Part

01

of one

Part

01

Connected TV Ad Spend (2023) #2

Key Takeaways

- US CTV ad spending will amount to roughly $24.2 billion in 2023, growing at 10% year-over-year.

- Millennials and Gen Z are driving this shift away from linear TV consumption, with consumers under 35 years consuming 25% less linear TV than older consumers.

- The top three categories that saw the highest digital video/CTV ad spend growth in 2021 are the travel, apparel, and wellness categories.

- The preferred buying method for CTV ads in the past year (2021) was publisher direct: sales rep (63%), followed by programmatic direct (61%), and publisher direct: self-serve (38%), indicating that buyers prefer direct buys.

- The Drum predicts that 40% of US households will become cord-cutters in 2023, transferring from linear TV consumption to CTV.

Introduction

This report provides the projected size of CTV ad spending for 2023, growth, growth drivers, preferred buying method, and ad spending per vertical. The shift in TV consumption from linear TV to CTV is driving the growth of CTV ad spending. Most ad buyers revealed that they would fund their CTV spending by diverting funding from their linear TV ad budgets. However, information on the CTV ad spending by industry vertical for 2023 is not publicly available. Instead, an analysis of CTV ad spending per vertical for previous years was provided. Detailed findings and research strategy can be found below.

CTV Ad Spending & Growth

- According to Statista, the size of connected TV (CTV) ad spending in the US is projected to be $23.9 billion, growing to $38.83 billion in 2026.

- However, eMarketer estimates the 2023 CTV ad spending in the US to reach $24.2 billion in 2023, growing at a CAGR of 26.7%.

- The IAB, an American advertising business organization, indicated that the US CTV ad spending will have a 10% year-over-year (YoY) growth in 2023.

- Shifting TV consumption and the increasing ownership of smart TVs are factors driving the CTV ad spending industry.

Growth Factors

Shifting TV Consumption

Shifting TV consumption from linear TV to CTV and other digital viewing mediums will drive the growth of CTV ad spending in 2023 and beyond.

- In a study by GroupM, the report noted that "the primary reason for all of the growth we expect in Connected TV+ advertising is that these environments are simply where a large and growing share of viewing is shifting."

- Millennials and Gen Z are driving this shift away from linear TV consumption, with consumers under 35 years consuming 25% less linear TV than older consumers.

- Magna also indicated that linear TV viewership in the US will reduce by 5.8% in 2023.

- Additionally, The Drum predicts that 40% of US households will become cord-cutters in 2023, transferring from linear TV consumption to CTV.

- About 73% of advertisers plan to fund their CTV ads by diverting their linear TV ad budgets.

Increasing Ownership of Smart TVs

The increasing ownership of smart/connected TVs is driving the growth of CTV ad spending in the US. Smart TVs currently represent the fastest-growing segment of streaming devices.

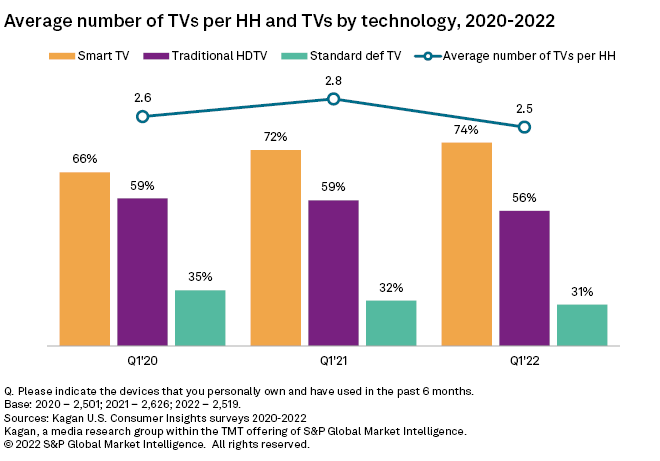

- Historical survey data also indicates that smart TV ownership in the US has increased by 8% in the past two years to 74% in 2022, with 79% of wifi-enabled households leveraging CTV devices to stream an average of 122 hours of content monthly.

- Additionally, advertisers can now run scalable, data-driven smart TV experiential campaigns by leveraging the behavioral history of the audience and contextual machine learning (ML) CTV solutions.

- Smart TVs are thus driving an increasing opportunity for advertisers to present customized messages to their audiences.

Preferred Buying Method & Ad Spending Breakdown

- The preferred buying method for CTV ads in the past year was publisher direct: sales rep (63%), followed by programmatic direct (61%), and publisher direct: self-serve (38%), indicating that buyers prefer direct buys.

- Small media spenders prefer self-serve CTV buying options (55%) more than large (34%) and mid-tier buyers (32%).

- Programmatic CTV advertising has been identified as the preferable route for advertisers and performance buyers.

- The projected CTV ad revenue breakdown by company in 2023 ranks Hulu as the single highest platform for CTV ads ($4.82 billion), followed by YouTube ($3.83 billion), Roku ($3.08 billion), Pluto ($1.64 billion), and Tubi ($1.26 billion).

- Other companies' collective CTV ad revenue is estimated to reach $9.58 billion in 2023.

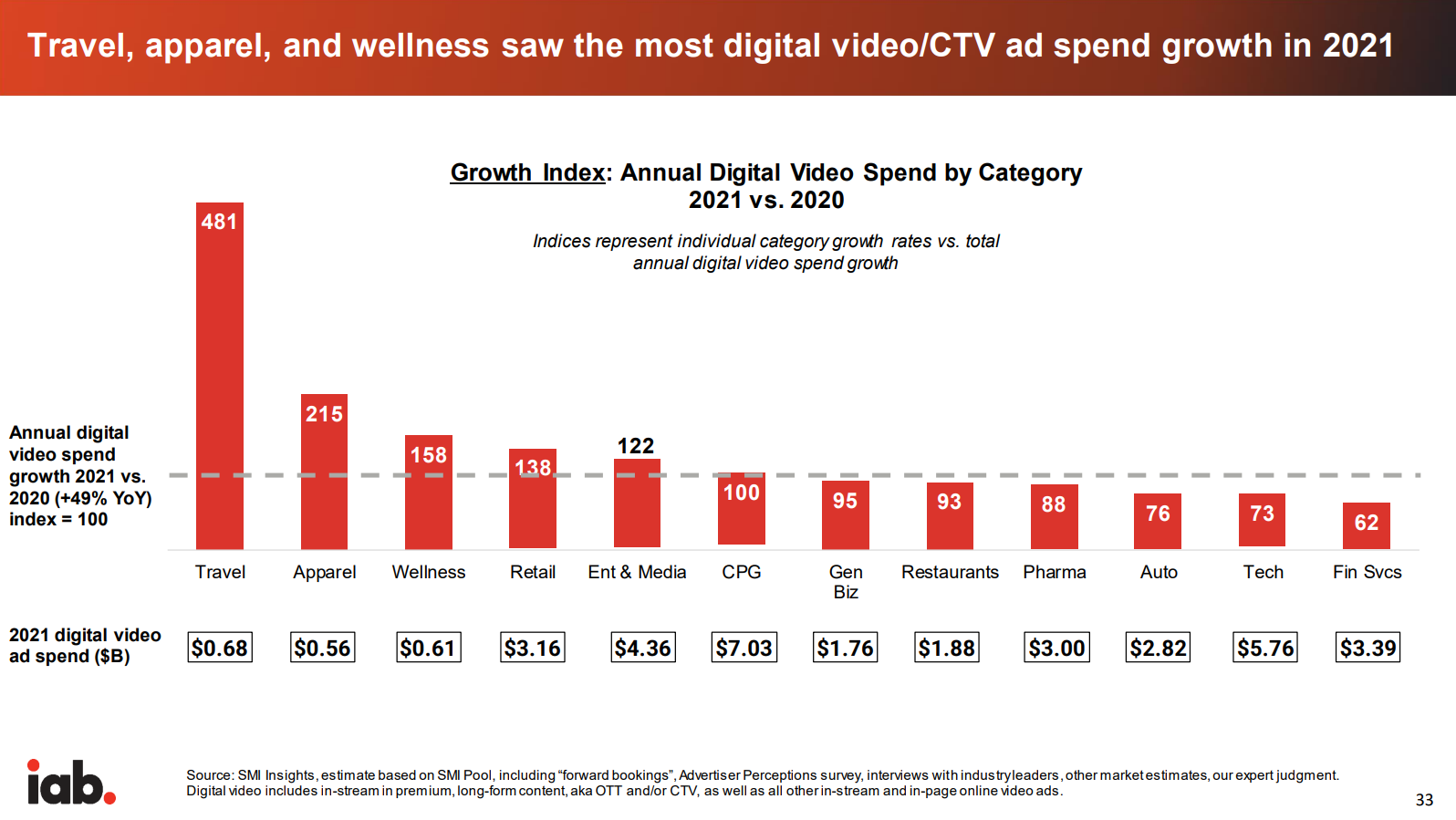

- The top three categories that saw the highest digital video/CTV ad spend growth in 2021 are the travel, apparel, and wellness categories. The categories reviewed do not include political ad spending. A breakdown of 2021 digital video/CTV ad spend and year-on-year growth per category is available below:

- Year-on-year, programmatic CTV ad spending is projected to increase by 39.2% in 2022, compared to the 82.4% increase experienced in 2021, according to a report published by eMarketer.

- According to a recent report, "political advertisers [in the US] increased their spending on CTV devices by 1500% in the first half of 2022 compared with the same period in 2020." Overall, political advertisers spent a total of $1.44 billion on CTV ads in the 2022 midterms.

Research Strategy

We leveraged industry reports and studies from Insider Intelligence, IAB, S&P Global, TV Technology, Statista, OnAudience, and The Drum. Our findings from these sources provided the forecasted size of CTV ad spending in the US for 2023 and its YoY growth. We also leveraged some of these resources to provide further insights, such as the growth drivers, preferred buying method, and ad spending breakdown. However, the research team could not identify any reports that discuss the projected ad spending per vertical for 2023. Therefore, we expanded our search to include a breakdown of ad spending per vertical from previous years.

Since we obtained some data from Statista, we included the infographics in the report. Lastly, we leveraged a report from Xenoss' blog. Although blog posts do not typically meet Wonder's credibility criteria, we included the report because Xenoss is a MarTech/AdTech software company and some companies include a blog section on their website to provide industry and company insights. Additionally, the article provided supporting findings relevant to the research and corroborated by other reports.