COVID-19 and digital marketing spend: what’s changing?

COVID-19 is changing everything. San Francisco has been told to shelter in place. New York City might be next.

As local, state, and national governments all over the world encourage people to stay in their homes, we’re quickly starting to see real-life economic consequences of the coronavirus. This is the new normal of social distancing and leveling the curve. And it has huge impacts on people’s lives as well as the economy.

And that means it also has massive ramifications for the online economy.

Mobile is now the dominant way for people to communicate, to research, to shop, and to order. In short, mobile is how we actualize all our intents and purposes in a modern digital economy.

Singular is the leading marketing analytics platform automatically tying marketers’ ad spend, sales results, and ROI together across multiple channels and platforms. That means we have significant insight into how brands are changing their customer acquisition behavior in response to the COVID-19 pandemic.

Here’s just a taste of what we’re seeing so far in 2020.

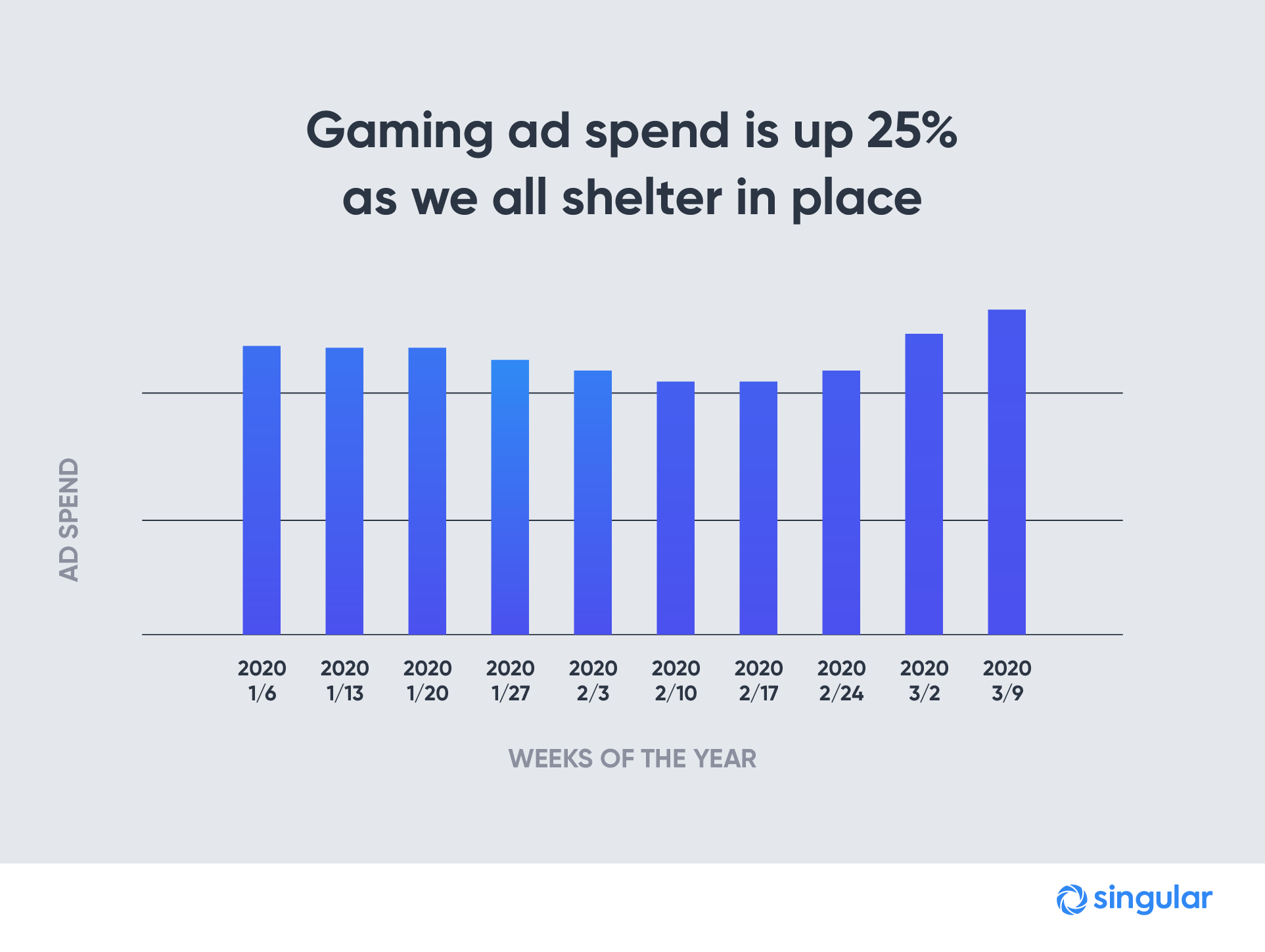

Gaming: a 25% jump with COVID-19

Gaming is a growth industry when the world hits pause on work and social interactions. We’re seeing a steady increase since the middle of February, with a 25% jump in the second week of March from the low point.

We’ve seen this story in China as well. As Singular’s top executive in China said recently, gaming companies “are reaching their revenue peak … because everybody is just playing games.”

It’s not just a rebound from the Christmas season, either. We’ve seen previously that gaming industry marketing spend is fairly steady throughout the year, generally, and this new peak is higher than any week in the final three months of 2019.

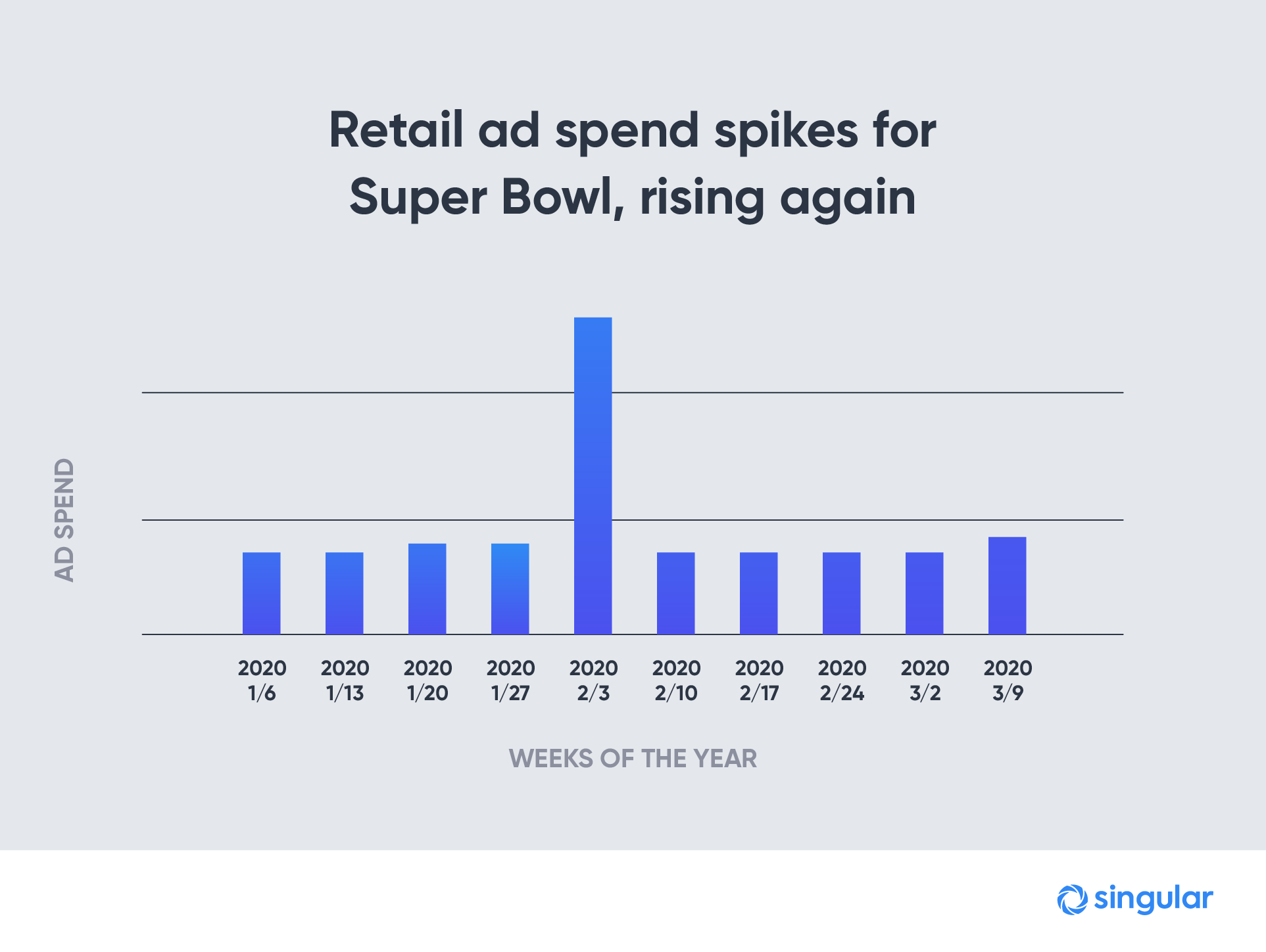

Retail – one massive spike, but also a 34% jump in March

Thank you, Super Bowl. Retail spending has been fairly steady throughout the year so far, with two exceptions: Super Bowl week, and a bump at the beginning of March.

It’s tempting to think that the spike may also have been an early reaction to some initial rumblings of cruise ship illnesses and potential challenges with in-store shopping experiences. After all, marketers tend to kick off ad spend before an actual event. And, with global customers throughout Asia and Europe, it’s conceivable Singular data is showing some early market share grab as well as Super Bowl hype.

Ultimately, however, the Super Bowl is the Super Bowl: an extravaganza of spending. (Not coincidentally, the data shows a big spike in agency spend in the same time period, another indicator of Super Bowl advertising.)

What we’re seeing at the beginning of March, however, is a bump in people ordering online.

We’re shopping less in stores to maintain social distance. We want to order our groceries and products online and via mobile, and have them delivered to our homes. In fact, this trend is growing so fast, we’re starting to see the big online retailers have challenges in providing delivery windows to everyone in larger cities, especially with 1-day or less shipping.

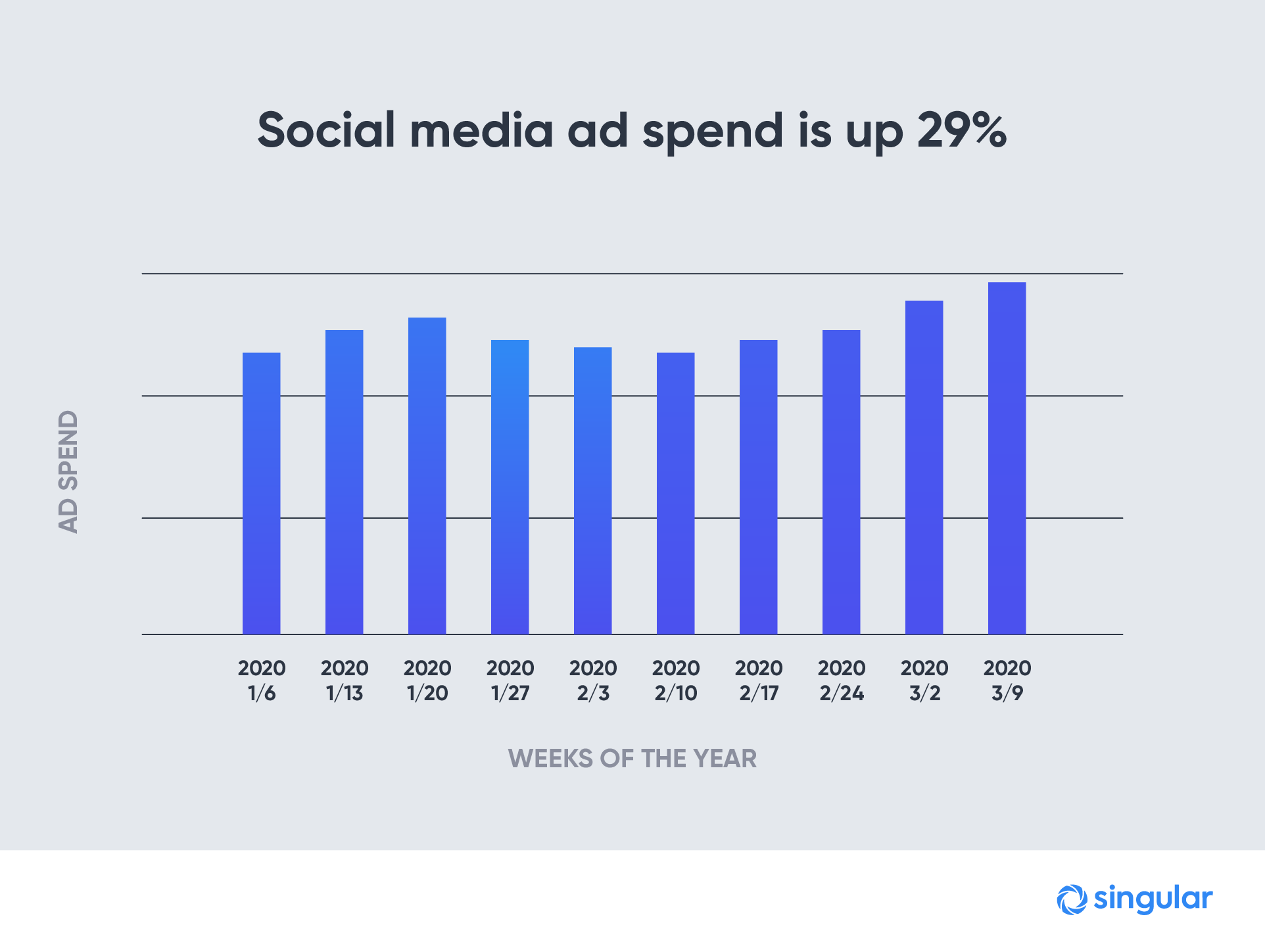

Social media: 29% increase

When the only way you can be social is via digital media, app installs for social platforms go up. After a moderate post-Christmas decrease, we’ve seen a steady rise in social media marketing activity for the last four weeks straight.

The last time marketing spend for social media was this high was just before Thanksgiving in November 2019. Expect this category to continue growing … especially apps and platforms that enable live, real-time video interaction.

Why? Introverts might like the shutdown, but extroverts need their social time.

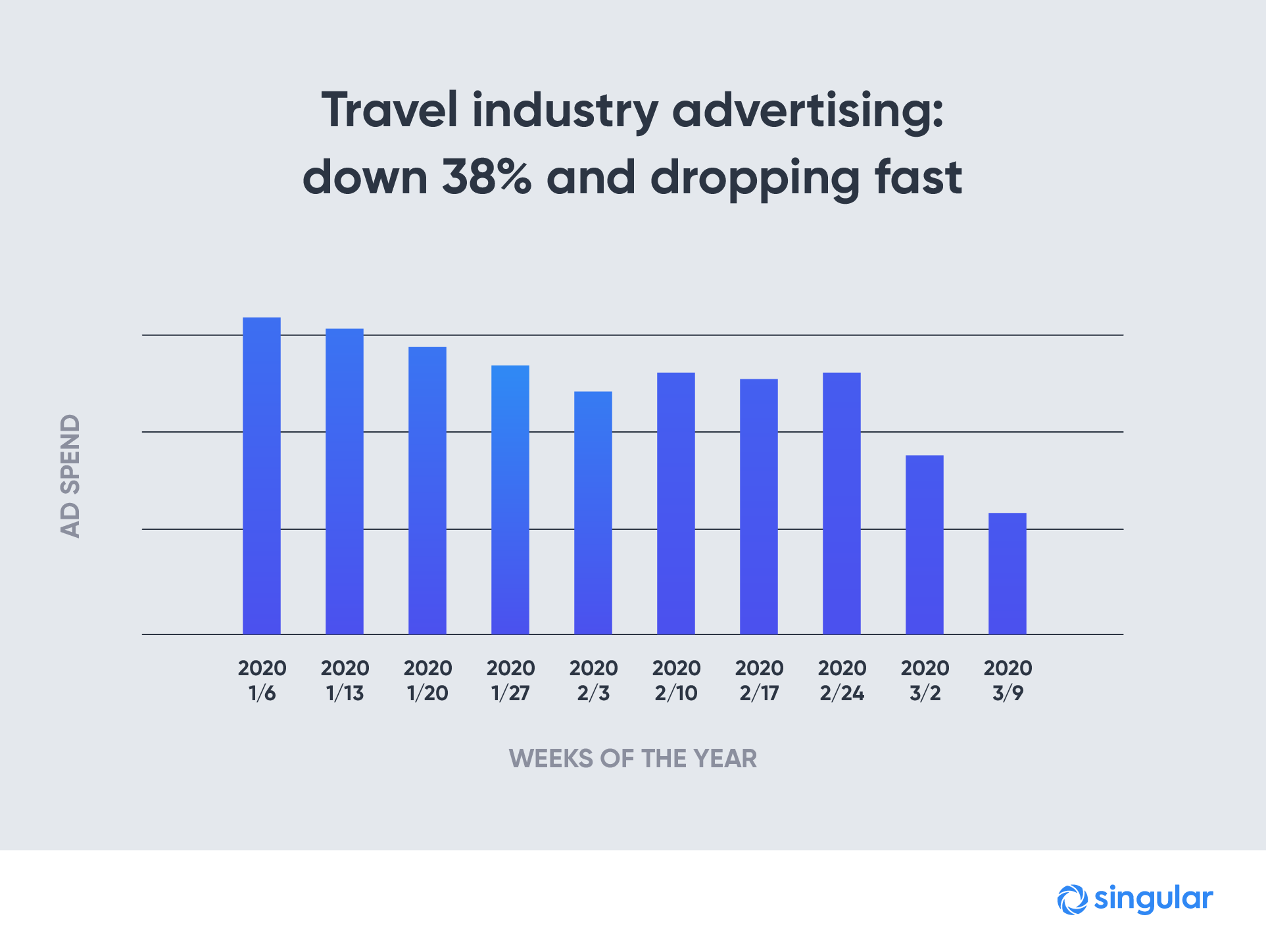

Travel marketing: down 38% so far

It’s not surprising that the travel industry is hurting. The US and Canada closed the largest undefended land border in the world on March 18 to all but essential services and transport. Most countries have followed suit, or had already set up travel bans.

Even Europe’s famously borderless nations are reinstituting border checks and closures.

As a result, air travel is expected to be down in 2020 for the first time in 11 years. Hotels are suffering. Airbnb is allowing guests to cancel reservations without penalty.

And with the COVID-19 lockdowns in major cities like San Francisco and Paris, even local transport utilities like BART and Eurostar are hardly being used.

Other categories: on-demand, news, marketplaces, and more

Other categories are reacting in sometimes-unexpected ways.

On-demand services, which you’d expect to be way up as people stay home and order in, are just up slightly, with a drop in the second week of March. Part of it is car-sharing services, which people aren’t using as much, since they’re spending their time indoors or, when traveling, are walking or cycling. And part of it is likely heavy organic marketing increases: if you’re stuck at home, you don’t need an ad for Instacart to go get the app and order groceries.

You just go to Google Play or the App Store and get it.

News, on the other hand, is way up.

In fact, spending by news and information companies jumped over 11X from early January to the second week of March. People don’t just want to know what’s going on with COVID-19 or Coronavirus … they need to know. And news organizations are capitalizing on that opportunity.

The Marketplaces category is a bit of a mixed bag. There’s some growth there, but it’s spiky and includes some drop-offs. The problem is that if you’re selling real goods to other people, there needs to be an actual physical hand-over at some point. Getting to a shipping office is harder, and meeting in person is also harder.

The same is true of the health and fitness category, and financial services.

While we need workout equipment at home when the gyms are closed, gyms and other facilities are a big part of the marketing for the category. So while we saw the expected huge spike in spending for the first week of January to catch the New Year’s resolution crowd—almost a 2X increase—marketing and advertising in the category has fallen off over the past few weeks.

As far as finance is concerned, investments have tanked, but there’s no clear option but to hold and wait for the post-virus uptick. Similarly, fintech marketing is fairly stable, but down for the past month and a half.

Marketers need to make decisions fast

Now more than ever, marketers need to make decisions fast and get quick insights into complete ad spend and ROI. This means all your data needs to be centralized, easily accessible and actionable.

Singular provides advanced marketing analytics, and makes it easy. There’s no code required, and you can set up in minutes.

Change is the new normal: looking to the future

It’s important to note that the coronavirus pandemic is about much more than the digital marketing industry. It’s about real lives being lost, physical suffering, and massive daily disruption in literally billions of peoples’ lives. As such, COVID-19 is an unprecedented global event. My 84-year-old mother actually compares it to the times she lived through during World War II.

At Singular, our hearts go out to all those impacted. We’re working from our homes right now to minimize the spread and flatten the curve.

And in and through it all, we’re also keeping the lights on so that our clients, and the part of the economy that we touch, can continue to do what needs to be done. Or, at least as much as possible.

Ultimately this time of great challenge will likely lead to significant change in how we work, how we socialize, how we entertain, how we shop, and how we live in general. Setting up our clients for success now and in this still-uncertain future is a top priority.

The very first priority, however, is doing what we can to help all of us get through this pandemic safely.

Stay up to date on the latest happenings in digital marketing