How Musk could win (or: how much subscription revenue Twitter needs to replace ad revenue)

The Twitter that Elon Musk bought is almost entirely ad-supported. That ad revenue — $5 billion in full-year 2021 — is now at risk due to advertiser angst at Musk, his pace of change, and missing human talent. But could Musk make it all back with a subscription product and change Twitter from a primarily ad-supported business to a primarily subscription-driven social media site?

Let’s run the numbers …

We’ll base them on the last quarter we have good public data for, Q2 2022. (There’s some value in looking at full-year 2021 data, but the numbers are not clean due to a one-time $810 million shareholder lawsuit settlement.)

Those Q2 numbers:

- Monetizable users: 237,800,000

- Revenue: $1,180,000,000

- Costs: $1,520,000,000

- ARPU: $4.96

Scenario 1, subscriptions only: 1 in 4 current Twitter users becomes a paying subscriber

Hold your disbelief for a moment, but Musk needs 64 million subscribers at an average of $8/month to say Sayonara to ad revenue.

Let’s start with Q2 revenue of about $1.2 billion, which requires just under 50 million subscribers.

That’s 20% of the 238 million monetizable userbase as of now. There’s other users, but Twitter has either considered them so occasional or so fake as to not be worth advertisers’ dollars. In aggregate, the monetizable users generated quarterly revenue of $1.2 billion, meaning that each monetizable Twitter account has an average revenue per user of just under $5/quarter.

But there’s another problem.

Costs for the quarter were high.

And in fact, historically Twitter’s costs have always been high: the company was founded in 2006 but made its first profit for the fiscal year 2018, and was not profitable last year (although that included a one-time litigation-related net charge of $765.7 million).

In Q2 2022, the last quarter we’ll have publicly verifiable information for, Twitter had quarterly costs of just under $5.6 billion, meaning a daily shortfall of over $6 million dollars. But Elon Musk recently tweeted that Twitter was losing $4 million per day, so perhaps the previous management had already found some efficiencies.

That adds $360 million worth of expense that Twitter subscribers would have to make up, in this scenario. Which adds 15 million more people at $8/month, for a total subscriber base on just over 64 million.

Still suspending your disbelief?

I know: it’s hard. YouTube, for example, just hit 80 million music and premium subscribers, but that’s for a company that is an absolute juggernaut in terms of users. About 2.6 billion people use YouTube at least monthly, and as I’ve researched previously, people who use YouTube often spend a long time on YouTube. Global annual revenue estimates for YouTube are in the $30 billion range, about 6X Twitter’s revenue.

So could an Elon Musk-led Twitter do it?

Is it possible for Twitter to go from almost no subscription revenue (there’s almost no public information about uptake so far, but Twitter said the revenue was not material in a 2021 earnings update) to a massive billions-of-dollars subscription giant basically overnight?

It’s hard to imagine, especially as some are exiting Twitter (or loudly threatening — on Twitter — to exit). But maybe there are other scenarios.

Scenario 2, subscriptions + ads: 1 in 10 Twitter users subscribes

A much more likely scenario is that Musk works to beef up Twitter’s subscription revenue while at the same time keeping ads. Twitter users who subscribe get half the ads, he’s suggested, while presumably the others keep the full ad load.

That’s a smart plan because it doesn’t put the burden of funding the entire enterprise on a small fraction of the users: everyone contributes. Some with cash, some with attention.

One option: half as many Twitter users actually subscribe as is necessarily in a fully subscription revenue model. In this model — still very aggressive (some might say delusional) for number of subscribers, Twitter actually makes about 50% more revenue: almost $1.8 billion. And that includes almost $600 million in subscription revenue.

Note, I’ve suggested that even at a 50% ad load, Twitter subscribers would be a significantly more valuable audience than just average Twitter users. One, they have money, and two, they’re hard-core users of the site. That means:

- They’re more valuable for advertisers

- They use the site more, so even at a 50% ad load, they probably still see more ads than other Twitter users

- With half the ads, the ads that remain are significantly more impactful, thanks to reduced ad blindness

Still, a 10% subscription rate is extremely aggressive. Even YouTube, which has huge value to deliver in YouTube music and a galaxy full of short and long-form content to consume, has about a 3% subscription rate, given 2.6 billion users and 80 million subscribers.

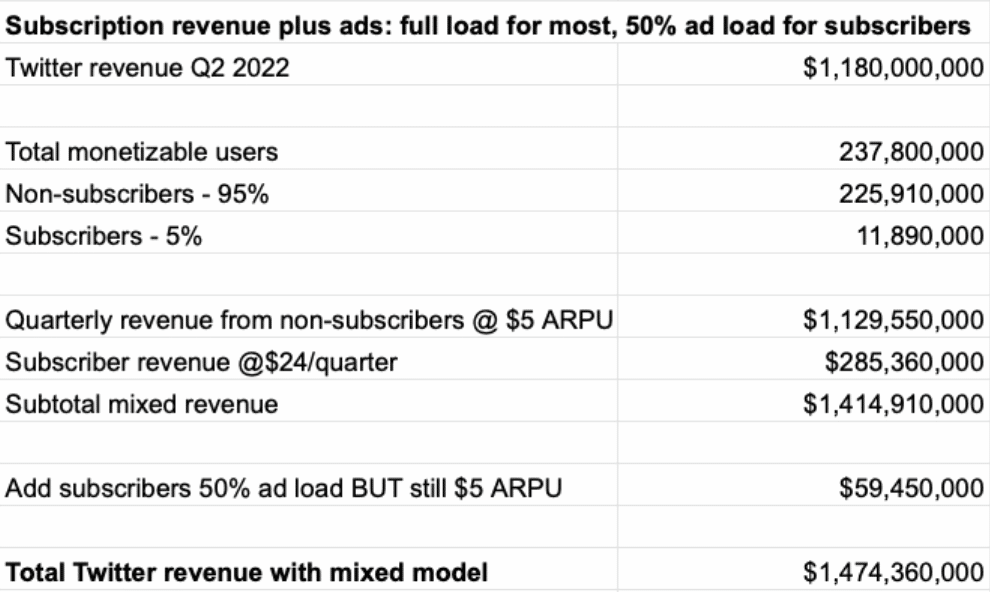

Let’s see what 5% gives us:

Interesting! A 5% subscription rate still provides a very nice near-$300 million in quarterly revenue, plus the $60 million in ad revenue from subscribers and the big chunk: $1.1 billion from non-subscribers who still see a full ad load.

Let’s be honest: even a 5% subscription rate for $8/month and almost $100/year is a massive stretch. It’s extremely unlikely. It would be an incredible achievement. It might take years.

But … perhaps … it is possible.

Confounding variables

Note, there are plenty of confounding variables here that can significantly impact any of this math.

One is advertiser appetite for selling on Twitter. Advertisers have been pulling back on Twitter spend simply due to a certain level of Elon-inspired chaos. Two major agencies, Interpublic Group and Havas Media have advised clients to “temporarily pause their paid advertising on Twitter.” That’s a risk on ad revenue, which is still hugely important with almost any reasonably possible level of subscription revenue. The likelihood is that as the dust settles and the Musk era of Twitter starts to approach a level of normalcy, they’ll come back. But there are no guarantees.

Also, when you drop close to half of your staff, as Twitter did when Musk snapped his Thanos-gloved fingers and 3,700 Tweeps lost their jobs, two things happen:

- Your costs drop a lot (but not immediately)

- Your capabilities decrease (but unpredictably)

I haven’t factored in savings in the above calculations because it’s unclear how much Twitter spent on them. In 2021, Twitter spent about $3 billion on R&D, sales and marketing, and G&A. How much of that was salary? I don’t know. How much of that salary will be saved? Hard to say. What you can say is that firing costs — and yes, there is a class action lawsuit from Twitter workers coming — mean Twitter may not see short term savings, though of course the company likely will in the long run.

But what losses in capability does Twitter now have?

Is the platform more likely to get hacked? Will it be less stable? Are there fewer ad sales and customer service people? Will Twitter be less able to develop compelling new ad products?

All good questions that we’ll learn more about in the coming months and quarters.

Summing up

Elon Musk’s purchase of Twitter is one of those sea changes that makes you think of the iconic quote at the beginning of the Lord of the Rings: “The world has changed. I see it in the water. I feel it in the Earth. I smell it in the air.”

And Twitter is an important platform for advertisers.

Sure, it’s particularly important for brand advertisers — 85% of revenue as of 2020, though that has likely changed somewhat in the years since — but it’s also a platform that many performance advertisers have used to good effect. Twitter ranked 10th in Singular’s 2022 ROI Index, ranking in no fewer than 19 of our various geographical, vertical, and platform top lists.

That means advertisers have a stake in how the platform develops under its new owner. There’s a huge amount of turmoil around the company right now, and advertisers — especially big brand advertisers — don’t tend to like turmoil and controversy.

The good news for Musk is that there is a potential path to a mixed model of revenue from both ads and subscriptions for Twitter. But it is not an easy one. Even at just a 1% conversion rate, the revenue from subscriptions would be only $60 million per quarter and just under a quarter of a billion dollars annually.

That’s nothing to sneeze at, sure.

But if that’s all that Twitter gets — and 1% is not an easy goal! — it shows how important it is for Elon Musk to prioritize making Twitter a safe and effective platform for advertisers, who would need to make up the multi-billion-dollar shortfall in revenue.

One thing we can say about Twitter right now: it’s at least interesting.

Stay up to date on the latest happenings in digital marketing