Are you a mobile marketer? Would you like to get more ROI from your mobile app business by using your data and measurement in your mobile analytics platform better? Then you probably want to understand how Average Revenue per User (ARPU) and Average Revenue per Paying User (ARPPU) can be used to make better investment decisions for mobile user acquisition. In other words, how you can turbo-charge your app install and re-engagement campaigns.

Quick note:

As always, we recommend using ROI (not ARPU or ARPPU) as your key metric for any effort to measure and optimize app marketing. ROI is critically important because it alone tells you in dollars and cents whether what you’re doing makes economic sense. However, ARPU and ARPPU can also be valuable marketing analytics because they provide guidance on appropriate CPIs for planning. They are critical components of ROI calculations. However, you need to use them in context. High ARPU is great. High ARPPU is wonderful. But not so great, and not so wonderful if your cost of user acquisition is higher.

Let’s start with simple definitions of ARPU and ARPPU

ARPU measurement defined

ARPU is one of the most useful measures in mobile analytics. ARPU is your average revenue per user, meaning that ARPU measures total revenue driven by your app divided by your number of app installs. Singular helps you calculate this for all app installs, including paid app installs, organic app installs, or total/paid/organic installs for a particular time period. Plus, you can use Singular to further slice and dice your mobile analytics and measure ARPU data by country, vendor and campaign.

ARPPU measurement defined

ARPPU is similar to ARPU, obviously, but it measures average revenue per paying user. ARPPU is a measure that was originally designed for subscription-based apps, like a game that you pay a fee to use every month. The core idea was to be able to understand the quality of paying game users by eliminating the free or non-revenue users from the math. As you might expect, this measure is particularly valuable for freemium model apps or businesses where a small number of users drive the lion’s share of your revenue. Another place ARPPU is relevant is where you have in-app purchase revenue. ARPPU data tends to be particularly relevant for game businesses that focus on sales of virtual in-app purchase sales (IAPs). Some chose to think of ARPPU as a measure of active users, but it’s literally a measure of active payers.

ARPU measurement and install campaign vendor allocation decisions

As you’re probably already aware, ARPU is a powerful metric for both overall and comparative business analysis. Examining ARPU data across all of your installs, or broad classes of installs like organic versus paid, helps you understand both overall business viability and the quality of your app experience. It also helps you compare different games or apps in your portfolio against each other when deciding where to invest in growth.

ARPU highlights problems and successes quickly and easily. If, for example, you expected to drive a thousand dollars per user per year but your ARPU is running at just $50 a year, you clearly have experience, payment, engagement, or other product problems that need to be addressed immediately.

Of course, some apps are primarily designed not to drive revenue, but rather to improve overall customer experience.

That can be non-game apps for industries like hospitality, where augmenting customer experiences is seen as a way to drive loyalty and brand preference. An example would be a companion app for a hotel. Such apps often have relatively low revenue goals – perhaps to simply break even — or no direct revenue goals. In this case, you can compare your ARPU to your acquisition cost to see if your app is meeting this admittedly modest goal, or you can assign revenue from your core activities to the contribution your app is making.

But ARPU data is primarily used to compare vendors and campaigns to each other and determine the quality of users that you’re getting. By examining ARPU data from different ad networks, for example, you can assess if certain media sources are attracting higher or lower quality users or customers for your app. That knowledge in hand, you can quickly make the appropriate ad spend allocation decisions.

The good news in case you’re now sure how to calculate ARPU or ARPPU: both ARPU and ARPPU are metrics you can get easily in the Singular unified analytics platform.

Real-world example: average revenue per user/per paying user

To make it a little more real, let’s look at an example of how ARPU data can help you make better media allocation decisions.

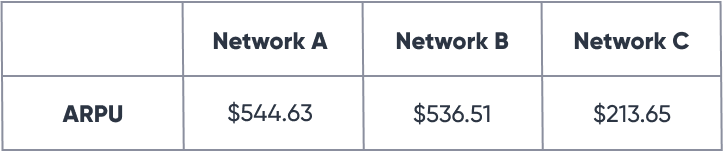

Suppose you worked with just three media vendors to drive installs for your app. All were using the same creative in the same campaign. Over the course of 90 days, you found the following ARPUs:

Network A is delivering the highest ARPU, at 1.3% above Network B and 155% more than Network C, and clearly both Network A and Network B are attracting a higher quality user than Network C, at least for your business or app. That’s important to know because even if Network C offers a bit lower cost per app install (CPI) than Networks A or B, it may not make up for the difference in revenue per game user. If your cost per install for Network A were $5, then the CPI for Network C would have to be less than $1.95 for it to be as cost effective as Network A.

ARPU is a valuable directional measure to consider for gaming budget allocation. But it needs to be considered in the context of ROI.

If we assume, for example, that Network C charges $4 per install, then putting more money into Network C is far less profitable than putting it into Networks A or B. That’s because the ARPU from Vendor C is far lower. But without ARPU, you might rely on CPI to make your allocation decisions. Many companies do, and end up pouring more dollars into channels and vendors that are actually less efficient at driving revenue on equivalent cost.

Obviously here we are focusing on a component of ROI as a way of comparing relative ROI figures.

In the analysis above we focused on differences between networks’ ARPU. But the same method of analysis can also be used to compare campaigns and creative executions.

Using ARPPU to analyze your game business

ARPPU is most useful for app businesses with revenue coming from a small fraction of total users. The classic example, of course, is a freemium game. ARPPU helps because it assesses your app monetization process and buyer flow. When only a small fraction of users are payers, ARPPU will be far easier for you to see the effects of a new monetization process on existing buyers.

Here’s what we mean.

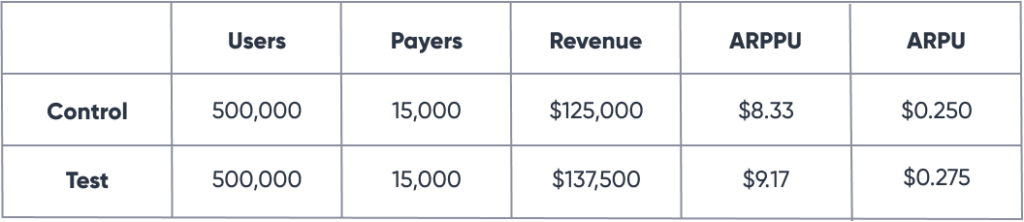

A 10% improvement in average revenue per payer driven by a better monetization process for an app with 1,000,000 installs but only 30,000 payers would be easy to spot in a test. Half your buyers go through the test process, the other half the control, and the outcome reveals a 10% difference. But if you had used ARPU, you would be dividing the revenue difference across 500,000 installs, and so the impact would seem negligible.

See below:

In this example, a 2.5 cent change in ARPU in your test versus the default standard process doesn’t look like much. In fact, you might think nothing really has happened: it’s only 2.5 cents more.

But if you look at ARPPU, the impact of your changes becomes obvious. When you’re just looking at paying users, the difference is almost a dollar. Clearly, ARPPU is useful in certain circumstances for apps with far more users than payers.

===================

Singular helps data-driven marketers connect, measure, and optimize siloed marketing data, providing the vital insights they need to drive ROI. Our unified analytics platform tracks billions of dollars in digital marketing spend to optimize revenue and lifetime value across industries including commerce, travel, gaming, entertainment, and on-demand services.

If you’d like to learn more or see a demo of the Singular unified analytics platform, get in touch.