- Gamelight hits no fewer than 15 lists itself

- AdAction, which ranks near the top of the growth class

- We also have Influence Mobile (the recently re-branded and upscaled Blind Ferret Engage), and Scrambly

- There’s TyrAds, with 11 placements, and RevU (Revenue Universe) with 6, and AppSamurai, with 4

In short: there’s a lot. Of the 34 ad networks in our growth leaderboard, no fewer than 10 are in the rewarded space, not including others that might have some rewarded or incentivized parts of their overall operations.

Why is the rewarded space exploding?

- The barrier to entry is relatively low. If you’re giving out-of-game rewards, you don’t need your SDK in a game.

- AppLovin has sucked up so much oxygen in the traditional ad network space, so if you’re going to start a mobile adtech company, rewarded or incentivized has been a bluer-ocean strategy. The big players can still compete, but startups have to find a different niche.

Reddit is a platform on the move

But it’s not just about the rewarded ad space that is growing.

Reddit is a monster in the making.

While we listed Reddit among the growth ad networks and platforms this year, that could change next year. Reddit is currently on a dual trajectory of growth that is impressive and should maintain momentum for the foreseeable future:

- Massive user growth

Last year, Reddit grew 47% to 97.2 million daily active users - Massive revenue growth

At the same time, Reddit became profitable for the first time in late 2024

Reddit is coming into its own. While historically the massive social/news/culture platform punched below its weight class when it came to monetization, that has dramatically changed in the last year. With new ad placements, a higher ad load, and an ongoing investment in its ad platform and measurement solutions, Reddit is taking more spend and delivering more ROI.

If it can maintain current user growth, time on platform, and ad effectiveness trajectories, Reddit has a shot at challenging the biggest players in adtech.

We’ve seen 2 areas where Reddit has shown outsized success:

- Gaming

- Fintech

We’ll see if Reddit can continue to grow in these areas and beyond throughout 2025 and 2026.

X Ads: still relevant, especially in 2 key categories

It’s also worth noting X Ads, the former Twitter. X Ads is a player, hitting 18 different lists in the growth class.

While we don’t disclose actual numbers in the ROI Index, ad spend by Singular customers on X and AppLovin are in the same ballpark: a fact that might be surprising to most in the industry.

There’s been a ton of turmoil at X over the last few years as everyone knows, but apparently the platform is still useful to advertisers, and not to a small degree either.

We’re seeing significant use of X Ads in gaming and by agencies on behalf of their clients, but there are 2 categories that absolutely kill it on X with almost literally insane off-the-charts ROI.

The categories?

- Porn or porn-adjacent apps

- Gambling or real-money gaming (RMG) as we call it now

What’s likely happening here is that apps that can’t advertise elsewhere are finding a safe place for marketing on X, which has loosened the rules on what is kosher compared to what Twitter allowed.

And, of course, in the case of RMG, X is still a place where a lot of breaking news — including about sports — sees first light of day. That aligns with RMG and gambling apps.

Apple Search Ads: mighty on iOS

In an ROI Index like this one, Apple Search Ads does not get the credit it deserves. That’s largely because it’s iOS-only, and Android is 70% of our mobile universe by device count, if not by app publisher revenue.

So we need to take some time to highlight the importance and impact of Apple Search Ads.

Some stats:

- $100 million customers

ASA has multiple 100-million-dollar advertisers: publishers that spend over $100 million annually. Few other ad networks and platforms can claim the same. - 7th in ROI

ASA ranks 7th in raw ROI among all ad networks of all sizes. Given that there are hundreds of smaller competitors, and in any given year it’s possible for 20 or 30 of them to vastly outperform the market, that’s impressive. - 3rd in spend

Only 2 ad networks and platforms capture more user acquisition spend than Apple Search Ads - 2nd in scope

Only 2 ad networks or platforms address as many different verticals and genres as ASA - 2nd in advertisers

ASA is second in number of advertisers among Singular customers

Apple Search Ads achieved revenue of about $5 billion in 2022, about $7 billion in 2023, and in the neighborhood of $8 billion in 2024. By 2027, it’s projected to hit almost $14 billion, assuming not much changes in terms of dominant app stores on iOS.

That’s slowing growth over time as the impact of ATT fades, but still significant growth, and growth on an ever-increasing massive base.

Translation: ASA is a big part of iOS mobile app marketing, and it’s likely to stay that way.

Moloco: stealthy success

As mentioned above, AppLovin gets all the headlines. That’s deserved: its stock price growth has made it a global story. And it ranks in all categories it competes in.

In contrast, Moloco has flown under the radar somewhat … at least in the press.

But this is not an ad partner that should be in the background. The 2025 Singular ROI Index data shows that Moloco is much bigger than some might realize:

- 5th in spend

Only 4 ad networks in the Singular ROI Index capture more spend than Moloco. - Top tier in coverage

Outside of the top 4 (Meta Ads, Google Ads, Apple Search Ads, and TikTok), Moloco is top tier for geo and vertical coverage. - 5th in overall ROI

Out of all the ad networks in the Singular ROI Index, Moloco is fifth overall in advertiser ROI (average ROI over all verticals, all geos, and all advertisers). This is impressive. - Every category for 2 years running

For the second year in a row, Moloco ranks in every ROI Index top list that it is eligible for. That’s impressive staying power.

AppLovin has structural advantages in the mobile adtech space thanks to its foresight in buying MoPub from the former Twitter and rolling that into its mediation platform, Max. That gives AppLovin unprecedented insight (outside of the giants like Meta/Google) into both the supply and demand side of the advertising equation, which is powerful.

But thanks to its relentless focus on machine learning for advertising optimization, Moloco has been successful in competing with not just AppLovin but also all the other players in the space.

Search: high-ROI ad networks by vertical & geo

When selecting ad partners, marketers want a sense of what different ad networks are good at: what they do well, what verticals they excel in, and what geos they have good coverage.

For the large ad partners that made it into our top ad networks by number of placements list, here’s where we’re seeing them get outsized ROI:

Aarki

AdAction

Adikteev

Adjoe

Almedia

Appier

Apple Search Ads

Applovin

AppSamurai

Aura from Unity

Bigabid

Digital Turbine

Exmox

Fluent

GameLight

Google Ads

Hang My Ads

Influence Mobile

InMobi

IronSource from Unity

Jampp

Kakao Ads

KashKick

Liftoff

Line Ads

Mintegral

Mistplay

Moloco

Motive Interactive

Persona.ly

Prodege

Remerge

Revu

Rokt Ads

Rtb House

Scrambly

Skyflag

Smaad

Smadex

Snapchat

Tiktok

Tnk Factory

Tradingworks

Tyrads

Unity Ads

Upyeild

X (Twitter)

YouAppi

Note:

This is based on Singular’s slice of the adtech ecosystem and what Singular customers do. It’s not a 100% comprehensive analysis of each ad networks’ capabilities. To be explicit: if you don’t see a specific strength here, that doesn’t mean an ad network is weak. It just means we haven’t seen it in Singular data.

Highlights:

- Apple Search Ads

Apple Search Ads is the only platform to achieve high ROI in every region and every vertical. Of course … that’s only on iOS. - Gaming: sometimes you want pure focus

There are some networks that perform extremely well on mobile games, including:- Exmox

- Mistplay

- YouAppi

- Almedia

- Adjoe

- Prodege

- Wide coverage of geos and verticals

If you’re looking for ad partners that work well over a wide range of geos and verticals, clearly ASA is an option. Other options include Meta Ads, Google Ads, and TikTok for Business. These 4 have the widest coverage geographically and by vertical. - Most crowded verticals: gaming and on-demand

There are 51 ad network names in the Gaming vertical across all geos and 37 in on-demand. (Note: ad networks show up multiple times because we’re looking across geos here.) - Least in-demand verticals

Only 7 ad networks show up in the Education vertical, and 9 in Utilities. Health & Fitness is the next least-in-demand vertical globally, with only 12 ad networks' names showing up (again, with repeats across geos).

Highest ROI verticals by geo

Here are the highest-ROI verticals Singular sees, by geo. Clearly, on-demand (delivery, transportation, etc.) and travel are the highest ROI areas across the board, but there are interesting differences that emerge in the third through sixth positions.

APAC

- On-demand

- Travel

- Financial

- Entertainment

- Shopping

- Games

EMEA

- On-demand

- Travel

- Shopping

- Health & Fitness

- Financial

- Education

North America

- On-demand

- Travel

- Financial

- Shopping

- Games

- Health & Fitness

South America

- On-demand

- Travel

- Financial

- Shopping

- Entertainment

- Games

CTV continues to grow

CTV is becoming a must-have channel, particularly for branding, storytelling, and highly targeted reach, but also increasingly for direct response as well.

We’re seeing rapid growth of AVOD (Ad-supported Video on Demand) and FAST (Free Ad-Supported Streaming TV) services. These are increasingly common, boosting available ad inventory significantly.

Key names here include:

- Pluto TV

- Tubi

- Roku Channel

- YouTube TV

- Peacock

On the platforms and networks side, we see increased spend for multiple players, especially:

- TV Scientific

- Vibe

- Smadex

- Innovid (which acquired TVSqared in 2022)

And for OEMs, the data shows growth for:

- Samsung Ads

- LG Ads

- Roku

- Vizio

Last year in the 2024 Singular ROI Index, we saw a 46% jump in spend by Singular clients on CTV ad campaigns. That growth slowed, but still outpaced growth in more established categories like in-app mobile advertising.

As we continue to see more growth here and as Singular continues to grow its solutions for CTV, we’ll add more data and insights to the ROI Index.

Marketers: an important note

The data in this report provides valuable insights drawn from a diverse range of sources based on campaigns in pretty much every country on the planet, including some regions that aren’t even countries.

(We’ll see data from scientists using their phones at McMurdo Station, for instance, in Antarctica.)

That offers a compelling look at key trends shaping the marketing landscape.

However, it’s important to note that this is not a complete view of the entire ecosystem: it’s a view of what Singular clients are doing. While the findings are based on billions of dollars of spend and installs, and trillions of ad impressions, making it highly indicative of what’s actually going on, marketers should consider the ROI Index as part of a broader context and complement them with additional data sources and strategic judgment.

That’s also why we’ll often bring in external data and insights to complement what we see in Singular data.

Insights from the market

Bora Sipahi

Head of Marketing

We’ve seen many strategic and exciting moves on the Apple Ads side very recently.

The first update we heard this year was Search tab ads supporting custom product pages as a tap destination. The newest enhancement lets advertisers route Search tab ads directly to custom product pages instead of the default listing—the second major custom product pages upgrade in six months, after deep links that land users at precise in‑app destinations.

The change shows Apple Ads’ focus on custom product pages, which equip marketers to swap screenshots, videos, copy, promo text, and deep links to match specific intents, audiences, and markets, ensuring tailored messaging and tighter creative alignment.

Per MobileAction’s 2025 Apple Ads Benchmark Report data, custom product pages impressions climbed 13.6% YoY to 6.56B in 2024, and conversion rates by custom product pages improved from 42.13% to 55.87%, confirming custom product pages as a high‑impact lever for maximizing every ad click in a mobile marketing landscape marked by rising UA costs and a strategic tool for app discovery.

Then, on March 27th, Apple rolled out View-Through Attribution (VTA) support for the ads on the App Store. This update means that when a view-through impression leads to an app install, an ad on the App Store can now be recognized as the source of user engagement. By capturing passive engagement, VTA offers marketers a more accurate and holistic view of campaign performance and media effectiveness across the ads on the App Store.

Right after that, the announcement of AdAttributionKit (fka SKAdNetwork) support for Apple Ads dropped on April 10th, marking a significant step toward unified attribution across ad networks. As the adoption of AdAttributionKit accelerates, developers and marketers have been requesting that their Apple Ads be added to the mix as well for better assessment of campaign performance along with their ads on third-party networks. And, Apple answered that call.

While current support covers SKAdNetwork versions 1, 2, and 3, integration with the latest version is expected in a future update. For the ads on the App Store, Apple will continue to support the AdServices API, which complements AdAttributionKit by delivering deeper, privacy-conscious insights to help optimize performance across marketing channels.

Last but not least, we heard the announcement of rebranding on April 15th, as Apple announced that Apple Search Ads has been renamed as Apple Ads, a name that captures the essence of the product better, considering the fact that the platform offers more than search-related ad placements for quite some time with Today tab ads and product page ads. It’s worth noting that the website now shows ads on the Apple News as a tab under Apple Ads, which allows advertisers to promote apps, products, websites, or content in various formats within the app.

Apple Ads has been connecting bottom‑of‑funnel, high‑intent users with marketers who need profitable scale for years now. The channel became a vital part of the UA mix by consistently delivering superior conversion and ROAS while also safeguarding brand terms, lifting awareness, and helping to improve organic keyword performance. And, that consistency drove a record‑breaking 2024: MobileAction’s 2025 Apple Ads Benchmark Report data shows all‑time highs in spend, average conversion rates (66.70%), and average tap-through rates (9.07%)—proof that Apple Ads remains the most efficient path to loyal customers for your mobile app even amid shifting macro conditions.

All these updates show that Apple is expanding its platform by remaining efficient within a long‑term vision while clearly reflecting user feedback. Given that there are still untapped avenues in Apple Ads and that product enhancements are accelerating at their own pace, I anticipate more new and high‑value updates this year.

Are you looking to capture this high-intent demand but do not know where to start? As an official Apple Ads Partner, MobileAction can help you drive growth to your mobile app or game with its highest level of support and deep expertise, competitive insights, multi-layered custom automations, and ML-driven bidding functionality. You can also combine your post-install metrics on Apple Ads for a complete UA funnel, integrating your measurement data in Singular to MobileAction!

See also: Quarterly Trends Report

Singular publishes the ROI Index annually, with occasional refreshes.

We also now publish the Singular Quarterly Trends Report, which focuses on data points such as CPI rates, hottest genres, top ad networks, share of spend data, web versus in-app ads, ATT opt-in rates, paid versus organic, and hundreds of regional data points.

Check it out online at any time right here:

https://lp.singular.net/quarterly-trends-report

Methodology

Singular data analysts summarized the data from trillions of ad impressions, billions of clicks, and billions of installs by thousands of ad networks and platforms to find top performing advertising partners.

On Android, we prioritize networks with scale in both spend and number of customers who work with them. We analyze retention, click-to-install counts, relative fraud levels, and weight them along with the most important metric, return on investment, to find the top ad networks.

On iOS, we use similar scale parameters but utilize Singular Unified Measurement as the primary source of data, with the exception of Apple Search Ads that uses a separate API. Unified Measurement includes data from SKAdNetwork, where we analyze the raw postbacks we receive as well as the information we have about the meaning of the conversion values and ad network parameters. We then translate these postbacks and to find higher-ROI conversions.

In both cases, we control for outliers and spurious data.