Stay up to date on the latest happenings in digital marketing

Summary

-

Targeted Audience Segmentation: Marketers should segment India's festive shoppers by verticals (e.g., beauty, e-commerce, grocery, gaming) to tailor messaging that aligns with the distinct behaviors and motivations of each group, ensuring a more effective connection during the peak shopping season.

-

Optimal Execution Timing: Leverage the dip in CPIs and CPMs during Diwali week to maximize ad spend efficiency, and utilize a mix of channels, including social, search, OEM placements, and commerce media, to achieve standout returns on ad spend (ROAS).

-

Dynamic Creative Strategies: Implement weekly creative rotations to combat ad fatigue and prioritize re-engagement campaigns immediately after Diwali, particularly in shopping and finance apps, to drive high ROAS and foster long-term user engagement beyond the festive season.

India’s festive season is upon us, and it’s the busiest shopping season of the year. Starting in late August with Ganesh Chaturthi and continuing with Navratri & Durga Puja in September, the festive season reaches its climax in the globally-known Festival of Lights, Diwali. It’s a critical time to reach India’s festive shoppers.

India’s festive season is the most intense stretch of the year for app marketers.

User activity surges, purchase intent skyrockets, and competition for attention reaches an all-year high. Festival season is a good time to buy in India, and many people will wait months to make major purchases during this period.

But for marketers, winning this season requires more than being aware of the peak in demand and competition. Marketers need a clear picture of who they’re trying to reach, how to connect with them, and when the perfect moment for that connection is.

Good news, Singular, Sensor Tower, and Mobupps are here to help with the insights you need to stay ahead during India’s busiest shopping season.

Our new report Festive Season 2025: App marketing trends and strategies for India, reveals how audience behaviors shift during this period, and the channels, tactics, and timing that can make or break a campaign. This is critical data for app marketers who want to maximize their installs and revenue during India’s festive season.

Here’s a snapshot of the report …

Who are India’s festive shoppers?

Smart marketers will segment and target to reach exactly those people within all of India’s festive shoppers who are most likely to be interested in their offerings.

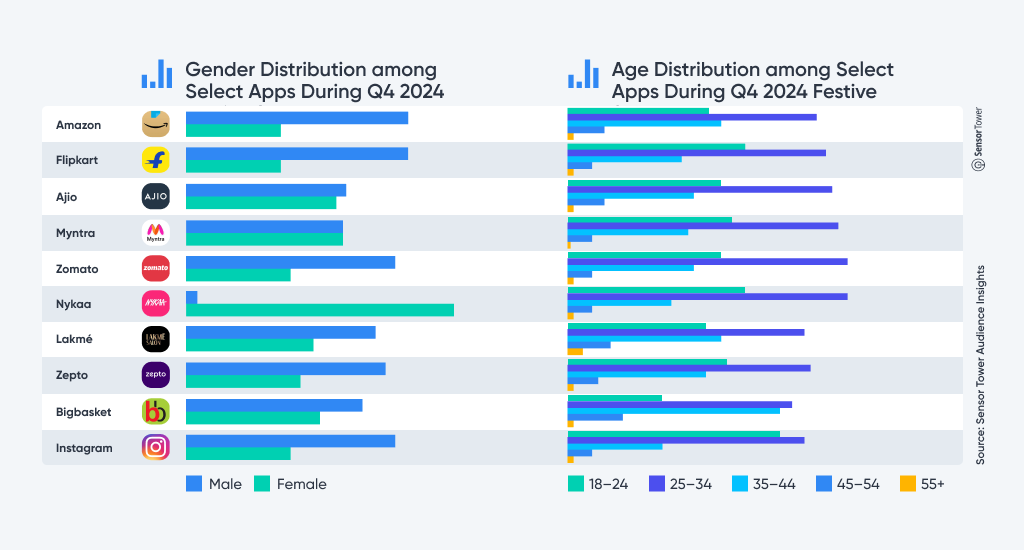

The festive season brings distinct audience patterns within different verticals:

- Beauty and fashion apps

These skew strongly female, with engagement peaking around gifting events and festival dates. Example: Nykaa. - E-commerce apps

Retail apps tend to appeal to a more male-dominant user base, driven by tech and electronics promotions. Think Flipkart. - Quick-commerce and grocery apps

Grocery and quick commerce apps appeal to a wide age range. This includes both Gen Z for impulse buys and older shoppers for essentials. Leading apps in this category include Blinkit, Zepto, BigBasket, and Swiggy Instamart. - Gaming and finance apps

These verticals over-index on urban, high-income users, with bonuses and holiday downtime driving activity. Games like LudoKing (casual) and Garena Free Fire (core) topped the charts, while PhonePe, Google Pay and Paytm reign over the finance rankings.

These differences matter.

A single creative strategy couldn’t possibly resonate with such vast and varied audiences. Timing, messaging, and offers need to reflect the wants, needs, and motivations of your most valuable users.

How to reach India’s festive shoppers

Of course, audience insight is only half the equation.

The other half is execution; that is, matching your creative and media plan to when and where your target users are most likely to convert.

Here are a few of the opportunities uncovered about how to reach India’s festive shoppers:

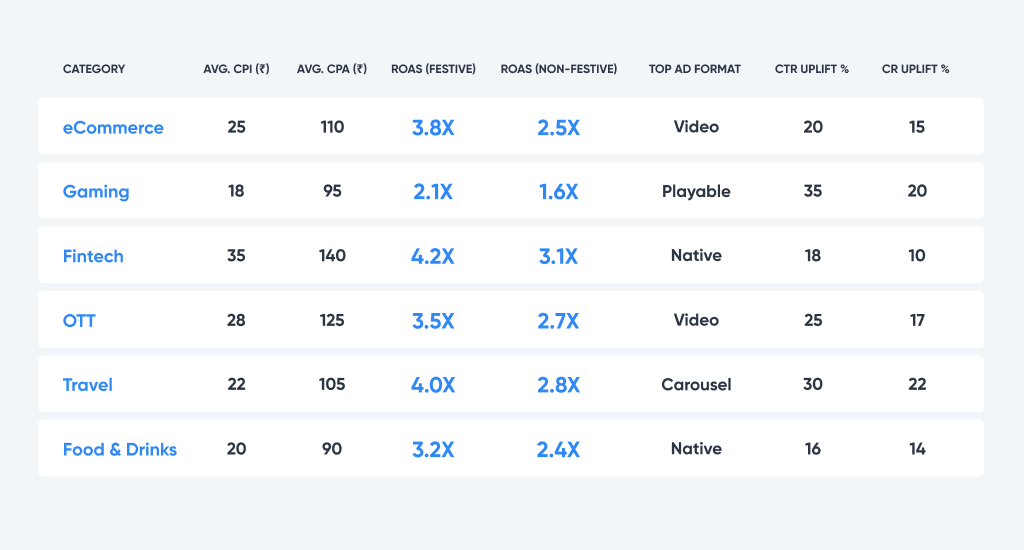

- Best windows

CPIs and CPMs often dip during Diwali week, even as engagement peaks, creating a sweet spot for marketers who are ready to scale. - Channel mix

While social and search are still key channels, OEM placements and commerce media showed standout ROAS gains in several verticals. - Creative rotation

Weekly refreshes helped marketers stay ahead of fatigue in high-frequency environments like social video and rewarded placements. - Remarketing

Re-engagement campaigns immediately after Diwali delivered some of the highest ROAS last season, particularly in shopping and finance apps.

When you combine demographic insight with proven media strategies, you can align both the message and the delivery to capitalize on the festive season’s full potential. And you maximize your return from the right set of India’s festive shoppers.

The bigger opportunity: year-defining growth

This isn’t just about reaching India’s festive shoppers once or twice, or getting a quick boost.

The festive quarter is about more than just big ad budgets. It’s about maximizing the rare alignment of high-intent audiences and high-performing channels so you can shift your results from “seasonal boost” to “year-defining growth.”

As Nikhil Sharma, Head of Growth & Partnerships at Times Internet, notes in the report:

“The festive season in India is not just about momentary spikes – it’s a strategic window where data-driven storytelling and timely user engagement make all the difference. At the scale we operate, leveraging real-time insights allows us to move beyond just installs and focus on long-term impact. Reports like these help decode shifting consumer behavior during high-intent periods like Diwali, enabling marketers to optimize both performance and brand outcomes.”

There’s much more in the full report.

Download the full report here for even more data, insights, and use-tomorrow tactics.