Content

- Performance marketing now: spend is up, money moved global, and UA performance is up

- CTR is up too, but clicks have a new meaning in performance marketing

- CPIs jumped but so did installs … so efficiency held up

- CTV is graduating from maybe-let’s-test-it to another tool in the performance marketing toolbox

- Rewarded ads: growing, but marketers need to manage quality and abuse

- Most underrated performance marketing levers: incrementality and creative

- Q4 is coming: here’s how to win

- So much more in the full webinar

Stay up to date on the latest happenings in digital marketing

Summary

-

Leverage Incrementality and Creative Optimization: Marketers should prioritize ongoing incrementality testing and enhance creative assets, as these are the most influential factors in performance marketing. Regularly audit how clicks are defined and shift focus to metrics like Installs Per Thousand Impressions (IPM) to better gauge campaign effectiveness.

-

Capitalize on the Shift to CTV and Rewarded Ads: With Connected TV (CTV) rapidly becoming a crucial performance marketing channel, brands should integrate it into their user acquisition strategies, optimizing for mobile KPIs and testing video-level targeting. Additionally, explore rewarded ad networks, as 41.7% of marketers plan to implement them, ensuring quality control to mitigate risks.

-

Ad Spend Trends and Global Market Opportunities: Increased global ad spending indicates a shift towards emerging markets with lower competition and higher returns. Marketers should adapt creative and onboarding processes to suit these diverse geographies, seizing growth opportunities outside traditional high-cost areas like the U.S. and

Ad spend is up, performance marketing results are up, and the channels we used to call experimental are now actually pulling their own weight. That’s the state of the union for performance marketing based on our recent Q3 2025 Quarterly Trends report, plus the insights from multiple partners.

In our recent Q3 2025 State of Mobile Marketing webinar, a cross-section of UA, ASO, analytics, and CTV leaders unpacked what actually changed last quarter … and how to win Q4.

Just need the exec summary in plain English? Your wish is my command:

- iOS gaming CTRs are inflated by design decisions and format evolution

- CTV went from maybe-let’s-test-it to part of the toolbox

- CPIs rose but so did installs (so net efficiency didn’t crater)

- Rewarded ads keep growing, growing, growing

- Creative is STILL the highest-leverage knob you can control

- Incrementality is super sizzling hot

For much, much, more, keep reading, but also please do check out these 2 critical resources:

- The webinar itself

- The Q3 2025 report it’s based on

OK. These were our panelists, while I moderated:

- Peter Koczak, head of analytics at YouAppi

- Joseph Iris, director of ML at Personal.ly

- Benjamin Waters, VP for APAC at Jampp

- Simon Thillay, head of ASO and market insights at Apptweak

- Stephanie Pilon, CMO at Singular

Here’s what we learned …

Performance marketing now: spend is up, money moved global, and UA performance is up

Singular clients boosted their ad spend 45% year over year globally.

That includes outsized growth not including the usual suspects in the U.S. and China. APAC, LATAM, and parts of Europe saw the biggest jumps. There’s still investment in the biggest gaming and mobile app markets, but there’s also some performance marketing budget reallocation to geos with higher marginal returns and lower competitive density.

Expect this to persist through Q4 as marketers chase cheaper reach and play the “global English + device/language” game to find high-value users outside expensive metros.

Why it matters: If you haven’t built creative and onboarding that travel well across languages and price bands — or specific creative and offers for the growing geos — you’re leaving arbitrage on the table.

Check the full report for all the details on where spend is increasing.

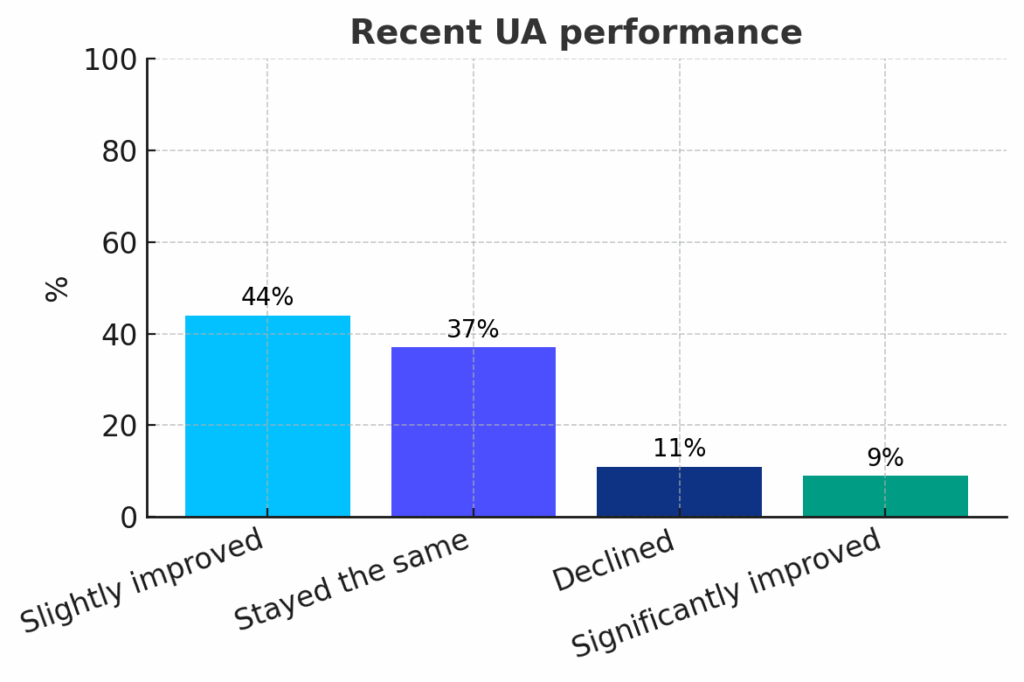

Most marketers’ UA performance is a bit better right now than in previous quarters:

- 44% say UA performance has slightly improved

- 9% says UA performance has significantly improved

- 11% say UA performance has declined

CTR is up too, but clicks have a new meaning in performance marketing

As we shared recently, CTR is way up on iOS gaming, specifically.

iOS gaming CTR exploded, driving a 38.6% global jump. But this isn’t a sudden surge in ad quality or targeting or consumer behavior. It’s playable ad UX and format evolution: overlays, end cards, and very small click-to-X-out buttons.

And it’s an SDK arms race to capture attribution.

Two important implications:

- Optimization signals are shifting

CTR is less predictive of down-funnel outcomes on iOS interstitial/video inventory. Optimize to IPM and revenue proxies, not clicks. - Definitions — or implications — are changing

When CTR approaches absurdity (think 100% click-through rates, which we are seeing in some cases) audit what counts as a click for you. Check how engaged views are fired, and how SKOverlay behaves in your inventory, and consider thinking about CTR on iOS gaming ads more like impressions.

We’re not saying clicks are the new impressions … but … if you’re doing performance marketing, you need to reconsider what clicks actually mean for you, at least on iOS in the gaming verticals.

CPIs jumped but so did installs … so efficiency held up

Finance and gaming saw the steepest CPI increases, but installs also rose.

That suggests better targeting and creative rather than competition or price increases. On iOS, CPMs jumped even more than CPIs, which is actually good news for publishers monetizing via ads.

As long as your LTVs hold up, CPI increases are annoying but not fatal.

What to do:

- Check LTV frequently

Keep your LTV math fresh and cohort-based; don’t pause just because price tags went up if paybacks still pencil. - Try new ad partners

Rebalance spend to partners and/or placements where IPM is improving, using incrementality testing to validate true lift.

Capital efficiency matters when CPIs jump, because you can get fewer growth cycles (spend, earn, re-spend) from a given war chest. Prioritize ad partners with quicker ROAS.

CTV is graduating from maybe-let’s-test-it to another tool in the performance marketing toolbox

Jampp saw the number of CTV campaigns jump 56%: a big increase in just 1 quarter.

That shouldn’t come as a shock to anyone who’s watching Netflix, Amazon Prime, Disney+, Paramount+, or Apple TV+ … free and ad-supported streaming channels are now ubiquitous.

- In May of this year, CTV accounted for 44.8% of all TV viewing time in the U.S., exceeding the combined total of broadcast (20.1%) and cable (24.1%) for the first time ever

- In June 2025, streaming commanded 46% of total TV viewership, while cable was 23.4% and broadcast just 18.5%

- July, Roku-powered streaming alone accounted for 21.4% of U.S. TV viewing, versus 18.4% for broadcast TV

Importantly, CTV is being run as a performance marketing channel, not brand. It’s integrated with Singular as a measurement partner, optimized for mobile KPIs, and orchestrated alongside ASA and social.

The good news: CTV is still way less crowded than mobile ads, especially in social apps. It adds incremental reach, and — a unique benefit — can influence multiple users per household.

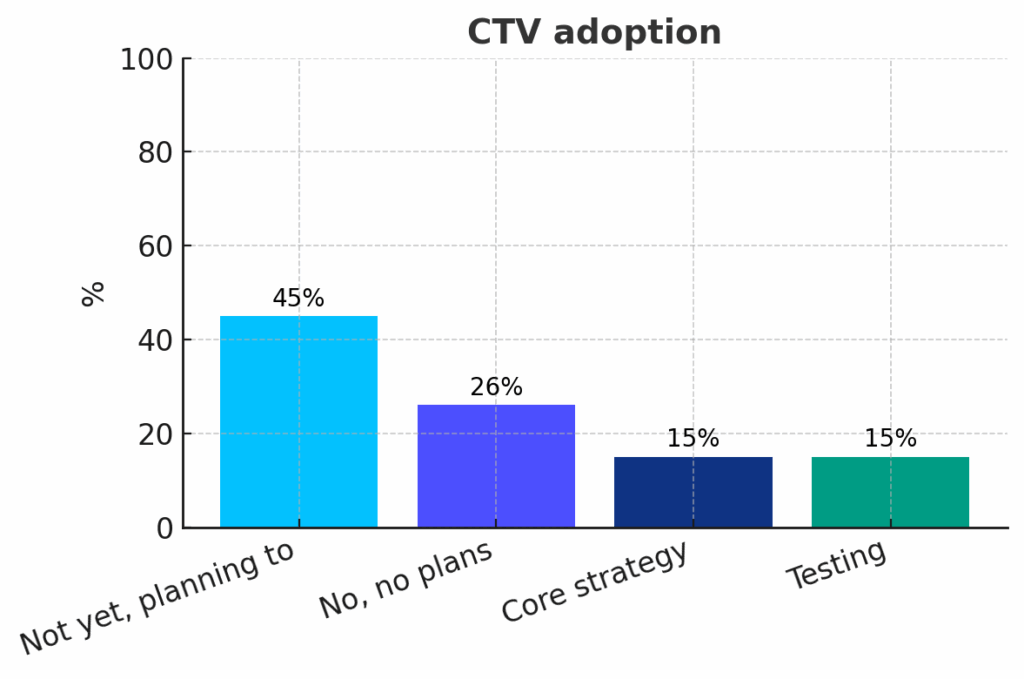

While about 30% of marketers attending the webinar were using CTV, another 45% were planning to soon.

“CTV isn’t just a branding channel anymore,” says Benjamin Waters. “Budgets have more than doubled … it’s becoming a must-have performance channel.”

How to incorporate CTV in your UA campaigns:

- Part of the journey

Treat CTV as assist + acquisition: use view-through windows thoughtfully and don’t over-credit. - Get the creative right

Creative fit matters: use short narrative, show an immediate value prop, and “what happens next” explicit to drive installs. - Test targeting

Test video-level and contextual targeting where available to reduce audience waste.

Rewarded ads: growing, but marketers need to manage quality and abuse

Rewarded networks are scaling because a meaningful slice of users see them as a getting a free rebate on the gaming they’d do anyways.

That’s great.

And some of those users monetize well, which is good for performance marketing using rewarded networks.

But, our panelists noted, it does increase the need for fraud controls, payout calibration, and down-funnel guardrails like quality thresholds before rewards escalate. Perhaps that’s why there’s still some caution when it comes to using rewarded ad networks.

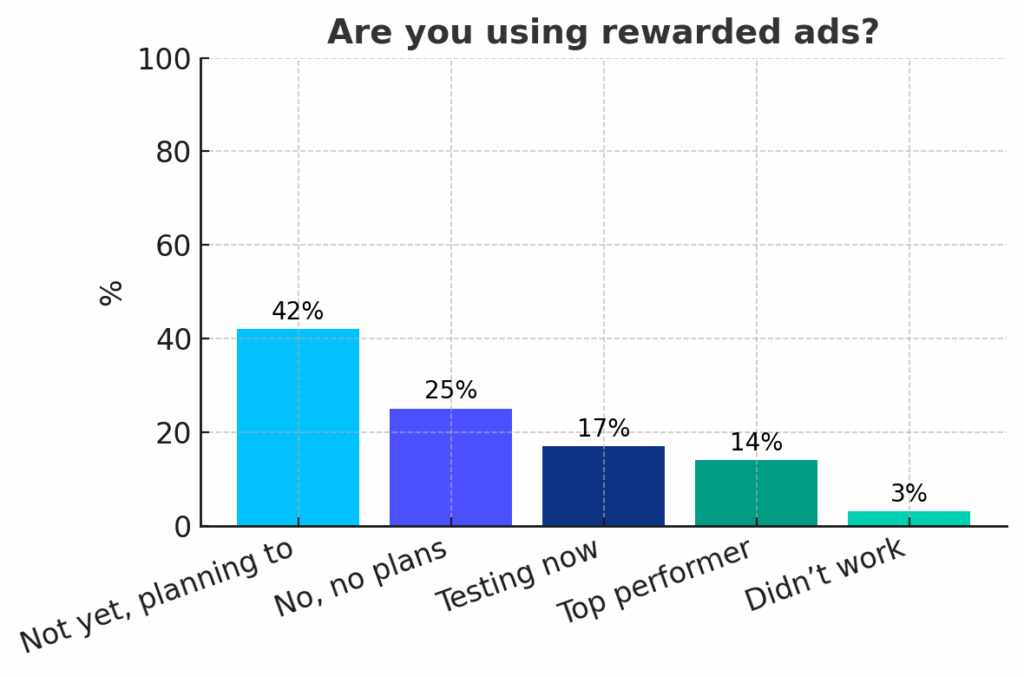

Most marketers aren’t yet using rewarded ad networks, but they’re planning to:

- 41.7%: Not yet, but planning to

- 25.0%: No, and no plans to

- 16.7%: We’re testing now

- 13.9%: Yes, they’re a top performer

- 2.8%: Tested and didn’t work

15% of marketers told us rewarded networks are a top performer for them, while another 16.7% are testing them now. A plurality, however — 41.7% — say they don’t use rewarded ad networks yet, but they are planning to.

So there’s likely more growth for rewarded ad networks in the future.

Most underrated performance marketing levers: incrementality and creative

Most marketers can’t out-toggle the rising tide of platform automation, but they can still out-learn competitors.

Two levers consistently matter:

Incrementality as a habit, not a project. In other words, always be testing some level of incrementality. Also test whether each of your ad networks is incremental to your overall growth goals.

How? Design always-on PSA/ghost bids, geo-splits, or audience-exclusion tests to measure true lift. Then use creative as the compounding asset: systematically test hooks, formats, and language.

And don’t forget to mirror winning ad narratives on your App Store/Google Play listings to achieve message match and raise tap-through and conversion.

This is a massive miss by most mobile marketers:

“We look at how many times you refreshed your creative gathering on the app store last year,” says AppTweak’s Simon Thillay. “And the numbers are single digits almost every time.”

That will not cut it.

Q4 is coming: here’s how to win

Q4 is almost upon us.

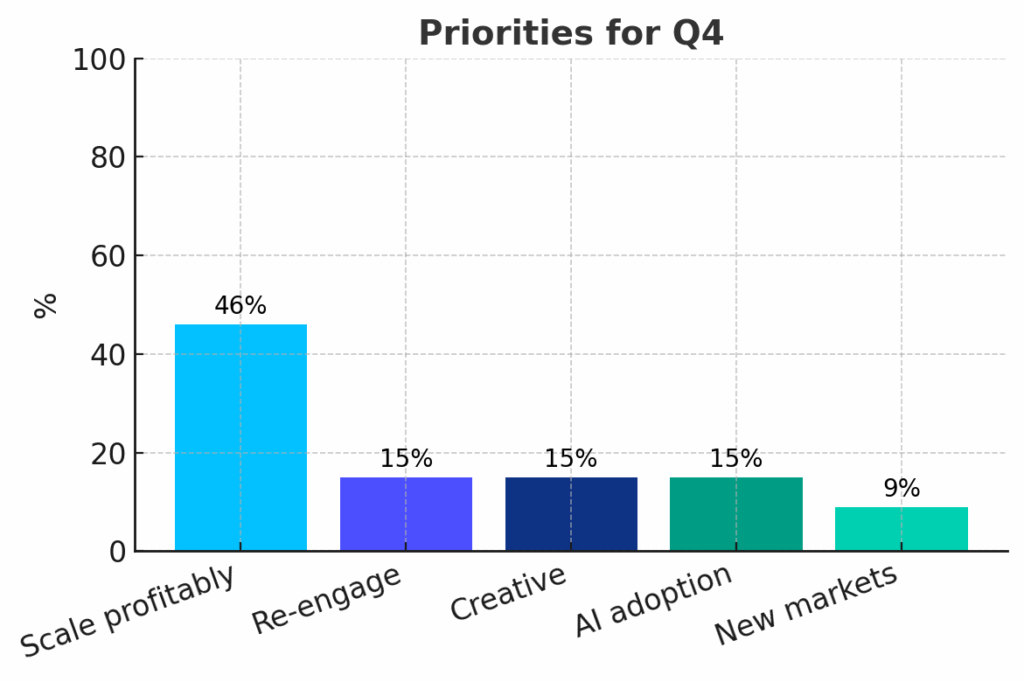

Most marketers are focusing on scaling UA profitably, while about 15% are focused on each of 3 different priorities: re-engagement, creative strategy, and AI adoption.

We asked all of our panelists how to win in Q4 performance marketing: preparation, execution, and “Q5” … the lull after the insanity.

Now in preparation for the holidays:

- Creative

Get your creative right and lock your creative system so you’re not wasting time and money during crazy season - Channels

Stand up your CTV-to-mobile solution with clean view-through settings and clear assist logic (Singular can help: here’s our CTV measurement product, plus our web attribution solution) - Partners

Expand your supply: add networks/partners where IPM is rising and you have measurement coverage.

During the peak:

- Optimization

Shorten your feedback cycles and send budget to what’s winning daily - Safety

Safe-guard your ROAS goals by isolating high-LTV geos/segments in their own campaigns with stricter thresholds - Flexibility

Keep a small extra bit of budget for opportunistic spikes (inventory, placements, or contextual wins)

After the holidays … in “Q5:”

- Attack

Millions of people have new devices in their hands. It’s a good time to win them over - Retarget

Deploy some win-back and cross-sell campaigns with softer post-holiday CPIs/CPMs

Finally, if you have any spare cycles to add/fix/check anything right now before the holidays, work on these key items:

- Re-check your KPIs on iOS playable … de-weight CTR and up-weight IPM and purchase-adjacent events

- Start incrementality testing: there’s some super-simple ways to begin

- Refresh your CPPs to mirror your top-performing ad narratives

- Pilot CTV if you haven’t AND IF YOU HAVE TIME before the holidays

- Instrument rewarded campaigns for quality (re-check eligibility gates, see if you’re getting diminishing returns, implement fraud screens)

So much more in the full webinar

As you’d expect, there’s a ton more in the full webinar.

Here’s just a brief overview:

- 04:48 Quarterly Trends Report Highlights

- 08:12 User Acquisition Market

- 10:22 Ad Spend and Performance

- 13:15 Click-Through Rates

- 19:52 Installs Per Thousand Impressions (IPM)

- 22:15 Cost Per Install (CPI)

- 26:19 Rewarded Ads

- 29:11 High CPI Verticals

- 33:33 Creative Strategies for High CPI Verticals

- 34:19 The Importance of App Store Page Optimization

- 35:45 Exploring CTV and Its Impact

- 40:37 Custom Product Pages: Underutilized Potential

- 44:41 Display Ads: Old but Gold

- 46:46 Q4 Marketing Priorities and Strategies

- 56:33 Q&A Session: Expert Insights

Here’s how to watch it on-demand, for free, right now …