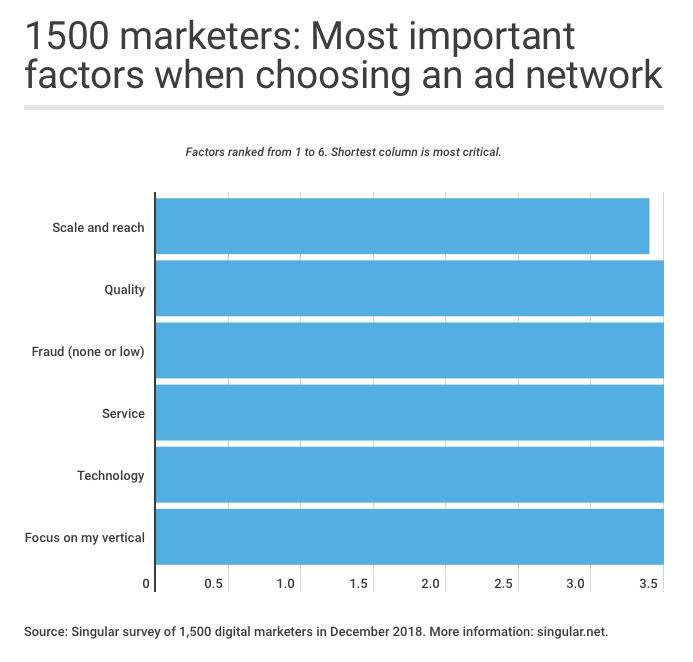

Is it scale? Quality? Lack of fraud? Personal service, or a great digital experience? Amazing technology? Or perhaps a tight focus on your particular niche?

We recently asked 1,500 marketers a simple question:

How do you choose ad networks? And what are the most important elements of that decision?

According to the responses, it’s pretty much all of the above. If they were absolutely forced to just pick one, completely compelled to isolate one single most important factor — on pain of losing their quarterly bonuses or maybe even the free triple-venti-soy-no-foam-lattes at the office — it’d probably be scale and reach.

But it’s a tight competition with the other options.

We only surveyed marketers who actively run ad campaigns. And the results make it clear that ad networks have their work cut out for them, because marketers are not easy customers. Quite simply, when it comes to choosing an ad network, they want it all, and they want it now.

As we all know, when everything’s a priority, nothing is a priority.

Looking at the results, we’d almost be tempted to say that when marketers are asked to choose ad networks, they don’t have a clue what the most important factors are.

But that’s probably unfair.

Individual marketers probably have a pretty good idea what works for them … and how to improve it. However, it is clear that marketers as a group lack consensus on what’s most important in finding new ad partners.

And that might just be the nature of the beast:

It’s not like this is easy.

Of course fraud protection is important. Of course scale matters. Of course a media source’s target tech can be a difference-maker. It never hurts when an ad network has special ability to focus on your specific vertical. And getting the best quality traffic, users, or customers is essential.

So it’s no surprise which ad networks marketers trust most.

We asked the same marketers that question, and the top four were names your grandparents recognize: Google, Facebook, Amazon, and Apple. They’re all massive companies, name brands, and have largely walled garden ad ecosystems, which typically means extremely low fraud.

But your marketing can’t end there.

Why?

We know that most marketers who are successful use many ad networks. In fact, they typically achieve 60% more conversions with 37% less cost. That’s not easy, and it takes work. Profitably scaling media sources is hard.

When everything matters, all your decisions are challenging. Because not all ad networks have huge scale, or super-strong fraud protection, or amazing targeting. But there are typically pockets of profitable growth spread in many different media sources.