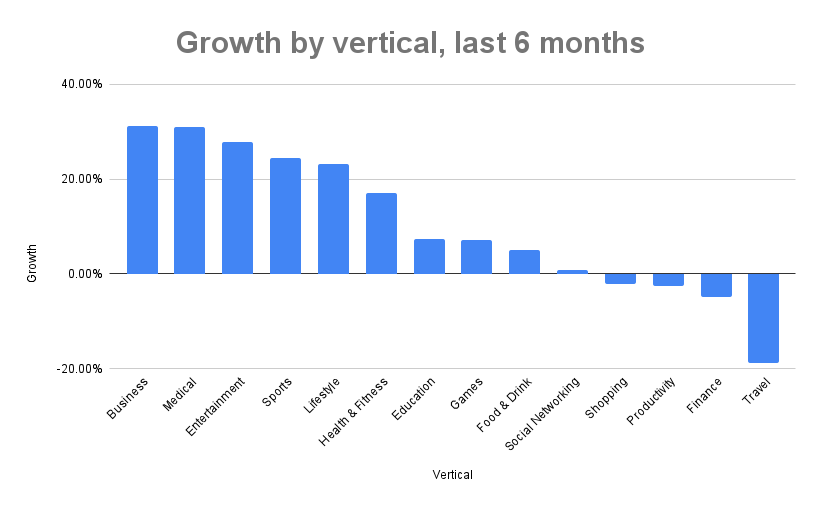

Ad spend growth: app verticals that are growing over the last 6 months

Ad spend growth? Ad spend growth! There’s a lot of doom and gloom in the world today, and that extends to the growth space as well. GDP growth is slowing, inflation is still high, ad spend now underpaces the GDP growth that remains, wars around the globe are dragging on, and the gaming industry is dumping jobs left and right.

But some app verticals are still growing, and growing fast.

In my preparation for a keynote at Mobile Apps Unlocked in Las Vegas next week, we pulled some year-over-year comparison data for various verticals looking for either ad spend growth or decline.

The results were surprising, to say the least.

If a picture is worth a thousand words, here’s a few more: it’s not all doom and gloom out there.

Smart performance marketers don’t expend resources when they’re not getting return on investment … so good things are happening in more than a few verticals.

Ad spend growth: the 20% club

Business, medical, entertainment, sports, and lifestyle are all up significantly in ad spend growth.

- Business: 31%

- Medical: 31%

- Entertainment: 28%

- Sports: 24%

- Lifestyle: 23%

The business category includes professional networking tools, job search engines, research and consumer insights tools, and more, and clearly there’s an economic impact driving some of this. Just as Covid increased leisure time and drove game usage, tight economic conditions are driving job search and related career activities.

Medical includes tools for brain health, ordering medical supplies, pharmaceutical supplies, and healthcare apps, and they’re clearly growing significantly right now as well, though I’m not certain what larger economic forces might be driving that.

Entertainment includes streaming apps, e-magazines, ticketing apps for in-person concerts and shows, and other apps for content distribution and consumption. The streaming wars might not be as hot as they were a year ago, but they’re still fueling ad spend growth.

Sports is pretty straightforward, you would think, but not really. This category, which is also fast-growing, includes numerous sports betting apps. But there’s also apps for organizing your community sports team’s activities, and sports memorabilia apps.

And lifestyle includes dating as well as virtual assistants or companions. It also includes self-help and motivational apps and services.

Games ad spend growth: just 7%

Games ad spend growth was just 7% year over year, but that’s actually quite significant.

As GroupM makes very clear, ad revenue growth spiked massively during COVID. A lot of that was in mobile, and a lot of that was ad spend growth inside mobile games for user acquisition. That spike was unsurprisingly unsustainable and has dropped significantly in the past few years.

So to see ad spend growth again in mobile games UA right now is significant. That spend has to come from revenue somewhere — especially since high-interest rates are increasing the cost of venture capital — and so is indicative of game revenue returning to growth (something I’ll take a closer look at in the future).

The other part of games ad spend growing 7% that is significant is that this is on a very high base.

Games are about half the App Store and Google Play, and are cutting-edge aggressive in UA and monetization. The slice of data I looked at was over $1.5 billion in both periods, suggesting that this 7% growth is widespread and not just an artifact of a few leaders in the space.

Not everything is up

Of course, as per usual, not everything is up. In some verticals, ad spend growth as actually ad spend decline. Social networking was essentially flat, and retail, productivity, finance, and travel were down, but especially travel.

- Shopping: -2%

- Productivity: -3%

- Finance: -5%

- Travel: -19%

These drops aren’t shocking, however. Artificially suppressed during Covid, travel rebounded as a category in the immediate post-Covid years, but is now subsiding. (High inflation isn’t helping with disposable income here.)

Fintech had a similar Covid bump, and seeing that demand soften a bit is also not a surprise.

More to share at MAU

I’ll have much more to share on the overall ecosystem and the financial environment, including 5 ways the best marketers are still winning, at Mobile Apps Unlocked in Vegas next week.

If you’re there, look me up!

Stay up to date on the latest happenings in digital marketing